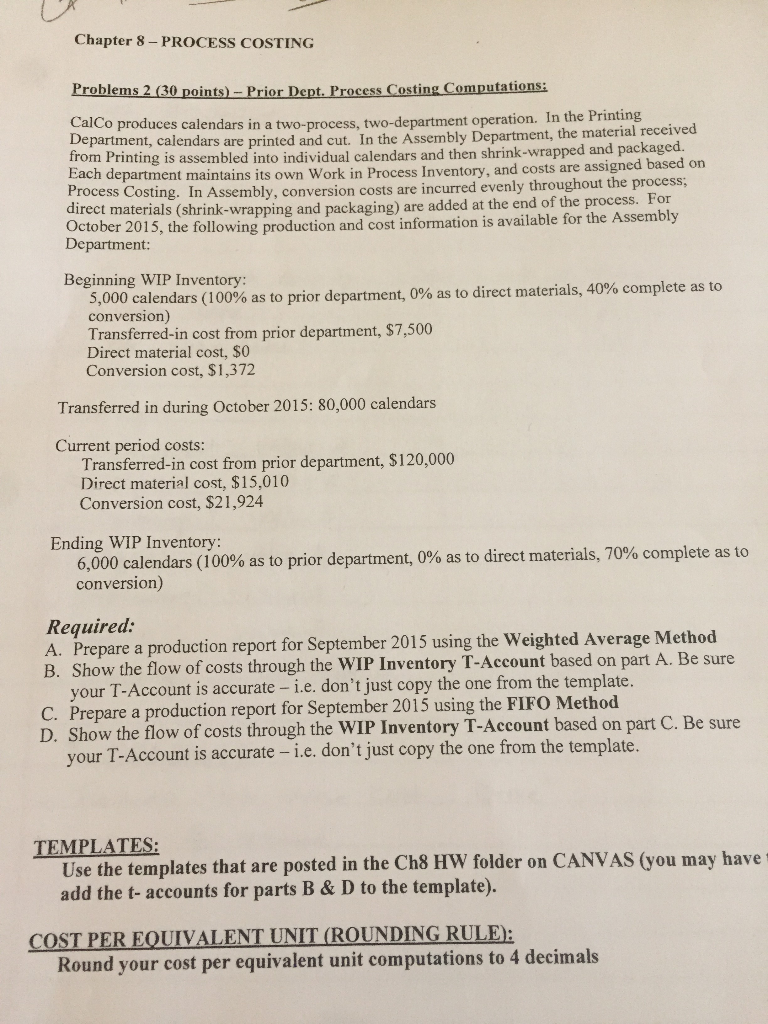

Question: Chapter 8- PROCESS COSTING Pr lems 2 (30 points) - Prior Dept. Process Cos 0 the Printing CalCo produces calendars in a two-process, two-department operation.

Chapter 8- PROCESS COSTING Pr lems 2 (30 points) - Prior Dept. Process Cos 0 the Printing CalCo produces calendars in a two-process, two-department operation. In Department, calendars from Printing is assembled into individual calendars and then shrink-wrapped and packaged Each department maintains its own Work in Process Inventory, and costs are a Process Costing. In Assembly, conversion costs are incurred evenly through direct materials (shrink-wrapping and packaging) are added at the end of the process. Fo October 2015, the following production and cost information is available for the Assembly Department: are printed and cut. In the Assembly Department, the material received ssigned based on out the process; Beginning WIP Inventory: 5,000 calendars (100% as to prior department 0% as to direct materials 40% complete as to conversion) Transferred-in cost from prior department, $7,500 Direct material cost, $0 Conversion cost, $1,372 Transferred in during October 2015: 80,000 calendars Current period costs: Transferred-in cost from prior department, $120,000 Direct material cost, $15,010 Conversion cost, $21,924 Ending WIP Inventory 6,000 calendars (100% as to prior department, 0% as to direct materials, 70% complete as to conversion) equired: A. P B. repare a production report for September 2015 using the Weighted Average Method Show the flow of costs through the WIP Inventory T-Account based on part A. Be sure your T-Account is accurate - i.e. don't just copy the one from the template C. Prepare a production report for September 2015 using the FIFO Method D. Show the flow of costs through the WIP Inventory T-Account based on part C. Be sure your T-Account is accurate -i.e. don't just copy the one from the template. TEMPLATES: Use the templates that are posted in the Ch8 HW folder on CANVAS (you may have add the t-accounts for parts B & D to the template). COST PER EQUIVALENT UNIT (ROUNDING RULE: Round your cost per equivalent unit computations to 4 decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts