Question: Chapter 9 1. A project has an initial cash outflow of $42,600 and produces cash inflows of $17,680,$19,920, an $15,670 for Years 1 through 3,

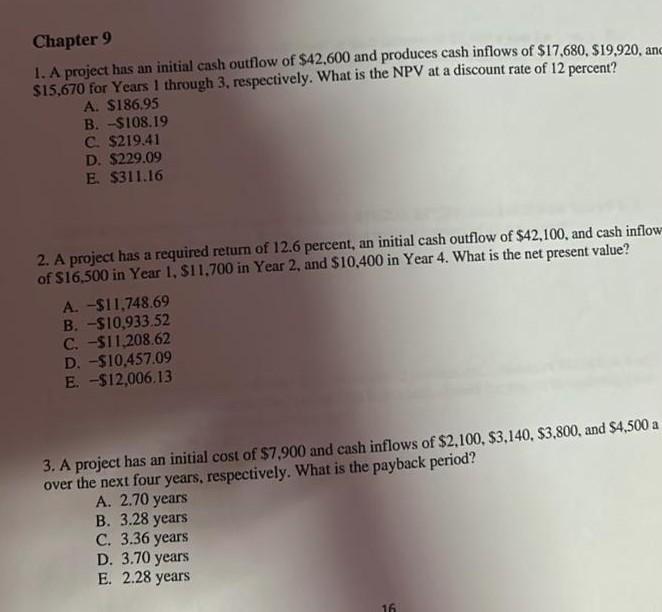

Chapter 9 1. A project has an initial cash outflow of $42,600 and produces cash inflows of $17,680,$19,920, an $15,670 for Years 1 through 3, respectively. What is the NPV at a discount rate of 12 percent? A. $186,95 B. -5108.19 C. $219.41 D. $229.09 E. $311.16 2. A project has a required retum of 12.6 percent, an initial cash outflow of $42,100, and cash inflow of $16,500 in Year 1, \$11.700 in Year 2, and $10,400 in Year 4. What is the net present value? A. $11,748.69 B. $10,933.52 C. 511,208.62 D. $10,457.09 E. $12,006.13 3. A project has an initial cost of $7,900 and cash inflows of $2,100,$3,140,$3,800, and $4,500 a over the next four years, respectively. What is the payback period? A. 2.70 years B. 3.28 years C. 3.36 years D. 3.70 years E. 2.28 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts