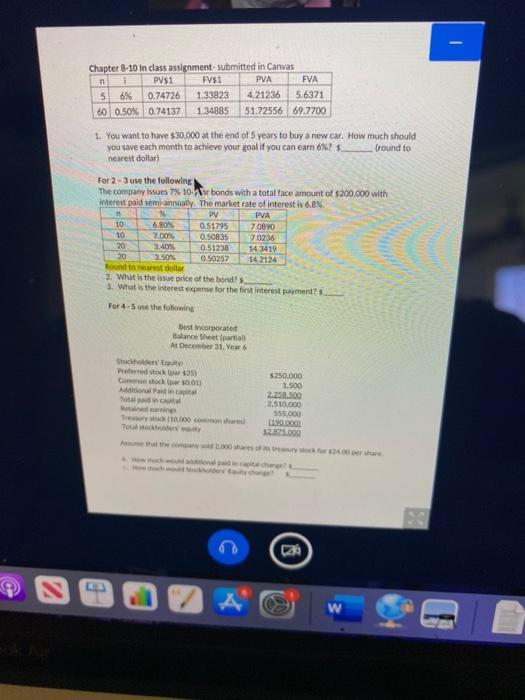

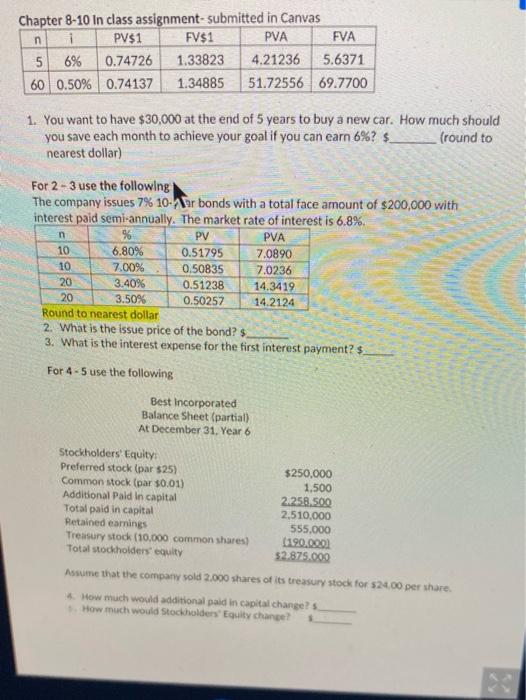

Question: Chapter 8-10 in class assignment submitted in Canvas n 1 PV$1 F$1 PVA FVA 5 6% 0.74726 1.33823 4.21236 5.6371 60 0.50% 0.74137 1.34885 51.72556

Chapter 8-10 in class assignment submitted in Canvas n 1 PV$1 F$1 PVA FVA 5 6% 0.74726 1.33823 4.21236 5.6371 60 0.50% 0.74137 1.34885 51.72556 69.7700 1. You want to have $30,000 at the end of 5 years to buy a new car. How much should you save each month to achieve your goal if you can earn 6? ! (round to nearest dollar) For 2 - 3 use the following The company issues 7% 10. bonds with a total face amount of $200,000 with interest paid semiannually. The market rate of interest is 6.8% PV PVA 10 6,80% 0.51795 7.0890 10 WOON 0.50835 7.0236 20 3.40 0.51238 14.3419 20 2.50 0.50257 14.2124 found to newest dollar 2. What is the issue price of the bond? 3. What is the interest expense for the first interest payments. For 4-5 use the following Best Incorporated Balance Sheet para At December 31. Ver Stockholders Prenock 35) Como tockor 0.01) Additional in capital Total $250,000 1.500 2.253.500 2.510.000 555.000 Tre 10.000 common share A w Chapter 8-10 In class assignment-submitted in Canvas n i PV$1 FV$1 PVA FVA 5 6% 0.74726 1.33823 4.21236 5.6371 60 0.50% 0.74137 1.34885 51.72556 69.7700 1. You want to have $30,000 at the end of 5 years to buy a new car. How much should you save each month to achieve your goal if you can earn 6%? $ (round to nearest dollar) n For 2 - 3 use the following The company issues 7% 10-War bonds with a total face amount of $200,000 with interest paid semi-annually. The market rate of interest is 6.8% PV PVA 10 6.80% 0.51795 7.0890 10 7.00% 0.50835 7.0236 20 3.40% 0.51238 14.3419 20 3.50% 0.50257 14.2124 Round to nearest dollar 2. What is the issue price of the bond? $ 3. What is the interest expense for the first interest payment? $. For 4 - 5 use the following Best Incorporated Balance Sheet (partial) At December 31. Year 6 Stockholders Equity Preferred stock (par 525) $250,000 Common stock (par $0.01) 1,500 Additional Paid In capital 2.258.500 Total paid in capital 2.510,000 Retained earnings 555.000 Treasury stock (10.000 common shares) (190.000 Total stockholders' equity $2.875.000 Assume that the company sold 2.000 shares of its treasury stock for $2400 per share. How much would additional paid in capital change? How much would Stockholders' Equity change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts