Question: Chapter 8 provides an overview of the three methods that lenders use to determine how much they'll loan you (pg. 262- 264 in both e-Text

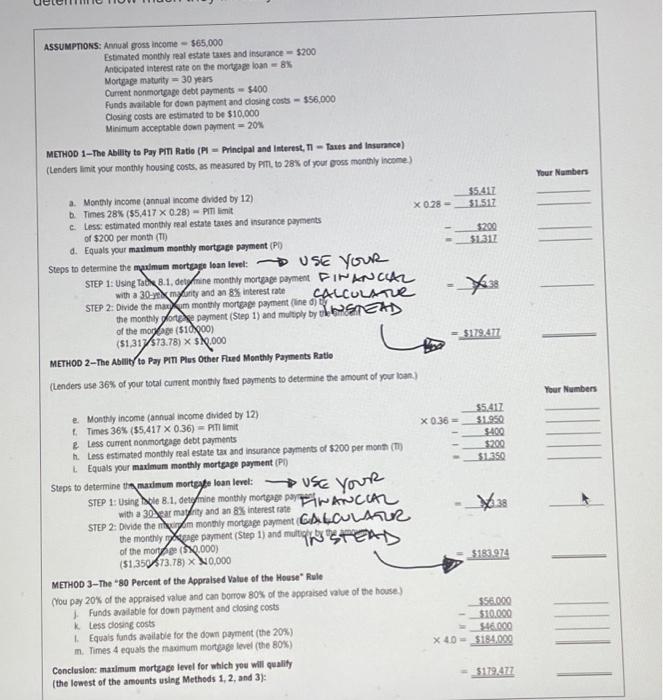

Chapter 8 provides an overview of the three methods that lenders use to determine how much they'll loan you (pg. 262264 in both e-Text and physical copies, including Figure 8.7). Using Figure 8.7 (screenshot added below) as a guide, calculate the maximum mortgage you would qualify for using the following assumptions for all three methods: - Annual gross income of $120,000 - Anticipated monthly real estate taxes and insurance =$750 - Anticipated interest rate on the mortgage loan =5.5% - Mortgage maturity =30 years - Current non-mortgage debt payments =$500 - Funds available for down payment and closing costs =$75,000 - Estimated closing costs of $15,000 - Minimum acceptable down payment 20% Please indicate your answers for each step in each of the following methods and indicate the maximum mortgage a lender would offer under: 1. Method 1 "The Ability to Pay PITI Ratio" mortgage amount 2. Method 2 "The Ability to Pay PITI Plus Other Fixed Monthly Payments Ratio" mortgage amount 3. Method 3 "The 80 Percent of the Appraised Value of the House" mortgage amount You may submit your answers in a text entry or in a file attachment. When calculating the maximum mortgage loan levels under Methods 1 and 2, please identify each of the five variables. Calculating Your Mortgage Limit The maximum loan size you'll qualify for is determined by the financial picture that develops as the lender reviews these three measures of your ability to pay. The lowest amount wins. Figure 8.7 @ shows the basic methods lenders use to determine how much they'll loan you. AssumpnoNS: Avnual gross income $65,000 Estunated monthly real estate taus and insurance =$200 Anbcipated interest rate on the mortae loan =8K Mortere muturity =30 years Current nonmorgage debt payments =$400 Funds available for doun papment and clasing coss =$56,000 Closing costs are estimated to be $10,000 Minimum acceptable down payment =20N METHOD 1-The Abllity to Pay Prn Ratio (P4 = Pincipal and interest, - Taus and Insunnce) (tenders limit your monthy housine costs, as measured by PTL, to 28S of your poss monthly income) a. Mantily income (annual income dvised by 12) b. Times 28%($5.4170.28)= PMT linit c. toss estimated monthly real estate taies and insurance payments of $200 per month (Ti) d. Equals your marimam monthly morteage payment (Pi) 0.28=51.517$5.417 Steps to determine the mualmum mortgage loan level: USE YOUR themonthlyforteyeparment(Step1)andmultiplybythenteftZnofthemogoge($10(00)($1.317573.78)$5,000 METHOD 2-The Ablity to Pay Fin Ples Other Fued Monthly Payments Ratlo (Lenders use 36% of your total cunent montily fred payments to determine the amount of your loan) e. Monttly income (annual income divided by 12) f. Times 36%($5,4170.36)= PTI limit e. tess current nonmontese debt payments h. Less estimated monthly real estate tar and insunce pojments of $2.00 per monh (ti) L. Equals your maximum monthly morteage payment (P) Your Number of the mor fe (S).000) ( $1.350T73.78)0.000 METHOD 3-The " 80 Percent of the Appralsed Value of the House" Rule (Nou pay 20% of the appraised value and can borrow 80% of the apposised vive of the house) 1. Funds aralable for down payment and closing costs i. tess dosing costs 1. Equals funds avilabie for the down payment (the 20\%) in. Times 4 equats the mamum morteage level (the 80N) 0.36=$51.95055.417$2005400=$1.350 Vour Nambens

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts