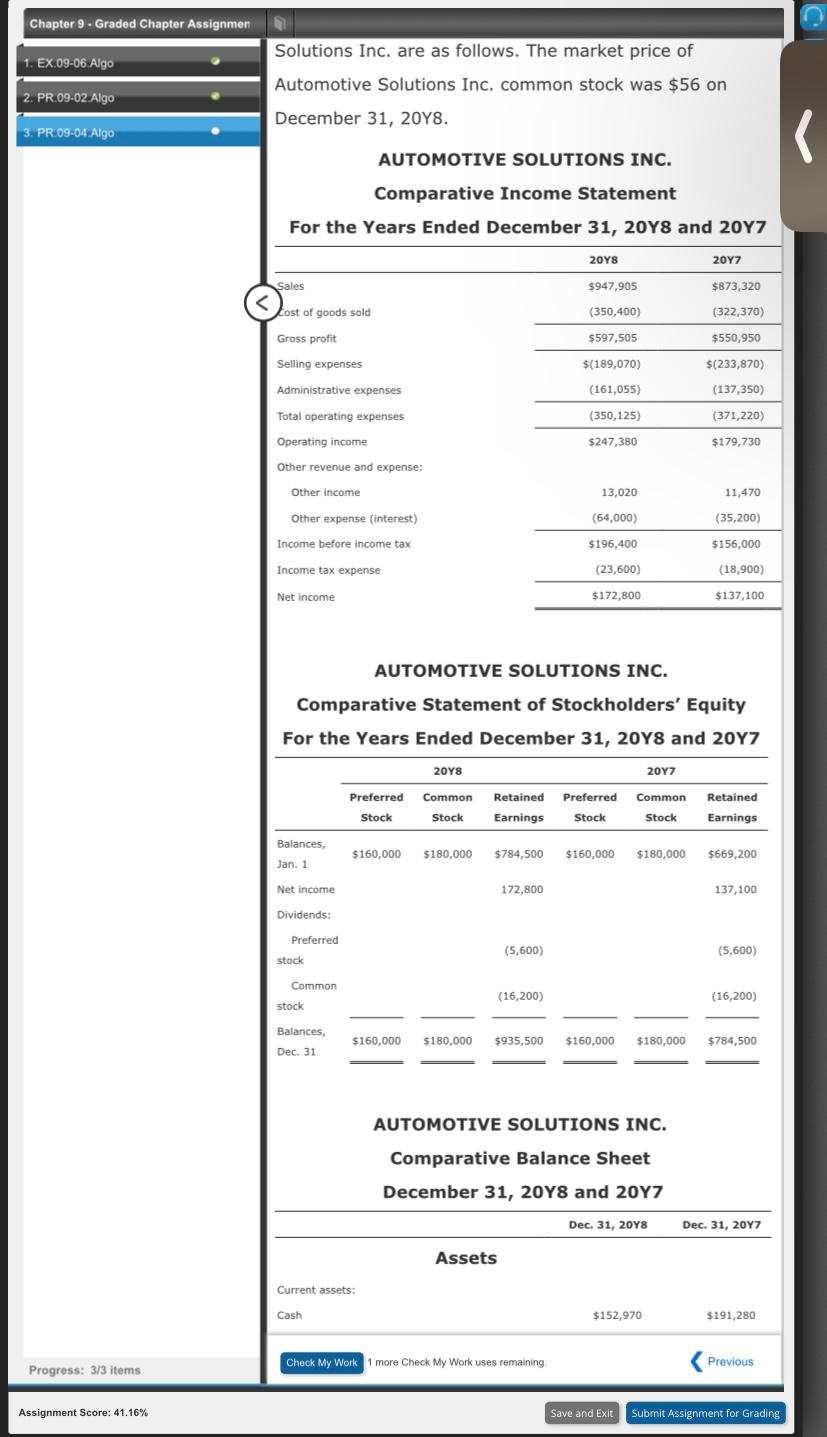

Question: Chapter 9 - Graded Chapter Assignmen 1. EX.09-06 Algo Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $56

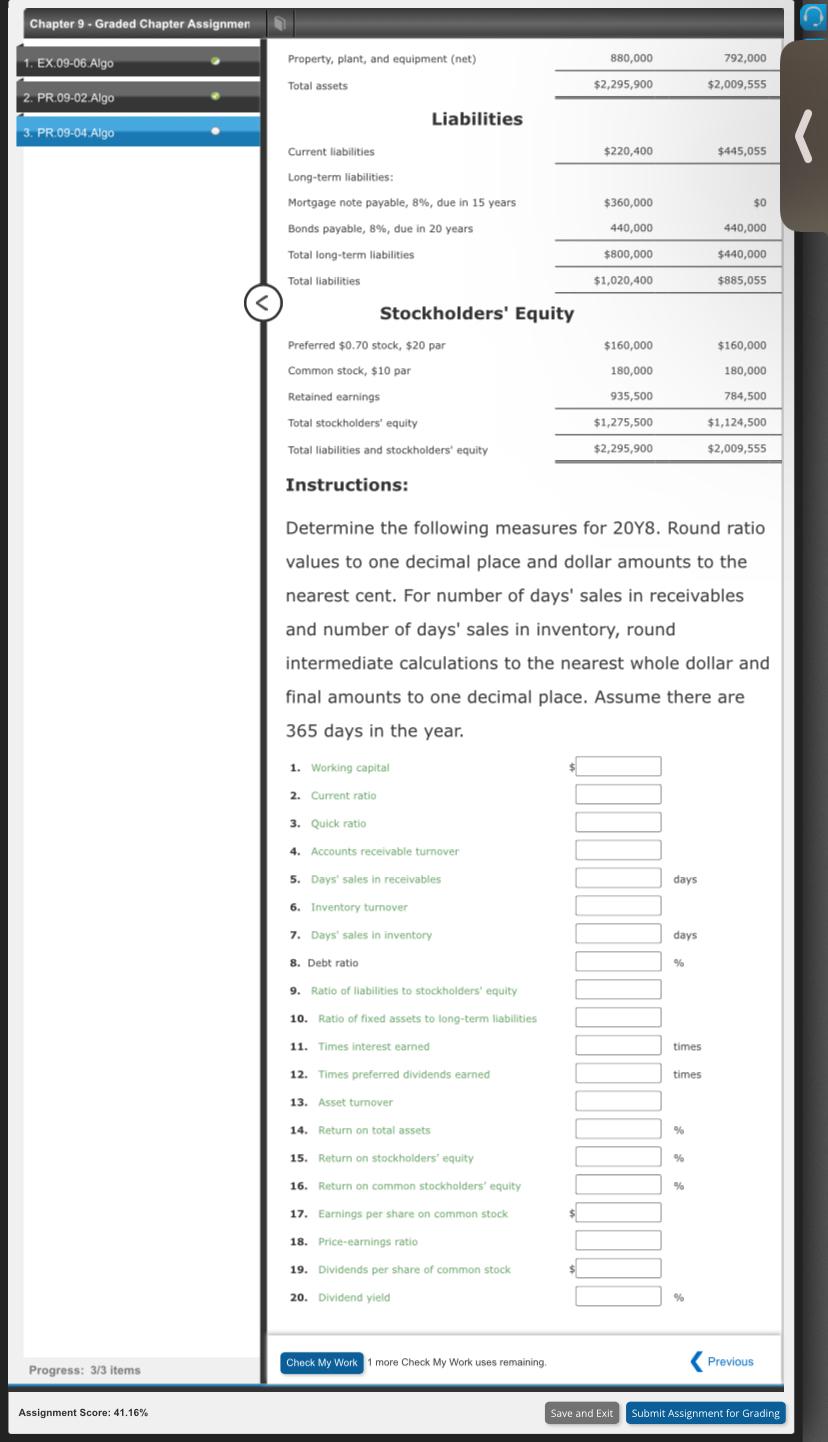

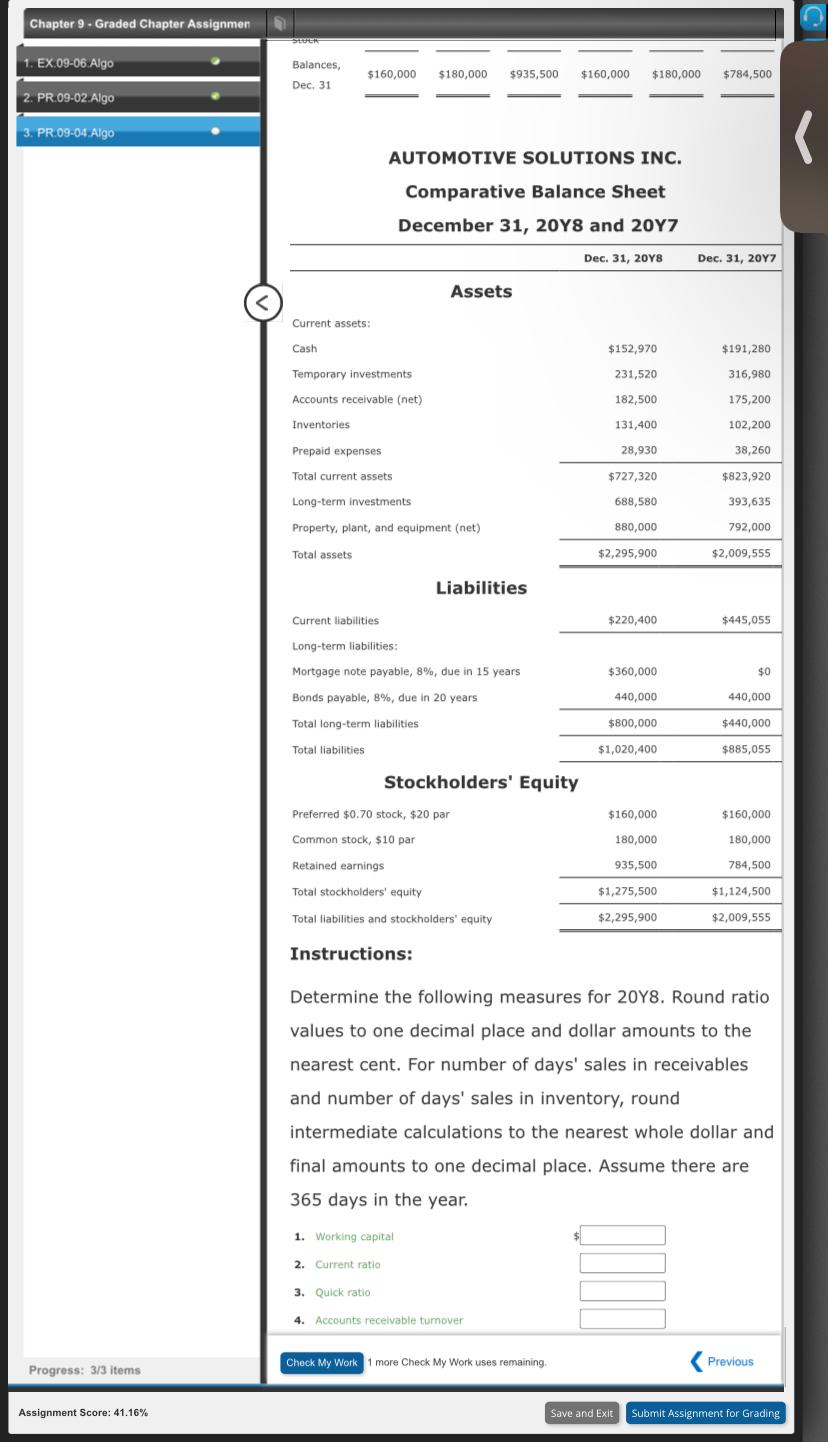

Chapter 9 - Graded Chapter Assignmen 1. EX.09-06 Algo Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $56 on December 31, 20Y8. 2. PR.09-02 Algo 3. PR.09-04. Algo AUTOMOTIVE SOLUTIONS INC. Comparative Income Statement For the Years Ended December 31, 2048 and 2017 20Y8 Sales $947,905 2017 $873,320 (322,370) Lost of goods sold (350,400) $597,505 Gross profit $550,950 Selling expenses $(189,070) $(233,870) Administrative expenses (161,055) (137,350) Total operating expenses (350,125) (371,220) Operating income $247,380 $179,730 13,020 11,470 Other revenue and expense: Other income Other expense (interest) Income before income tax (64,000) (35,200) $156,000 $196,400 (23,600) Income tax expense (18,900) Net income $172,800 $137,100 AUTOMOTIVE SOLUTIONS INC. Comparative Statement of Stockholders' Equity For the Years Ended December 31, 2048 and 2047 2018 Preferred Common Retained Preferred Common Retained Earnings Earnings 2017 Stock Stock Stock Stock Balances, Jan. 1 $160,000 $180,000 $784,500 $160,000 $180,000 $669,200 Net income 172,800 137,100 Dividends: Preferred stock (5,600) (5,600) Common (16,200) (16,200) stock Balances, $160,000 $180,000 $935,500 $160,000 $180,000 $784,500 Dec. 31 AUTOMOTIVE SOLUTIONS INC. Comparative Balance Sheet December 31, 2018 and 2047 Dec. 31, 2048 Dec 31, 2017 Assets Current assets: Cash $152,970 $191,280 Check My Work 1 more Check My Work uses remaining Previous Progress: 3/3 items Assignment Score: 41.16% Save and Exit Submit Assignment for Grading Chapter 9 - Graded Chapter Assignmen 880,000 Property, plant, and equipment (net) 1. EX.09-06. Algo 792,000 Total assets $2,295,900 $2,009,555 2. PR.09-02 Algo Liabilities 3. PR.09-04 Algo . Current liabilities $220,400 $445,055 Long-term liabilities: Mortgage note payable, 8%, due in 15 years $360,000 $0 440,000 440,000 Bonds payable, 8%, due in 20 years Total long-term liabilities $800,000 $440,000 Total liabilities $1,020,400 $885,055 Stockholders' Equity $160,000 Preferred $0.70 stock, $20 par Common stock, $10 par , 180,000 $160,000 180,000 935,500 $1,275,500 Retained earnings 784,500 Total stockholders' equity $1,124,500 Total liabilities and stockholders' equity ' $2,295,900 $2,009,555 Instructions: Determine the following measures for 20Y8. Round ratio values to one decimal place and dollar amounts to the nearest cent. For number of days' sales in receivables and number of days' sales in inventory, round intermediate calculations to the nearest whole dollar and final amounts to one decimal place. Assume there are 365 days in the year. 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Days' sales in receivables days 6. Inventory turnover 7. Days' sales in inventory days 8. Debt ratio % 9. Ratio of liabilities to stockholders' equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest eamed times 12. Times preferred dividends earned times 13. Asset turnover 14. Return on total assets % % 15. Return on stockholders' equity ' 16. Return on common stockholders' equity % 17. Earnings per share on common stock $ 18. Price-earnings ratio 19. Dividends per share of common stock $ 20. Dividend yield % Progress: 3/3 items Check My Work 1 more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts