Question: Chapter 8 Problems Saved Required information [The following information applies to the questions displayed below.] Part 2 of 2 Timberly Construction makes a lump-sum purchase

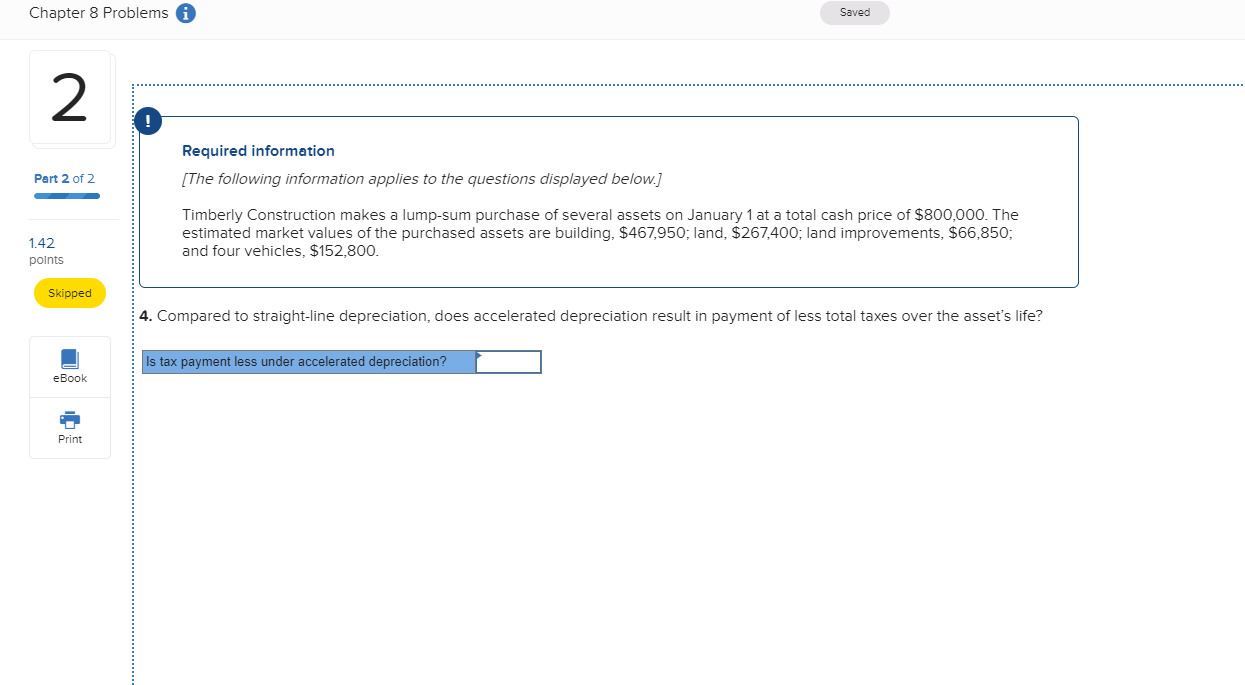

Chapter 8 Problems Saved Required information [The following information applies to the questions displayed below.] Part 2 of 2 Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $800,000. The estimated market values of the purchased assets are building, $467,950; land, $267,400; land improvements, $66,850; and four vehicles, $152,800. 1.42 points Skipped 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset's life? Is tax payment less under accelerated depreciation? eBook Print

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts