Question: Chapter 9 - Homework Assignment: eBook 1. EX.09.02A Journalizing And Posting Payroll Entries Cascade Company has four employees. All are paid on a monthly basis.

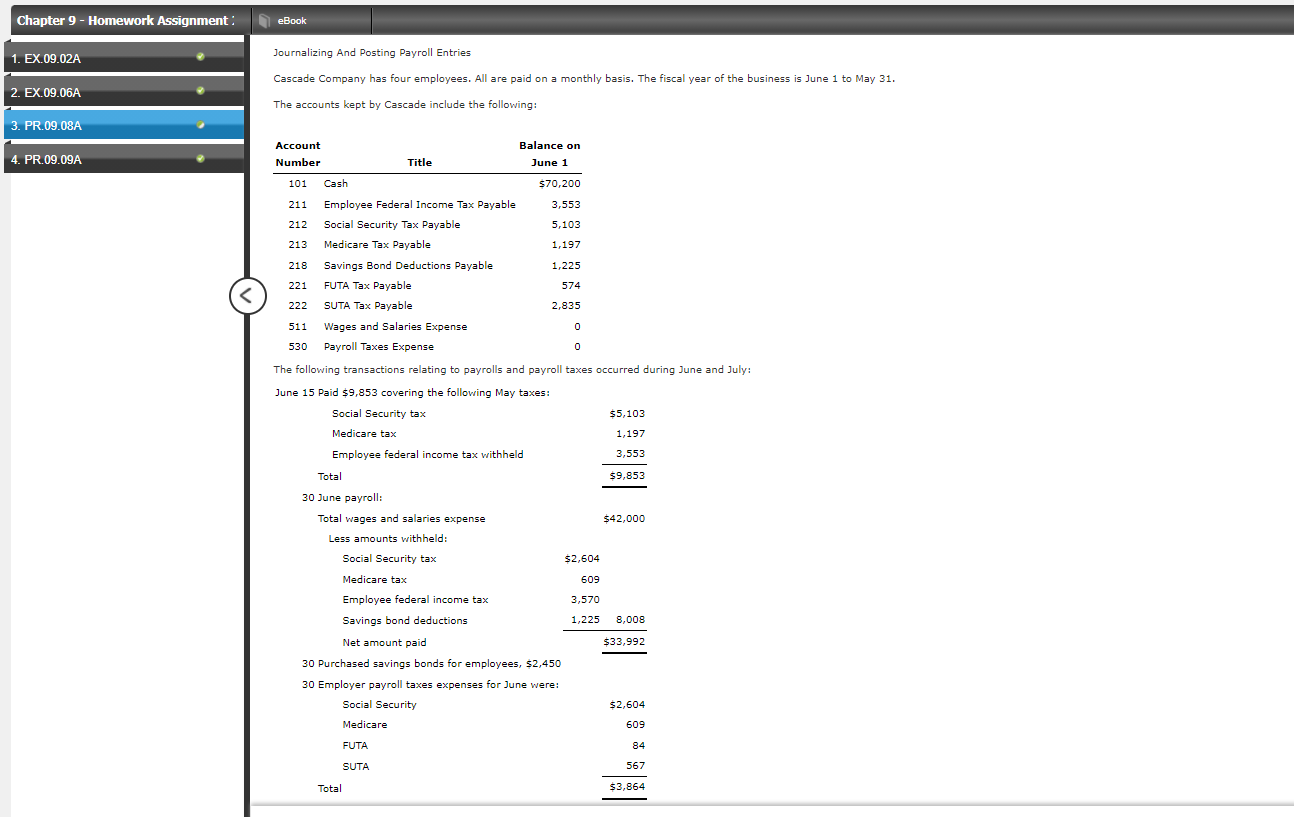

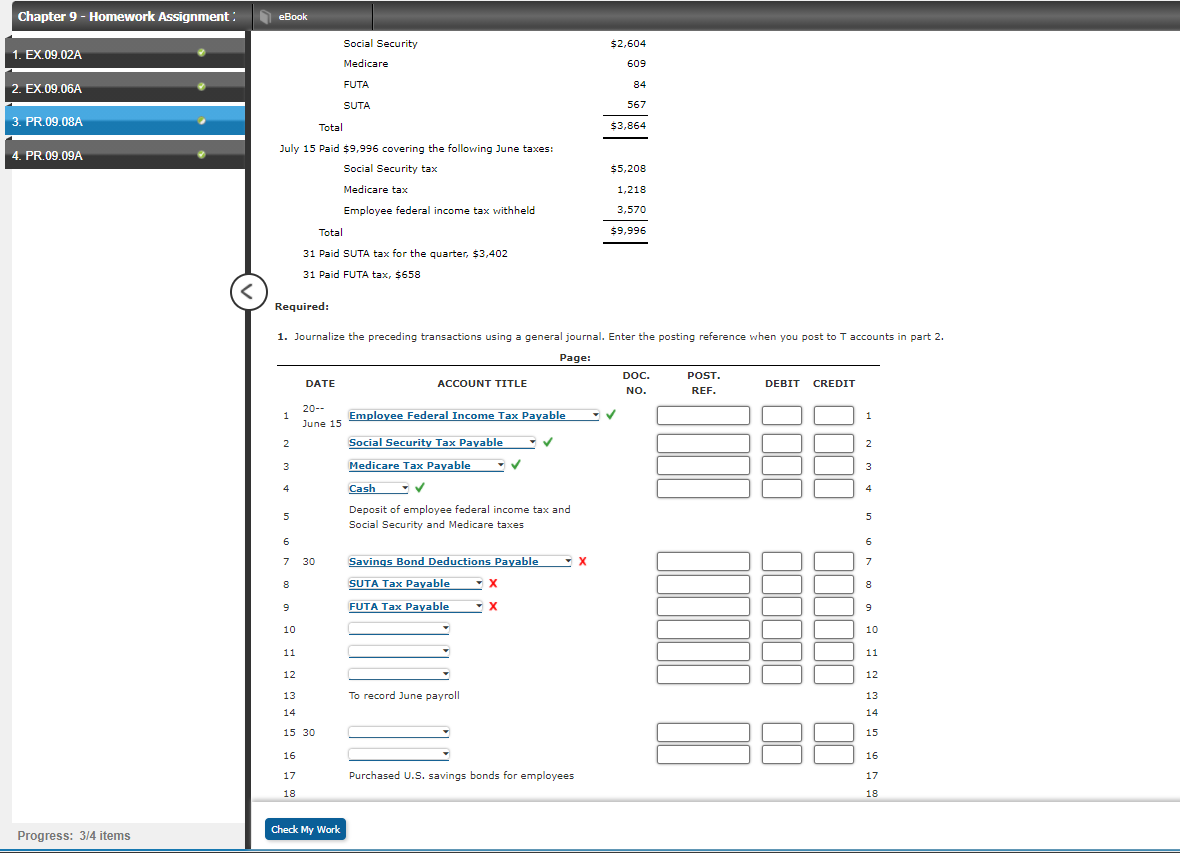

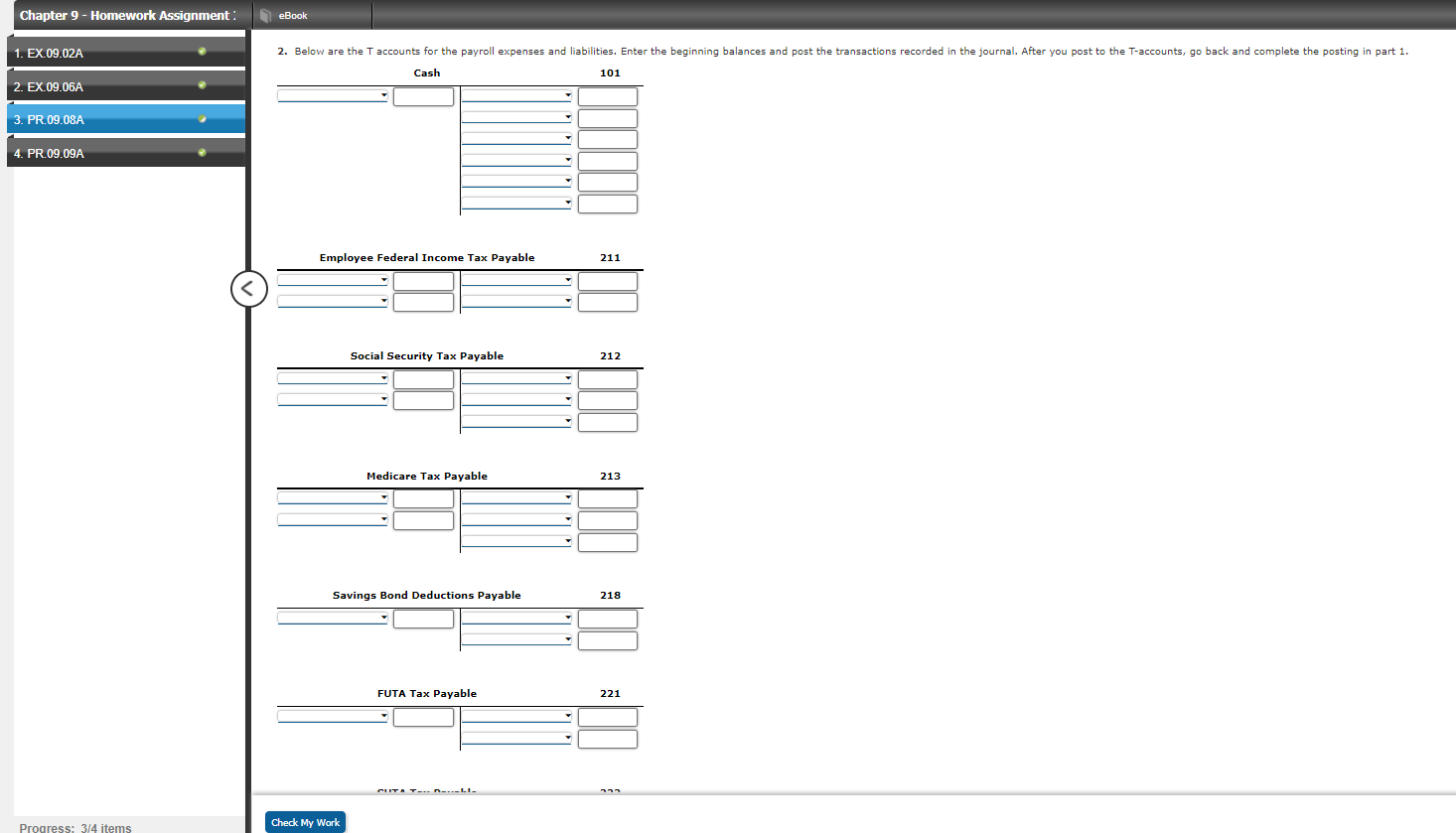

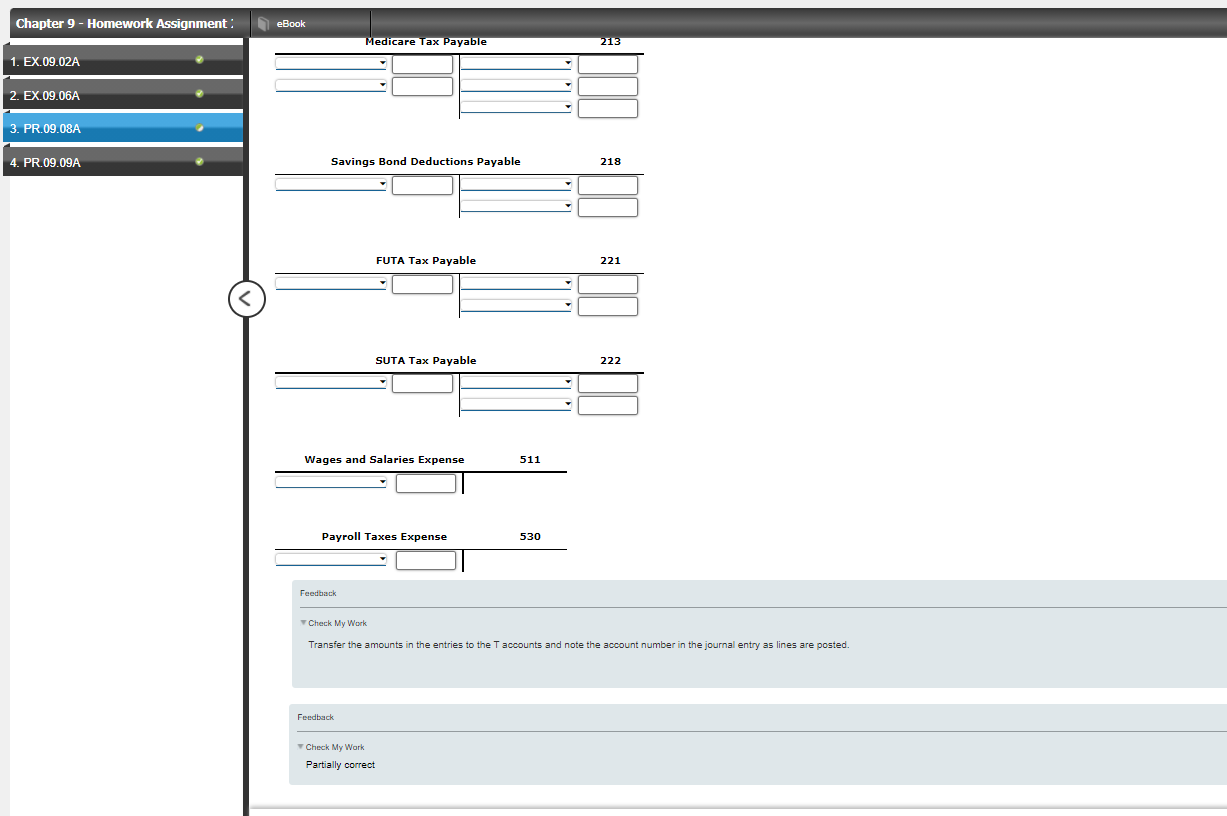

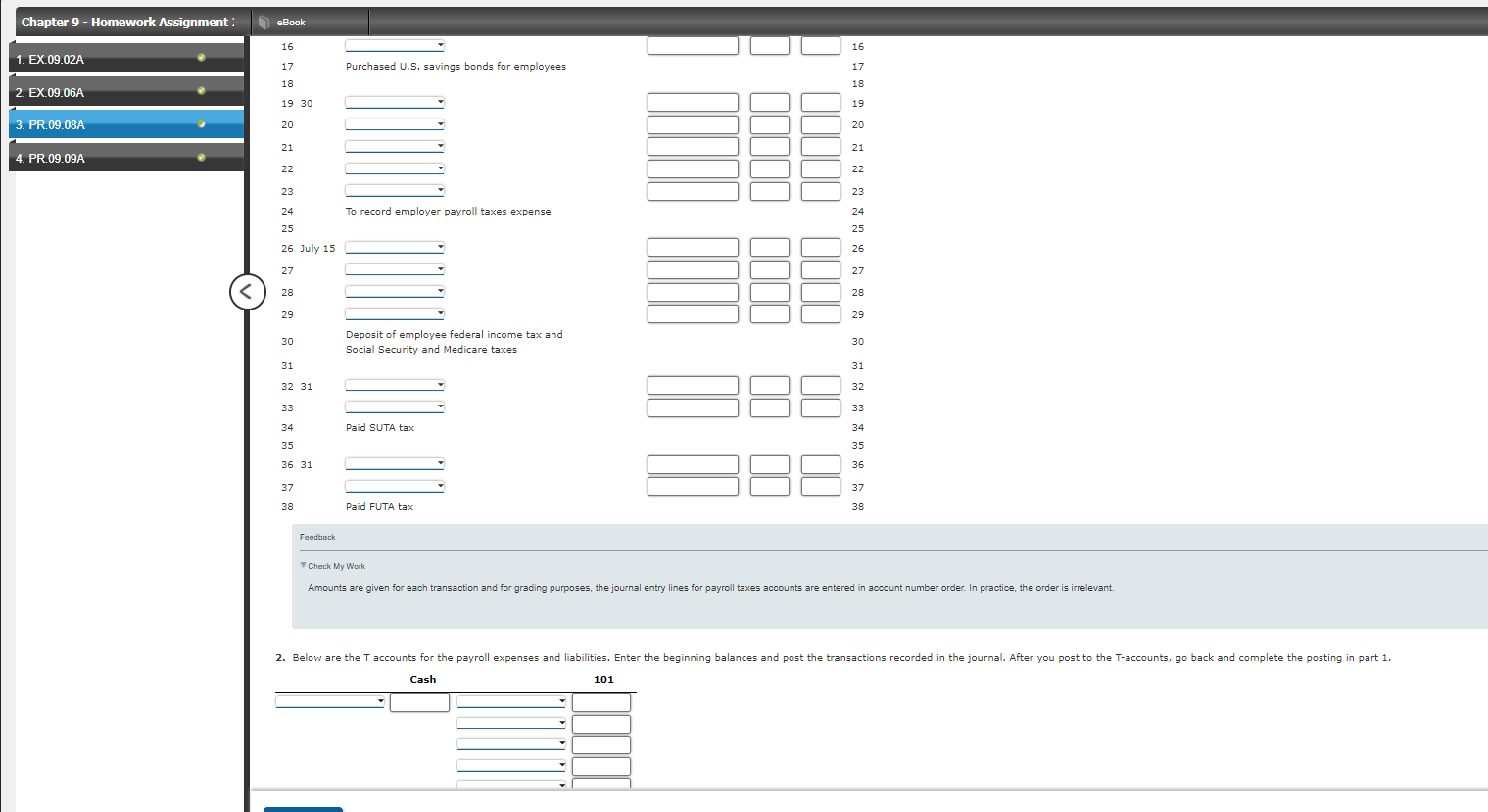

Chapter 9 - Homework Assignment: eBook 1. EX.09.02A Journalizing And Posting Payroll Entries Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31. 2. EX.09.06A The accounts kept by Cascade include the following: 3. PR.09.08A Balance on 4. PR.09.09A Account Number Title June 1 101 Cash $70,200 211 3,553 212 5,103 213 1,197 218 Employee Federal Income Tax Payable Social Security Tax Payable Medicare Tax Payable Savings Bond Deductions Payable FUTA Tax Payable SUTA Tax Payable Wages and Salaries Expense Payroll Taxes Expense 1,225 574 221 222 2,835 511 0 530 0 The following transactions relating to payrolls and payroll taxes occurred during June and July: June 15 Paid $9,853 covering the following May taxes: Social Security tax $5,103 Medicare tax 1,197 3,553 Employee federal income tax withheld Total 59,853 $42,000 30 June payroll: Total wages and salaries expense Less amounts withheld: Social Security tax Medicare tax Employee federal income tax Savings bond deductions $2,604 609 3,570 1,225 8,008 Net amount paid $33,992 30 Purchased savings bonds for employees, $2,450 30 Employer payroll taxes expenses for June were: Social Security Medicare FUTA $2,604 609 84 SUTA 567 Total $3,864 Chapter 9 - Homework Assignment eBook Social Security $2,604 1. EX.09.02A Medicare 609 FUTA 84 2. EX.09.06A SUTA 567 3. PR.09.08A Total $3,864 4. PR.09.09A $5,208 July 15 Paid $9,996 covering the following June taxes: Social Security tax Medicare tax Employee federal income tax withheld Total 1,218 3,570 $9,996 31 Paid SUTA tax for the quarter, $3,402 31 Paid FUTA tax, $658 Required: 1. Journalize the preceding transactions using a general journal. Enter the posting reference when you post to T accounts in part 2. Page: DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 20- 1 Employee Federal Income Tax Payable 1 June 15 2 Social Security Tax Payable 2 3 Medicare Tax Payable 3 4 Cash 4 Deposit of employee federal income tax and 5 Social Security and Medicare taxes 5 6 6 7 30 Savings Bond Deductions Payable X 7 8 SUTA Tax Payable 8 9 FUTA Tax Payable X 9 10 10 11 11 IMI I 12 12 13 To record June payroll 13 14 14 15 30 15 16 16 17 Purchased U.S. savings bonds for employees 17 18 18 Progress: 3/4 items Check My Work Check My Work Chapter 9 - Homework Assignment eBook 1. EX.09.02A 2. Below are the Taccounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal. After you post to the T-accounts, go back and complete the posting in part 1. Cash 101 2. EX.09.06A 3. PR.09.08A 4. PR.09.09A Employee Federal Income Tax Payable 211 Social Security Tax Payable 212 Medicare Tax Payable 213 Savings Bond Deductions Payable 218 FUTA Tax Payable 221 CUITA T-O-..-LI- Progress: 3/4 items Check My Work Chapter 9 - Homework Assignment eBook Medicare Tax Payable 1. EX.09.02A 2. EX.09.06A 3. PR.09.08A 4. PR.09.09A Savings Bond Deductions Payable 218 FUTA Tax Payable 221 SUTA Tax Payable 222 Wages and Salaries Expense 511 Payroll Taxes Expense 530 Feedback Check My Work Transfer the amounts in the entries to the T accounts and note the account number in the journal entry as lines are posted. Feedback Check My Work Partially correct Chapter 9 - Homework Assignment eBook 16 16 1. EX.09.02A 17 Purchased U.S. savings bonds for employees 17 18 18 2. EX.09.06A 19 30 19 3. PR.09.08A 20 20 21 21 4. PR.09.09A 22 22 23 23 24 To record employer payroll taxes expense m. lll 11. llll 24 25 25 26 July 15 26 27 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts