Question: Chapter 9 Continuing Problem Preparation of fund financial statements and schedules Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and

Chapter Continuing Problem

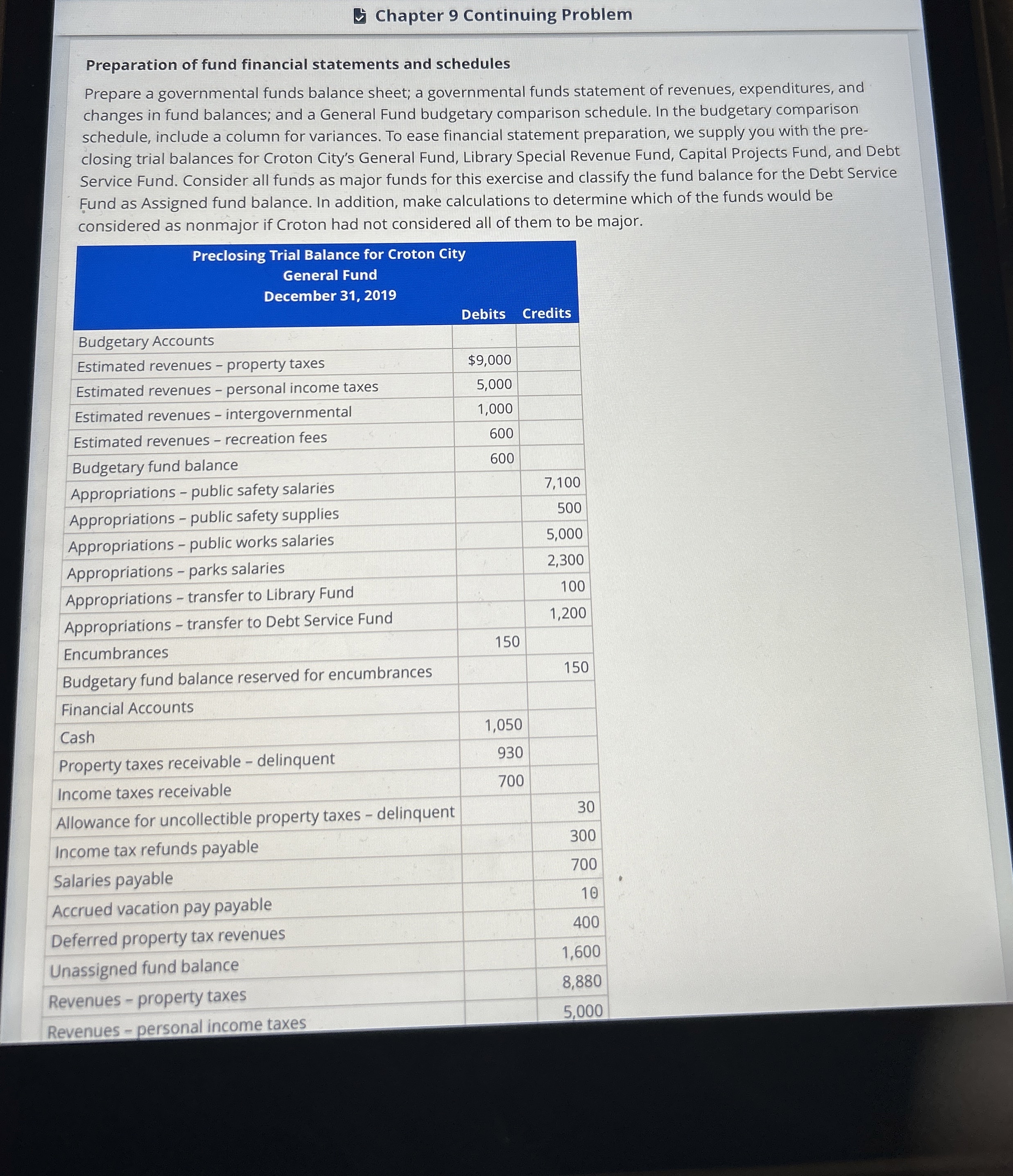

Preparation of fund financial statements and schedules

Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and changes in fund balances; and a General Fund budgetary comparison schedule. In the budgetary comparison schedule, include a column for variances. To ease financial statement preparation, we supply you with the preclosing trial balances for Croton City's General Fund, Library Special Revenue Fund, Capital Projects Fund, and Debt Service Fund. Consider all funds as major funds for this exercise and classify the fund balance for the Debt Service Fund as Assigned fund balance. In addition, make calculations to determine which of the funds would be considered as nonmajor if Croton had not considered all of them to be major.

tabletablePreclosing Trial Balance for Croton CityGeneral FundDecember Debits,CreditsBudgetary AccountsEstimated revenues property taxes,$Estimated revenues personal income taxes,Estimated revenues intergovernmental,Estimated revenues recreation fees,Budgetary fund balance,Appropriations public safety salaries,,Appropriations public safety supplies,,Appropriations public works salaries,,Appropriations parks salaries,,Appropriations transfer to Library Fund,,Appropriations transfer to Debt Service Fund,,EncumbrancesBudgetary fund balance reserved for encumbrances,,Financial AccountsCashProperty taxes receivable delinquent,Income taxes receivable,Allowance for uncollectible property taxes delinquent,,Income tax refunds payable,,Salaries payable,,Accrued vacation pay payable,,Deferred property tax revenues,,Unassigned fund balance,,Revenues property taxes,,Revenues personal income taxes,,

Chapter Continuing Problem

Preclosing Trial Balance for Croton City Library Special Revenue Fund December

tableDebits,CreditsCash$Restricted fund balance,,Transfer in from General Fund,,Revenues intergovernmental grant,,Revenues miscellaneous,,Expenditures culture salaries,Expenditures culture supplies,Totals$$

Chapter Continuing Problem

Preparation of fund financial statements and schedules

Prepare a governmental funds balance sheet; a governmental funds statement of revenues, expenditures, and changes in fund balances; and a General Fund budgetary comparison schedule. In the budgetary comparison schedule, include a column for variances. To ease financial statement preparation, we supply you with the preclosing trial balances for Croton City's General Fund, Library Special Revenue Fund, Capital Projects Fund, and Debt Service Fund. Consider all funds as major funds for this exercise and classify the fund balance for the Debt Service Fund as Assigned fund balance. In addition, make calculations to determine which of the funds would be considered as nonmajor if Croton had not considered all of them to be major.

tabletablePreclosing Trial Balance for Croton CityGeneral FundDecember Budgetary Accounts,,Estimated revenues property taxes,$Estimated revenues personal income taxes,Estimated revenues intergovernmental,Estimated revenues recreation fees,Budgetary fund balance,Appropriations public safety salaries,,Appropriations public safety supplies,,Appropriations public works salaries,,Appropriations parks salaries,,Appropriations transfer to Library Fund,,Appropriations transfer to Debt Service Fund,,EncumbrancesBudgetary fund balance reserved for encumbrances,,Financial Accounts,,CashProperty taxes receivable delinquent,Income taxes receivable,Allowance for uncollectible property taxes delinquent,,Income tax refunds payable,,Salaries payable,,Accrued vacation pay payable,,Deferred property tax revenues,,Unassigned fund balance,,Revenues property taxes,,Revenues personal income taxes,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock