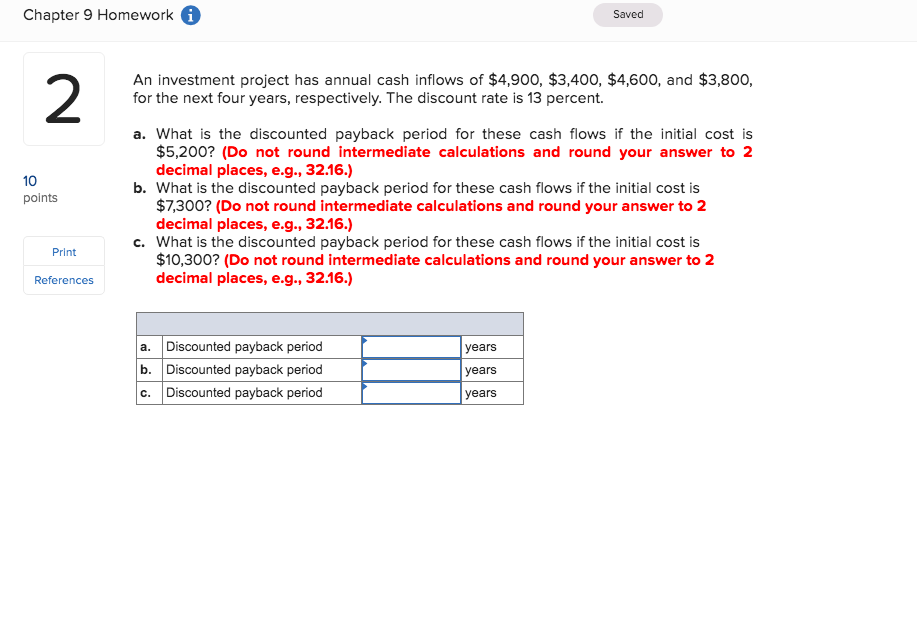

Question: Chapter 9 Homework 6 Saved 2 An investment project has annual cash inflows of $4,900, $3,400, $4,600, and $3,800 for the next four years, respectively.

Chapter 9 Homework 6 Saved 2 An investment project has annual cash inflows of $4,900, $3,400, $4,600, and $3,800 for the next four years, respectively. The discount rate is 13 percent. a. What is the discounted payback period for these cash flows if the initial cost is 5,200? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 10 points b. What is the discounted payback period for these cash flows if the initial cost is $7,300? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the discounted payback period for these cash flows if the initial cost is Print $10,300? (Do not round intermediate calculations and round your answer to2 decimal places, e.g., 32.16.) References a. Discounted payback period b. Discounted payback period c. Discounted payback period years years years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts