Question: Chapter 9 EXERCISE 9-2 Activity Variances LO9-2 Flight Caf prepares in-flight meals for airlines in its kitchen located next to a local airport. The company's

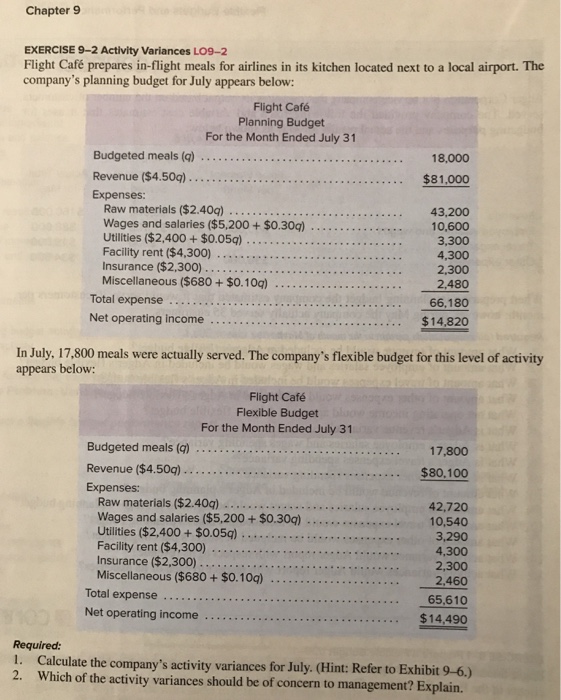

Chapter 9 EXERCISE 9-2 Activity Variances LO9-2 Flight Caf prepares in-flight meals for airlines in its kitchen located next to a local airport. The company's planning budget for July appears below: Flight Caf Planning Budget For the Month Ended July 31 ....$81,000 Expenses Raw materials ($2.40q) .. . Wages and salaries ($5.200 +$0.30q) Utilities ($2,400+ $0.05q) . Facility rent ($4,300).. . Insurance ($2,300).. ..43,200 10,600 3,300 4,300 2,300 2,480 66.180 . . . . Total expense . Net operating income $ 14.820 In July, 17,800 meals were actually served. The company's flexible budget for this level of activity appears below: Flight Caf Flexible Budget For the Month Ended July 31 Budgeted meals (g) Revenue ($4.50q)... Expenses: 17,800 $80,100 Raw materials ($2.40q) Wages and salaries ($5,200 + $0.309) .. Utilities ($2,400+$0.05q).. Facility rent ($4,300) 10,540 3,290 4,300 2,300 2.460 Miscellaneous ($680+$0.10q) 65.610 $14,490 Net operating income Required: 1. Calculate the company's activity variances for July. (Hint: Refer to E 2. Which of the activity variances should be of concern to management? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts