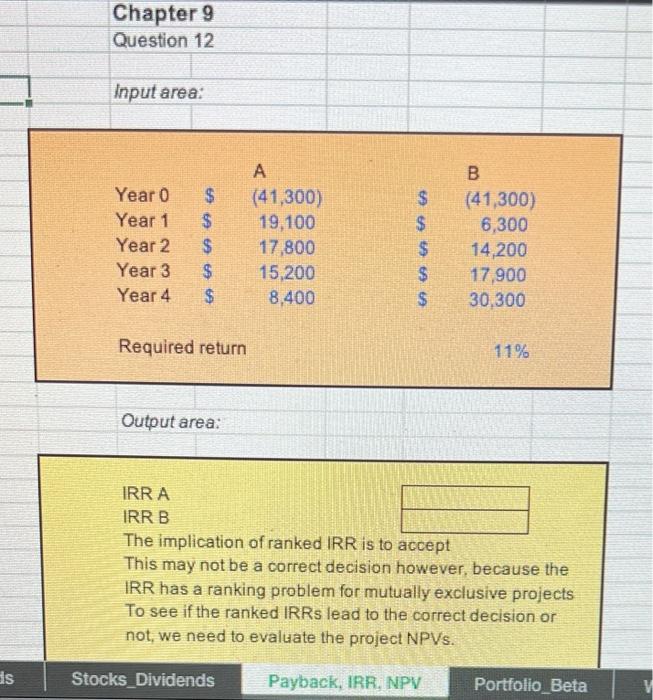

Question: Chapter 9 Question 12 Input area: begin{tabular}{|lcccc|} hline & & A & & Year 0 & $ & (41,300) & $ & multicolumn{1}{c|}{ B

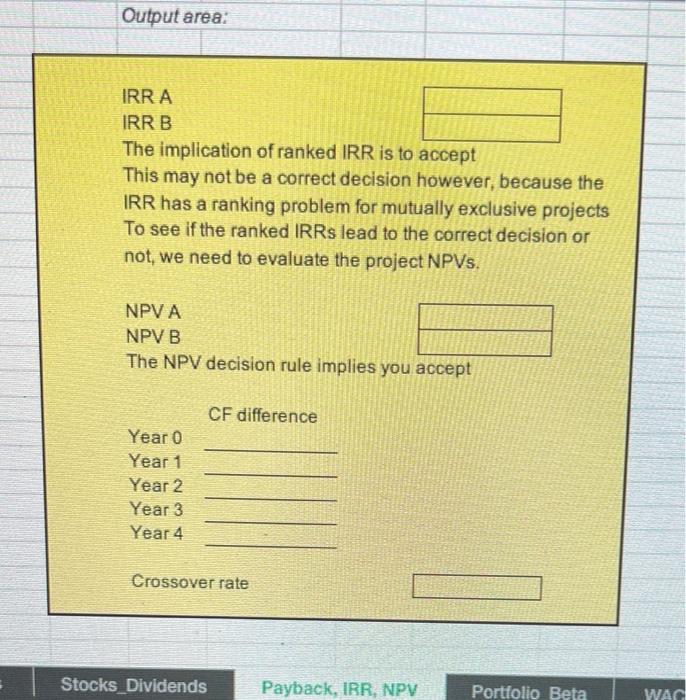

Chapter 9 Question 12 Input area: \begin{tabular}{|lcccc|} \hline & & A & & \\ Year 0 & $ & (41,300) & $ & \multicolumn{1}{c|}{ B } \\ Year 1 & $ & 19,100 & $ & 6,300) \\ Year 2 & $ & 17,800 & $ & 14,200 \\ Year 3 & $ & 15,200 & $ & 17,900 \\ Year 4 & $ & 8,400 & $ & 30,300 \\ Required return & & & & 11% \\ \hline \end{tabular} Output area: IRR A IRR B The implication of ranked RR is to accept This may not be a correct decision however, because the IRR has a ranking problem for mutually exclusive projects To see if the ranked IRRs lead to the correct decision or not, we need to evaluate the project NPVs. Stocks_Dividends Payback, IRR, NPV Portfolio_Beta IIIE ivry decision rule implies you accept Crossover rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts