Question: Chapter 8 | Question 1: Please answer the questions below (see image and empty boxes in the images)! Thank you!: You are choosing between two

Chapter 8 | Question 1: Please answer the questions below (see image and empty boxes in the images)! Thank you!:

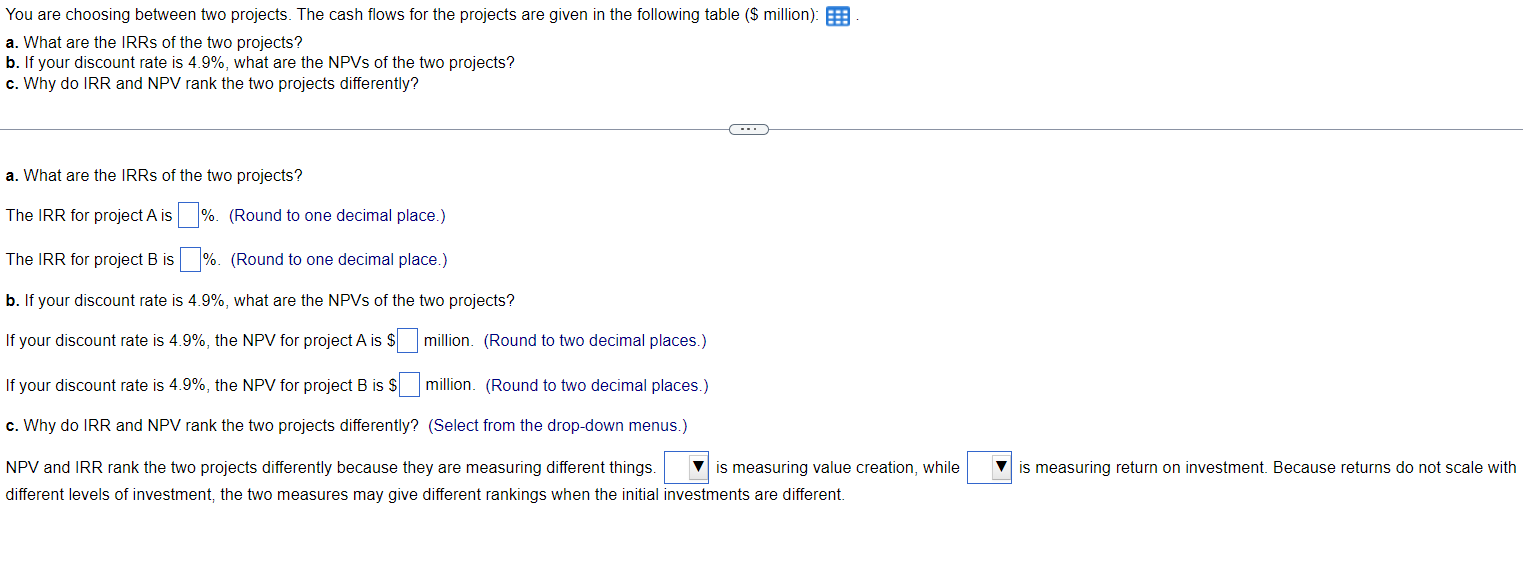

You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): LOADING.... a. What are the IRRs of the two projects? b. If your discount rate is , what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently?

You are choosing between two projects. The cash flows for the projects are given in the following table (\$ million): a. What are the IRRs of the two projects? b. If your discount rate is 4.9%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project A is %. (Round to one decimal place.) The IRR for project B is %. (Round to one decimal place.) b. If your discount rate is 4.9%, what are the NPVs of the two projects? If your discount rate is 4.9%, the NPV for project A is S million. (Round to two decimal places.) If your discount rate is 4.9%, the NPV for project B is $ million. (Round to two decimal places.) c. Why do IRR and NPV rank the two projects differently? (Select from the drop-down menus.) different levels of investment, the two measures may give different rankings when the initial investments are different. You are choosing between two projects. The cash flows for the projects are given in the following table (\$ million): a. What are the IRRs of the two projects? b. If your discount rate is 4.9%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project A is %. (Round to one decimal place.) The IRR for project B is %. (Round to one decimal place.) b. If your discount rate is 4.9%, what are the NPVs of the two projects? If your discount rate is 4.9%, the NPV for project A is S million. (Round to two decimal places.) If your discount rate is 4.9%, the NPV for project B is $ million. (Round to two decimal places.) c. Why do IRR and NPV rank the two projects differently? (Select from the drop-down menus.) different levels of investment, the two measures may give different rankings when the initial investments are different

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts