Question: Chapter 9 Question 14 Output area Chapter 9 Question 14 Project Evaluation Kolb/s Korndogs is looking at a new sausage system with an installed cost

Chapter 9 Question 14 Output area

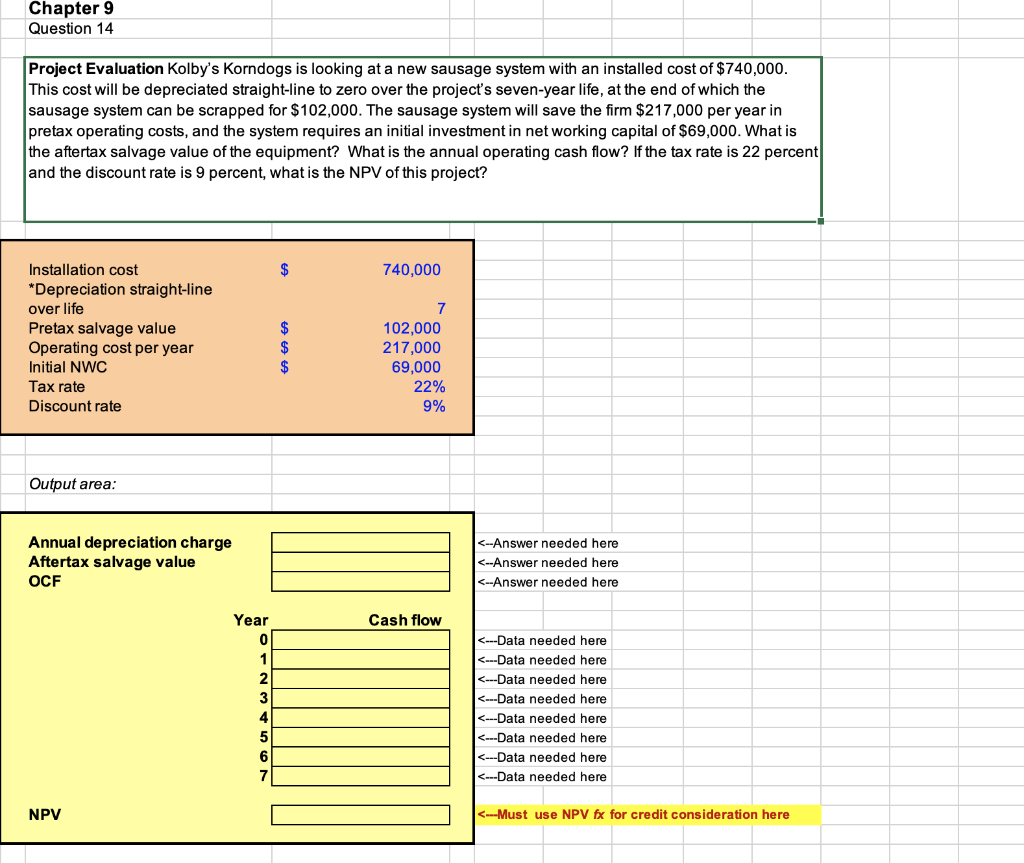

Chapter 9 Question 14 Project Evaluation Kolb/s Korndogs is looking at a new sausage system with an installed cost of $740,000. This cost will be depreciated straight-line to zero over the project's seven-year life, at the end ofwhich the sausage system can be scrapped for $102,000. The sausage system will save the firm $217,000 per year in pretax operating costs, and the system requires an initial inveshent in net working capital of $69,000. What is the aftertax salvage value of equipment? What is fre annual operating cash flow? Ifthe tax rate is 22 percent and the discount rate is 9 percent, what is the NPV of this project? Installation cost *Depreciation straight-line over life Pretax salvage value Operating cost per year Initial NWC Tax rate Discount rate Output area: Annual depreciation charge Aftertax salvage value OCF Year 2 3 4 5 6 7 NPV 740,000 7 102,000 217,000 69,000 22% 9% needed here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts