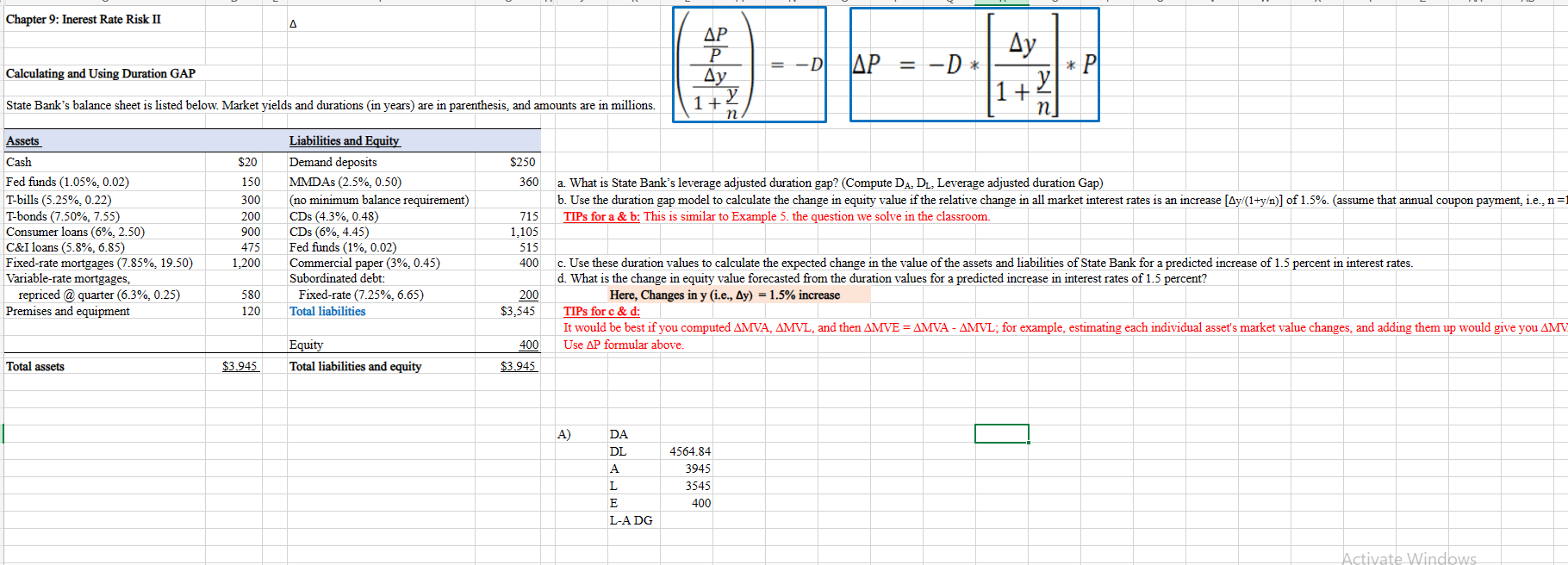

Question: Chapter 9: Inerest Rate Risk II Ay P = -D === -D* P Ay 1+ y n Calculating and Using Duration GAP State Bank's

Chapter 9: Inerest Rate Risk II Ay P = -D === -D* P Ay 1+ y n Calculating and Using Duration GAP State Bank's balance sheet is listed below. Market yields and durations (in years) are in parenthesis, and amounts are in millions. Assets 1+8 n Liabilities and Equity Cash $20 Demand deposits $250 Fed funds (1.05%, 0.02) 150 MMDAs (2.5%, 0.50) 360 T-bills (5.25%, 0.22) 300 (no minimum balance requirement) T-bonds (7.50%, 7.55) 200 CDs (4.3%, 0.48) 715 Consumer loans (6%, 2.50) 900 CDs (6%, 4.45) 1,105 C&I loans (5.8%, 6.85) 475 Fed funds (1%, 0.02) 515 Fixed-rate mortgages (7.85%, 19.50) 1,200 Commercial paper (3%, 0.45) 400 Variable-rate mortgages, Subordinated debt: repriced @ quarter (6.3%, 0.25) 580 Fixed-rate (7.25%, 6.65) Premises and equipment 120 Total liabilities Equity 400 Total assets $3.945 Total liabilities and equity $3.945 a. What is State Bank's leverage adjusted duration gap? (Compute DA. DL. Leverage adjusted duration Gap) b. Use the duration gap model to calculate the change in equity value if the relative change in all market interest rates is an increase [Ay/(1+y/n)] of 1.5%. (assume that annual coupon payment, i.e., n=1 TIPS for a & b: This is similar to Example 5. the question we solve in the classroom. c. Use these duration values to calculate the expected change in the value of the assets and liabilities of State Bank for a predicted increase of 1.5 percent in interest rates. d. What is the change in equity value forecasted from the duration values for a predicted increase in interest rates of 1.5 percent? 200 $3,545 Here, Changes in y (i.e., Ay) = 1.5% increase TIPS for c & d: It would be best if you computed AMVA, AMVL, and then AMVE = AMVA - AMVL; for example, estimating each individual asset's market value changes, and adding them up would give you AMV Use AP formular above. A) DA DL 4564.84 A 3945 3545 E 400 L-A DG Activate Windows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts