Question: Chapter 9 Fall 2020 Practice problems week 3 1. Jones Corporation purchased a machine at a cost of $40,000. After taking $10,000 of depreciation on

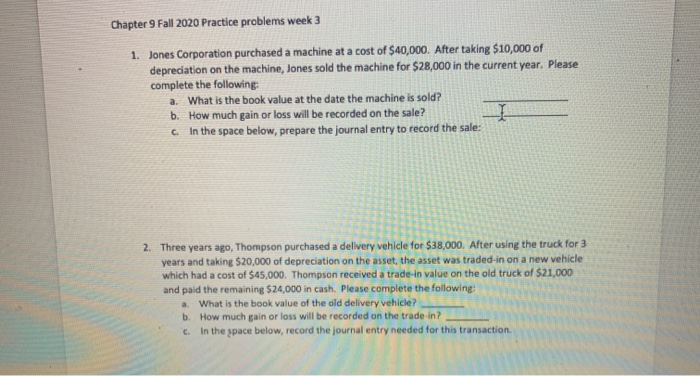

Chapter 9 Fall 2020 Practice problems week 3 1. Jones Corporation purchased a machine at a cost of $40,000. After taking $10,000 of depreciation on the machine, Jones sold the machine for $28,000 in the current year. Please complete the following: a. What is the book value at the date the machine is sold? b. How much gain or loss will be recorded on the sale? cIn the space below, prepare the journal entry to record the sale: 2. Three years ago, Thompson purchased a delivery vehicle for $38,000. After using the truck for 3 years and taking $20,000 of depreciation on the asset, the asset was traded-in on a new vehicle which had a cost of $45,000. Thompson received a trade-in value on the old truck of $21,000 and paid the remaining $24,000 in cash. Please complete the following: a. What is the book value of the old delivery vehicle? b. How much gain or loss will be recorded on the trade-in? c. In the space below, record the journal entry needed for this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts