Question: CHAPTER 8 Receivables 05 8-7 Adjusting entry to estimate bad debts-percentage of receivables Lo2, 3 Foster Company uses the allowance method to account for uncollectible

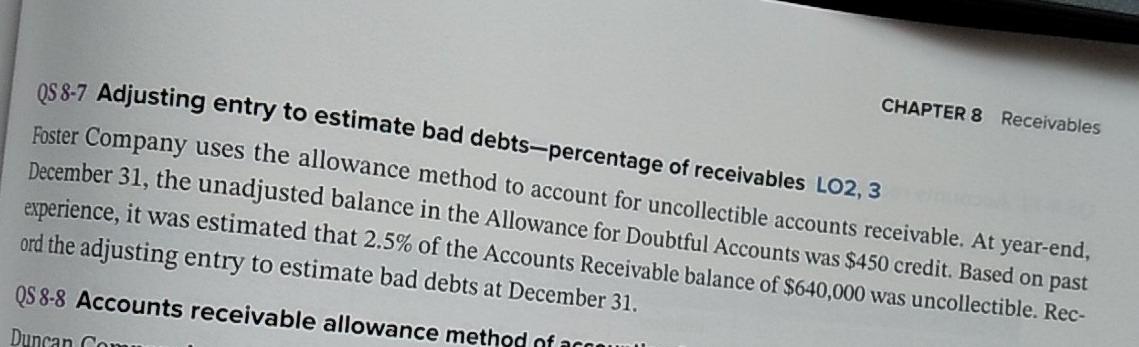

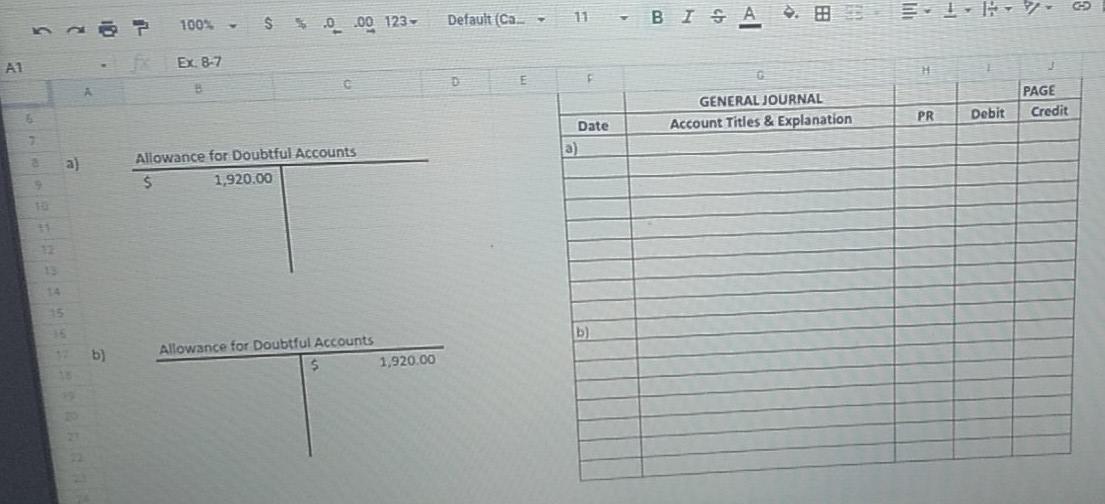

CHAPTER 8 Receivables 05 8-7 Adjusting entry to estimate bad debts-percentage of receivables Lo2, 3 Foster Company uses the allowance method to account for uncollectible accounts receivable. At year-end, December 31, the unadjusted balance in the Allowance for Doubtful Accounts was $450 credit. Based on past experience, it was estimated that 2.5% of the Accounts Receivable balance of $640,000 was uncollectible. Rec- ord the adjusting entry to estimate bad debts at December 31. QS 8-8 Accounts receivable allowance method of acou Duncan Co 11 Default (Ca. $5.000 123- BISA Ik 100% A1 Ex. 87 H 3 GENERAL JOURNAL Account Titles & Explanation PAGE Credit PR Debit Date a) a) Allowance for Doubtful Accounts $ 1,920.00 15 b) b) Allowance for Doubtful Accounts 1,920.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts