Question: Chapter 9 Financial Planning Exercise 2 Out-of-pocket plan costs John Chang was seriously injured in a snowboarding accident that broke both his legs and an

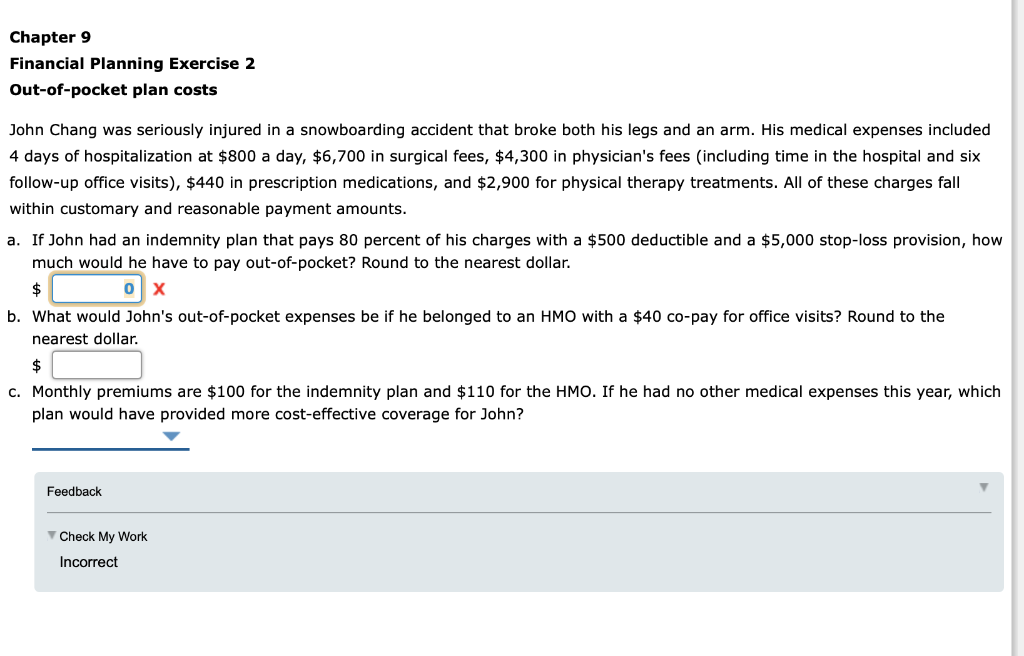

Chapter 9 Financial Planning Exercise 2 Out-of-pocket plan costs John Chang was seriously injured in a snowboarding accident that broke both his legs and an arm. His medical expenses included 4 days of hospitalization at $800 a day, $6,700 in surgical fees, $4,300 in physician's fees (including time in the hospital and six follow-up office visits), $440 in prescription medications, and $2,900 for physical therapy treatments. All of these charges fall within customary and reasonable payment amounts. a. If John had an indemnity plan that pays 80 percent of his charges with a $500 deductible and a $5,000 stop-loss provision, how much would he have to pay out-of-pocket? Round to the nearest dollar. $ 0 x b. What would John's out-of-pocket expenses be if he belonged to an HMO with a $40 co-pay for office visits? Round to the nearest dollar. $ c. Monthly premiums are $100 for the indemnity plan and $110 for the HMO. If he had no other medical expenses this year, which plan would have provided more cost-effective coverage for John? Feedback Check My Work Incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts