Question: Chapter 9 Blanksheet Instructions Yent 1 Jan. 4. Purchesed a uses deivery truck for $20.400, paying cash. Nov, 2. Paid garage $750 for miscoleneous repairs

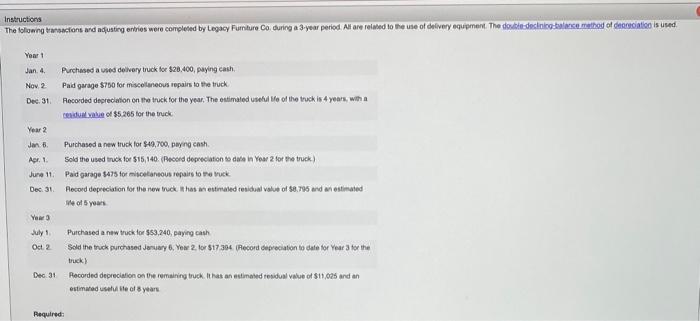

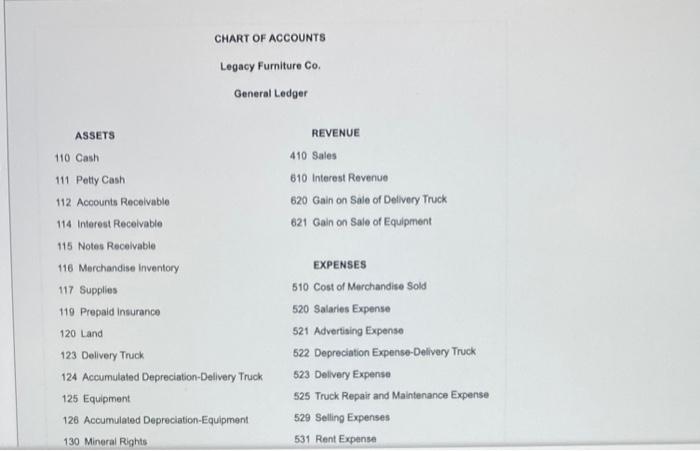

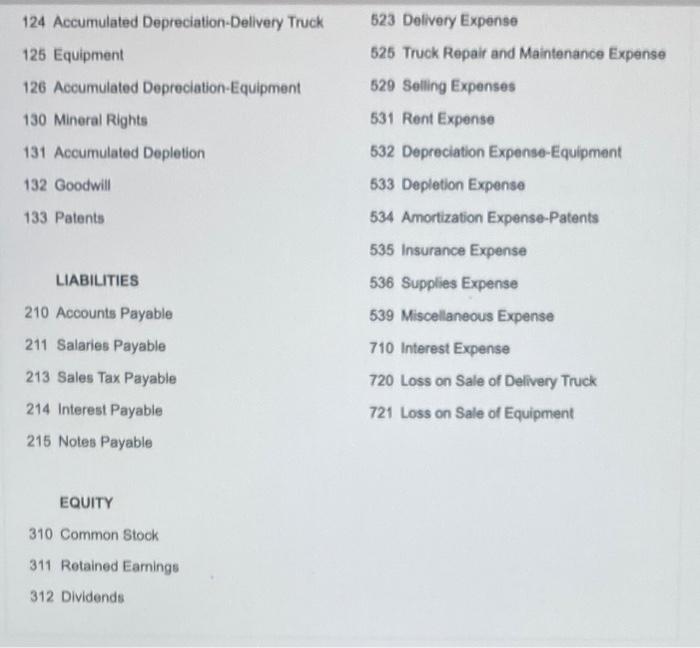

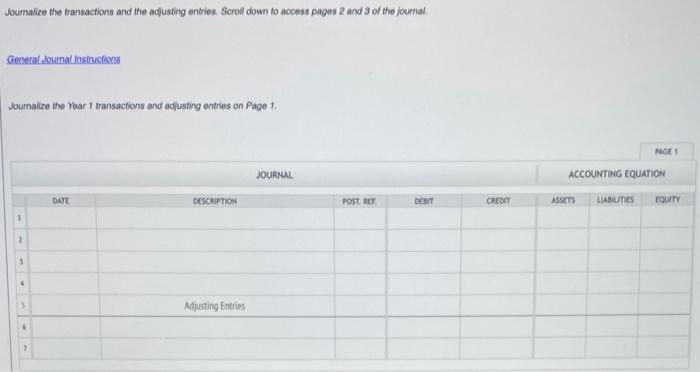

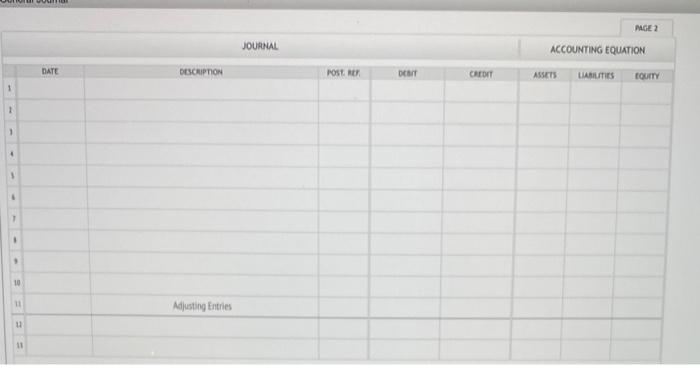

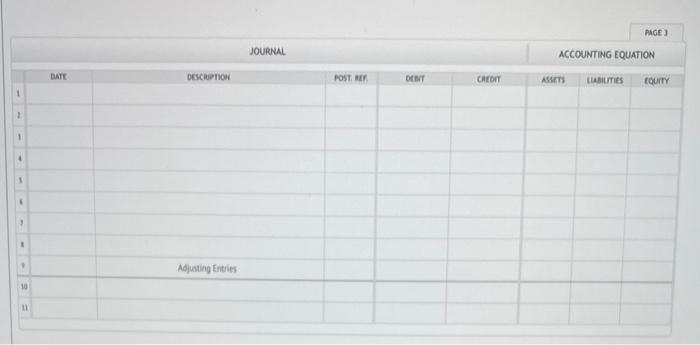

Instructions Yent 1 Jan. 4. Purchesed a uses deivery truck for $20.400, paying cash. Nov, 2. Paid garage $750 for miscoleneous repairs to the truck. Des. 31. Fecorded degreciation on the truck for the year, The entimaled usetul to of the thuck is 4 yeark, with a celidual vabue of $5.265 for the truck: Year 2 Jan. 6. Purchased a new truck for $49,700, peyng eash. Acr. 1. Sold the used truck foe 515,140 . (Aecond deprecation so daca in Year 2 for the truck) Jure 11. Pad garage sa75 for mitcelaheous repairs to the truck. Dec: 31. Aecord depreciation tor the new thuck ithes at estimaled residual value of 58.795 end an estirated ife of 5 yoars. Year 0 July 1. Purchased a new truck lor $53,240, paying cash. Oct.2. Sold the truck purchased Jasiay 6, Yes 2, lor $17.394 (Pecord depreciation to date for Year 3 for the truck) Dec. 31 Recorded depreciation on the remairing truck. It hat an estimaled tesidual value of 511 , o2s and an estimated usehul ble of 3 years Required: CHART OF ACCOUNTS Legacy Furniture Co. General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 112 Accounts Recelvable 620 Gain on Sale of Delivery Truck 114 interest Receivable 621 Gain on Sale of Equipment 115 Notes Recelvable 116 Merchandise inventory EXPENSES 117 Supplies 510 Cost of Merchandise Sold 119 Prepaid insurance 520 Salaries Expense 120 Land 521 Advertising Expense 123 Delivery Truck 522 Depreciation Expense-Delivery Truck 124 Accumulaled Depreciation-Delivery Truck 523 Delivery Expense 125 Equipment 525 Truck Repair and Maintenance Expense 126 Accumulated Depreciation-Equipment 529 Selling Expenses 130 Mineral Rights 531 Rent Expense 124 Accumulated Depreciation-Dellvery Truck 523 Delivery Expense 125 Equipment 525 Truck Repair and Maintenance Expense 126 Accumulated Depreciation-Equipment 529 Selling Expenses 130 Mineral Rights 531 Rent Expense 131 Accumulated Depletion 532 Depreciation Expense-Equipment 132 Goodwill 533 Depletion Expense 133 Patents 534 Amortization Expense-Patents 535 Insurance Expense LIABILITIES 536 Supplies Expense 210 Accounts Payable 539 Miscellaneous Expense 211 Salaries Payable 710 Interest Expense 213 Sales Tax Payable 720 Loss on Sale of Delivery Truck 214 Interest Payable 721 Loss on Sale of Equipment 215 Notes Payable EQUITY 310 Common Stock 311 Retained Eamings 312 Dividends Joumatize the transactions and the adjusting entries. Scroll down to access pages 2 and 3 of the joumal. Journalize the Year 1 transactions and adjusting entries on Page 1. mGE 2 Pace 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts