Question: Chapter 9 Problem 15 In early 2018, Integrated Communications, Ltd. was interested in acquiring Fractal Antenna Systems, Inc., a privately held company producing compact antennae.

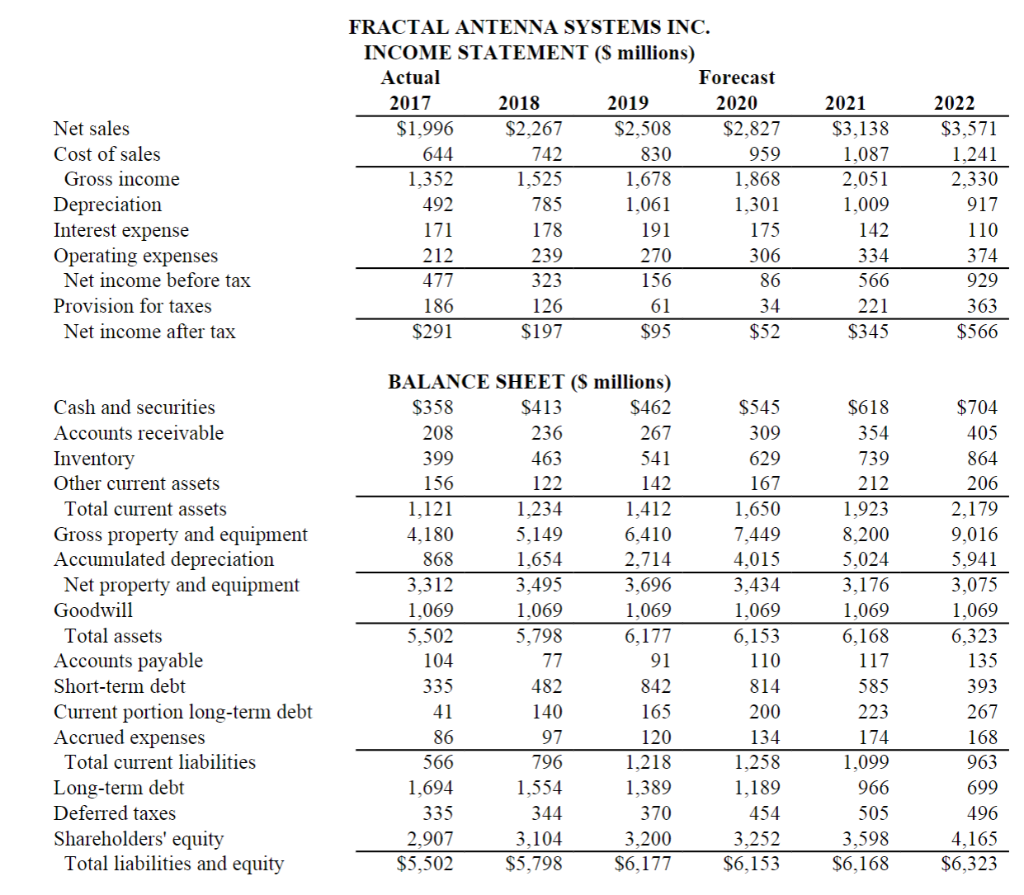

Chapter 9 Problem 15 In early 2018, Integrated Communications, Ltd. was interested in acquiring Fractal Antenna Systems, Inc., a privately held company producing compact antennae. As a first step in deciding what price to bid for Fractal, Integrated's finance department has prepared a five-year financial projection for the company assuming an acquisition. Use this projection and Fractal's 2017 actual financial figures to answer the questions below. a. Estimate Fractal's free cash flow from 2018 through 2022. b. Estimate the present value of Fractal's free cash flow for the years 2018 to 2022. Integrated's WACC is 8.0 percent. Fractal's WACC is 11.5 percent, and the average of the two companies' WACCs, weighted by sales, is 8.2 percent.c. Estimate Fractal's firm value at the end of 2017 under each of the following terminal value scenarios: i. Projected book value of assets at the end of 2022 ii. Perpetual growth in free cash flow at 4% per year after 2022 iii. Equity is worth 15 times after-tax earnings and debt is worth book value d. Assuming Fractal has 60 million shares outstanding, what is the maximum price per share Integrated should pay to acquire Fractal's equity in each of the three scenarios? e. Which of the three estimated maximum acquisition prices in question (i) above do you think is least reliable?

FRACTAL ANTENNA SYSTEMS INC. INCOME STATEMENT (S millions) Actual Forecast \begin{tabular}{rrrrrr} 2017 & 2018 & \multicolumn{1}{c}{2019} & 2020 & 2021 & 2022 \\ \hline$1,996 & $2,267 & $2,508 & $2,827 & $3,138 & $3,571 \\ 644 & 742 & 830 & 959 & 1,087 & 1,241 \\ \hline 1,352 & 1,525 & 1,678 & 1,868 & 2,051 & 2,330 \\ 492 & 785 & 1,061 & 1,301 & 1,009 & 917 \\ 171 & 178 & 191 & 175 & 142 & 110 \\ 212 & 239 & 270 & 306 & 334 & 374 \\ \hline 477 & 323 & 156 & 86 & 566 & 929 \\ 186 & 126 & 61 & 34 & 221 & 363 \\ \hline$291 & $197 & $95 & $52 & $345 & $566 \end{tabular} Net sales Gross income Depreciation Interest expense Operating expenses Provision for taxes Net income after tax BALANCE SHEET (S millions) $358208$413236$462267$545309$618354$704405 Cash and securities Accounts receivable Other current assets Total current assets Gross property and equipment Accumulated depreciation Net property and equipment Goodwill Total assets Accounts payable Short-term debt Current portion long-term debt Accrued expenses Total current liabilities Long-term debt Deferred taxes Shareholders' equity Total liabilities and equity \begin{tabular}{rrrrrr} 335 & 344 & 370 & 454 & 505 & 499 \\ 2,907 & 3,104 & 3,200 & 3,252 & 3,598 & 4,165 \\ \hline$5,502 & $5,798 & $6,177 & $6,153 & $6,168 & $6,323 \end{tabular} FRACTAL ANTENNA SYSTEMS INC. INCOME STATEMENT (S millions) Actual Forecast \begin{tabular}{rrrrrr} 2017 & 2018 & \multicolumn{1}{c}{2019} & 2020 & 2021 & 2022 \\ \hline$1,996 & $2,267 & $2,508 & $2,827 & $3,138 & $3,571 \\ 644 & 742 & 830 & 959 & 1,087 & 1,241 \\ \hline 1,352 & 1,525 & 1,678 & 1,868 & 2,051 & 2,330 \\ 492 & 785 & 1,061 & 1,301 & 1,009 & 917 \\ 171 & 178 & 191 & 175 & 142 & 110 \\ 212 & 239 & 270 & 306 & 334 & 374 \\ \hline 477 & 323 & 156 & 86 & 566 & 929 \\ 186 & 126 & 61 & 34 & 221 & 363 \\ \hline$291 & $197 & $95 & $52 & $345 & $566 \end{tabular} Net sales Gross income Depreciation Interest expense Operating expenses Provision for taxes Net income after tax BALANCE SHEET (S millions) $358208$413236$462267$545309$618354$704405 Cash and securities Accounts receivable Other current assets Total current assets Gross property and equipment Accumulated depreciation Net property and equipment Goodwill Total assets Accounts payable Short-term debt Current portion long-term debt Accrued expenses Total current liabilities Long-term debt Deferred taxes Shareholders' equity Total liabilities and equity \begin{tabular}{rrrrrr} 335 & 344 & 370 & 454 & 505 & 499 \\ 2,907 & 3,104 & 3,200 & 3,252 & 3,598 & 4,165 \\ \hline$5,502 & $5,798 & $6,177 & $6,153 & $6,168 & $6,323 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts