Question: Chapter 8 Thursday Fall 2019 Due. OCT.31 1. Consider the following statements: I. Budgets are used to plan and control operations. II. A disadvantage of

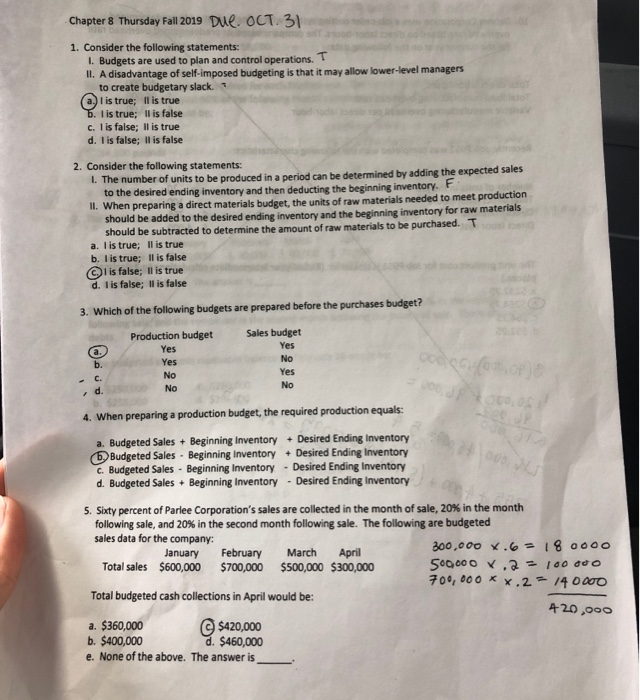

Chapter 8 Thursday Fall 2019 Due. OCT.31 1. Consider the following statements: I. Budgets are used to plan and control operations. II. A disadvantage of self-imposed budgeting is that it may allow lower-level managers to create budgetary slack. (a.) i is true; Il is true b. I is true; llis false c. I is false; Il is true d. I is false; Il is false 2. Consider the following statements: The number of units to be produced in a period can be determined by adding the expected sales to the desired ending inventory and then deducting the beginning inventory. F II. When preparing a direct materials budget, the units of raw materials needed to meet production should be added to the desired ending inventory and the beginning inventory for raw materials should be subtracted to determine the amount of raw materials to be purchased. T a. I is true; Il is true b. I is true; Il is false C is false; Il is true d. I is false; Il is false 3. Which of the following budgets are prepared before the purchases budget? Production budget Yes Yes No Sales budget Yes No Yes 4. When preparing a production budget, the required production equals: a. Budgeted Sales + Beginning Inventory + Desired Ending Inventory (b) Budgeted Sales - Beginning inventory + Desired Ending Inventory c. Budgeted Sales - Beginning Inventory - Desired Ending Inventory d. Budgeted Sales + Beginning Inventory - Desired Ending Inventory 5. Sixty percent of Parlee Corporation's sales are collected in the month of sale, 20% in the month following sale, and 20% in the second month following sale. The following are budgeted sales data for the company: 300,000 X.6 = 180000 January February March April Total sales $600,000 $700,000 $500,000 $300,000 500,000 V.2 - 1000 700,000 * *.2 = /4 0000 Total budgeted cash collections in April would be: 420,000 a. $360,000 $420,000 b. $400,000 d. $460,000 e. None of the above. The answer is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts