Question: Chapter 9 Homework: 1 P. D 9 Flotation cost for common P. D Flotation cost for preferred Band maturity Annual coupon rate Par Bond price

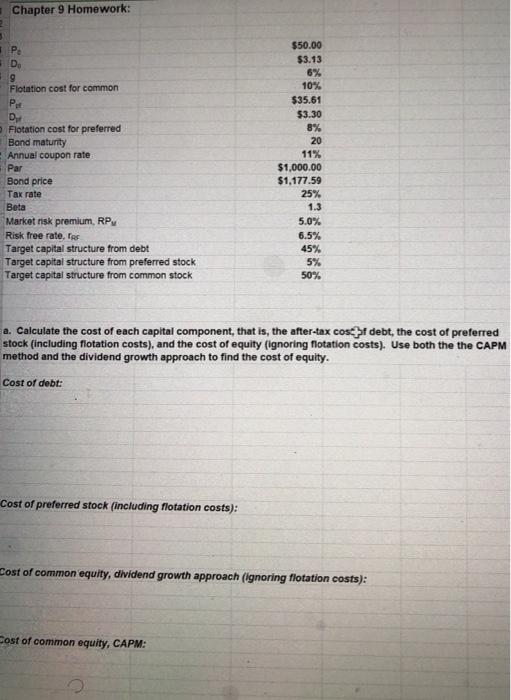

Chapter 9 Homework: 1 P. D 9 Flotation cost for common P. D Flotation cost for preferred Band maturity Annual coupon rate Par Bond price Tax rate Beta Market risk premium, RPM Risk free rate, as Target capital structure from debt Target capital structure from preferred stock Target capital structure from common stock $50.00 $3.13 6% 10% $35.61 $3.30 8% 20 11% $1,000.00 $1,177.59 25% 1.3 5.0% 6.5% 45% 5% 50% a. Calculate the cost of each capital component, that is, the after-tax cost bf debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the cost of equity. Cost of debt: Cost of preferred stock (including flotation costs): Cost of common equity, dividend growth approach (ignoring flotation costs): Cost of common equity, CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts