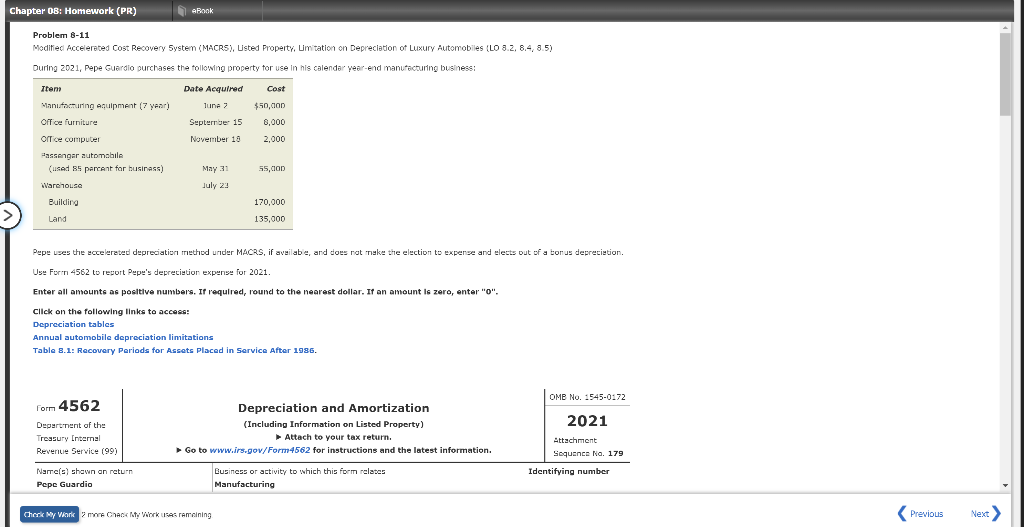

Question: Chapter 8 - Question 11 Problem E-11 Modifed focelereted Cost Recovery 5ysten (MACRS), Listed Property, Lm tation on Depreciation of Luxury Automobiles (LD 3.2, 8.4,

Chapter 8 - Question 11

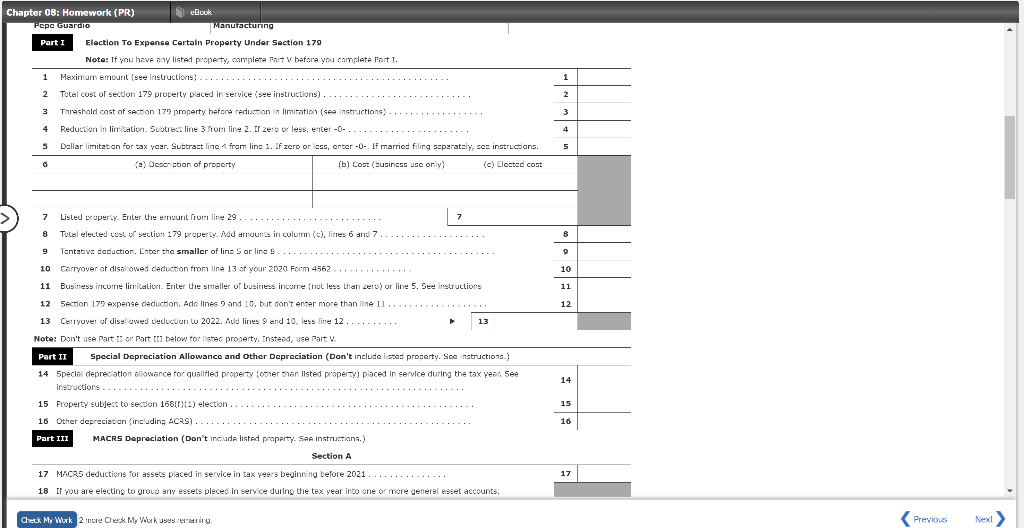

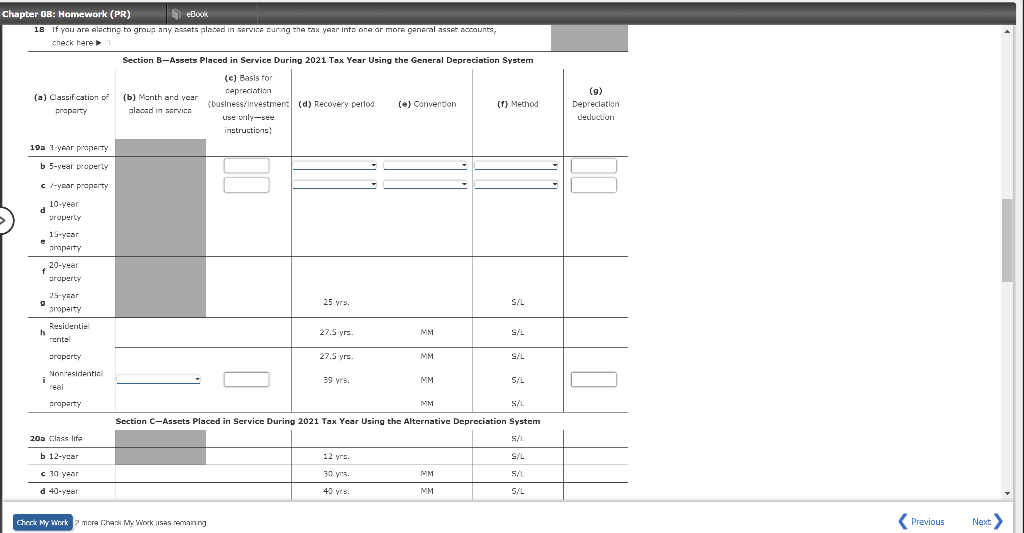

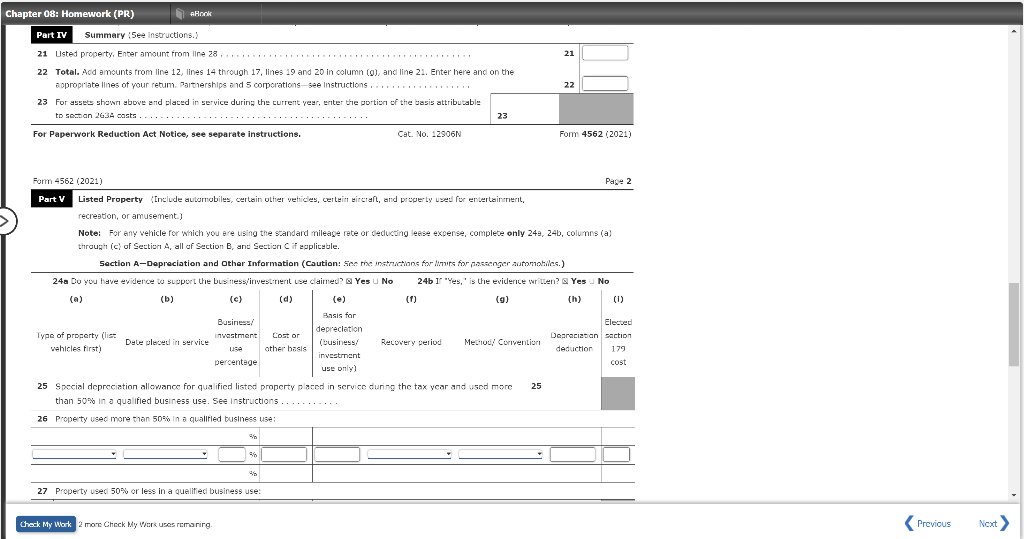

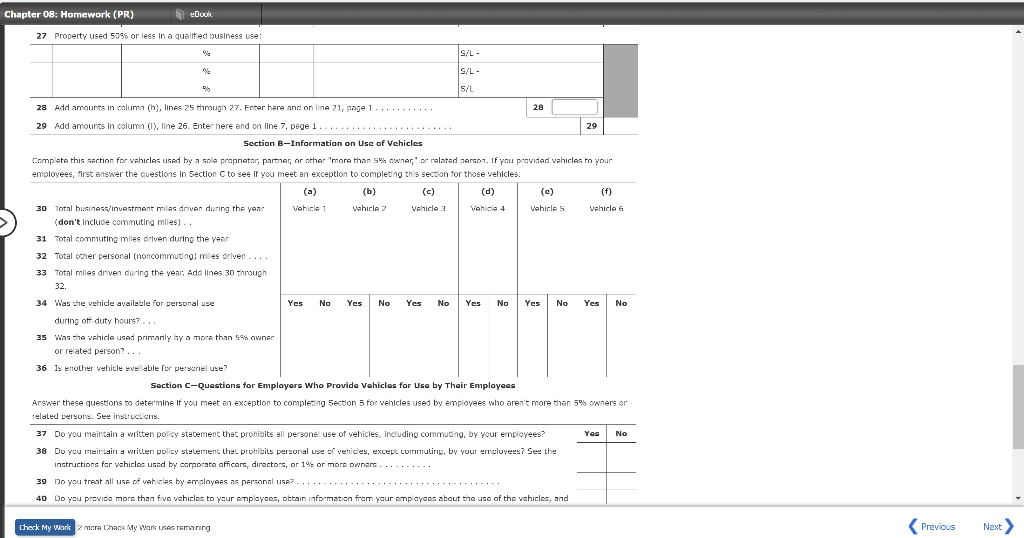

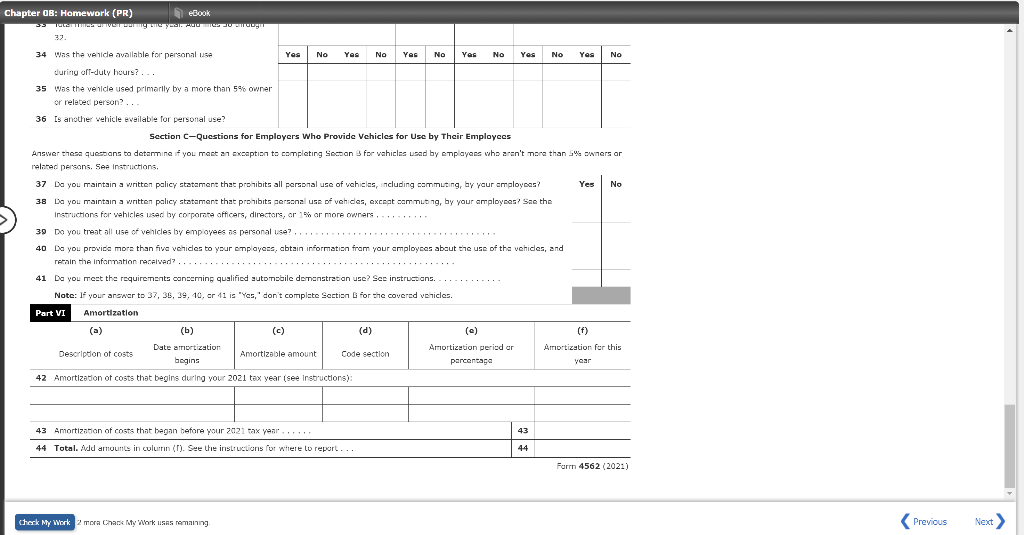

Problem E-11 Modifed focelereted Cost Recovery 5ysten (MACRS), Listed Property, Lm tation on Depreciation of Luxury Automobiles (LD 3.2, 8.4, 8.5) During 2021, Pepe Guerdio purchases the tollowing property tor use in his calendar year-end manutecturing business: Pepe uses the eccelareted depreciatien method under MACRS, if availabe, and does not riake the election to expense and elects out of a tonus depreciation. Usu Furn 4562 to report Pupe's depreciztion expensu for 2021. Enter all amounts as posltlve numbers. If required, round to the nearest dollar. If an amount is zero, enter "o". Click on the following links to access: Depreciation tables Annual automobile depreciation limitations Table 8.1: Recovery Periods for Assets Placed in Service After 1986. mrre CNACA Rty biork UWA: ramcining mera Chask kety bork usas remain ny Part V Listed Property [nclude autarnabiles, certain other vehicles, certyin eirctaft, and pruper ty used for entertainariert, recreation, or amusement.] Note: For eny vehicle for which you e'e using the srandand mileage rete or deducting leese expense, complebe only 24y,24b, columns (a) throunh (c) of Sectiun A, all of Section B, and Settiur C if applitable. Section A-Depreciation and Other Information (Caution: soe rhe instrations for lings for paceenger autanahiles.) Section B-Information on Use of Vehicles Complate this saction for wahieles used by a sole proprietor, partner, ar ather "more than 5% owner, 7 or ralatad aerson. If 'You provided wahirles to your employees, first answer the questions in Section C to see it you meet an exception to completing this section tor thase wehicles. Section C-Questions for Employers Who Provide Vahicles for Use by Their Employees related persons. See instructions. 37 Do you mairtain a written policy statement that prohibits all persone use of vehicles, including commuting, by your enployees? 38 Do you mair tair a vitten policy stytement that prohibits personal use of vehicdes, except commutirin, by vour erneloyeas? Sen the instructions fer whicles used by carporate afficars, directors, or 1% b or more pwnars . . . . . 40 Do you previde more than fve vahieles to Your emplayaes, obtain informatian fram your amplayees stout the use of the wahieles, and Section C-Questions for Employers Who Provide Vehicles for Use by Their Employecs Answer thesa questans to detanmine if you mest an exaptisn to camploting Soutan 3 far whiclas usad by emplayoes whs aran't mara than GWs wwners or relited persons, See instructions, 37 Da you maintain a written palicy statament that pronibits all personal use of vehizlas, including cammuting, by vaur amployeas? 38 Lo you maintain a written palicy statament that prohibits persanal use of vehides, except oammut ng, by your amployeas? Sae the Instuctions for wehicles used ly corpornte officers, directors, or 1g or more owners, 39. Do you treat all use of velicles by emp oyees as personal use?, 40 Da you provida morz than fiva vehides to yaur emplayess, abtain informatian fram your amployees abaut the use of tha vehides, and 41 Da you mest the requirements caneeming quslified sutpmebile demenstratan use? See instruesans. . . . . . . . Note: If your arewar to 37, 38, 39, 14, ar 41 is "Yes, don't complate Sectian b for the coverted ve7icles. Problem E-11 Modifed focelereted Cost Recovery 5ysten (MACRS), Listed Property, Lm tation on Depreciation of Luxury Automobiles (LD 3.2, 8.4, 8.5) During 2021, Pepe Guerdio purchases the tollowing property tor use in his calendar year-end manutecturing business: Pepe uses the eccelareted depreciatien method under MACRS, if availabe, and does not riake the election to expense and elects out of a tonus depreciation. Usu Furn 4562 to report Pupe's depreciztion expensu for 2021. Enter all amounts as posltlve numbers. If required, round to the nearest dollar. If an amount is zero, enter "o". Click on the following links to access: Depreciation tables Annual automobile depreciation limitations Table 8.1: Recovery Periods for Assets Placed in Service After 1986. mrre CNACA Rty biork UWA: ramcining mera Chask kety bork usas remain ny Part V Listed Property [nclude autarnabiles, certain other vehicles, certyin eirctaft, and pruper ty used for entertainariert, recreation, or amusement.] Note: For eny vehicle for which you e'e using the srandand mileage rete or deducting leese expense, complebe only 24y,24b, columns (a) throunh (c) of Sectiun A, all of Section B, and Settiur C if applitable. Section A-Depreciation and Other Information (Caution: soe rhe instrations for lings for paceenger autanahiles.) Section B-Information on Use of Vehicles Complate this saction for wahieles used by a sole proprietor, partner, ar ather "more than 5% owner, 7 or ralatad aerson. If 'You provided wahirles to your employees, first answer the questions in Section C to see it you meet an exception to completing this section tor thase wehicles. Section C-Questions for Employers Who Provide Vahicles for Use by Their Employees related persons. See instructions. 37 Do you mairtain a written policy statement that prohibits all persone use of vehicles, including commuting, by your enployees? 38 Do you mair tair a vitten policy stytement that prohibits personal use of vehicdes, except commutirin, by vour erneloyeas? Sen the instructions fer whicles used by carporate afficars, directors, or 1% b or more pwnars . . . . . 40 Do you previde more than fve vahieles to Your emplayaes, obtain informatian fram your amplayees stout the use of the wahieles, and Section C-Questions for Employers Who Provide Vehicles for Use by Their Employecs Answer thesa questans to detanmine if you mest an exaptisn to camploting Soutan 3 far whiclas usad by emplayoes whs aran't mara than GWs wwners or relited persons, See instructions, 37 Da you maintain a written palicy statament that pronibits all personal use of vehizlas, including cammuting, by vaur amployeas? 38 Lo you maintain a written palicy statament that prohibits persanal use of vehides, except oammut ng, by your amployeas? Sae the Instuctions for wehicles used ly corpornte officers, directors, or 1g or more owners, 39. Do you treat all use of velicles by emp oyees as personal use?, 40 Da you provida morz than fiva vehides to yaur emplayess, abtain informatian fram your amployees abaut the use of tha vehides, and 41 Da you mest the requirements caneeming quslified sutpmebile demenstratan use? See instruesans. . . . . . . . Note: If your arewar to 37, 38, 39, 14, ar 41 is "Yes, don't complate Sectian b for the coverted ve7icles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts