Question: CHAPTER CASE SCHAPTER CASE S CHAPTER CASE S&S Air Goes International M ark Sexton and Todd Story, the owners of S 8 S Air, have

CHAPTER CASE

SCHAPTER CASE

S

CHAPTER CASE

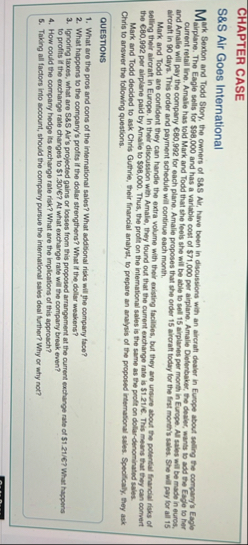

S&S Air Goes International

M ark Sexton and Todd Story, the owners of SS Air, have been in discussions with an aircraft dealer in Europe about selling the companyls Eagle airplane. The Eagle sells for $ and has a variable cost of $ per airplane. Amalie Dielenbaker, the dealec, wants lo add the Eagle to her

current retall line. Amale has lold Mark and Todd that she feels she will be able to sell airplanes per month in Europe. Al sales wall be made in euros, and Amalle will pay the company EBO, for each plane. Amalie proposes that she order aircraft today for the linst month's sales. She will pay for all alroraft in days. This order and psyment schedule will continue each month.

Mark and Todd are confident they can handle the extra volume with their existing facilses, but they are unsure about the potential francial risks of selling their aircraft in Europe. In their discussion with Amale, they found out that the cument exchange rate is $ This means that they can comvert the per airplane paid by Amalie to $ Thus, the proft on the intemational sales is the same as the proft on doliardenominated sales.

Mark and Todd decided to ask Chris Guthrie, their financial analyst, to prepare an analysis of the proposed intemational sales. Specifically, Shey ask Chris to answer the following questions.

QUESTIONS

What are the pros and cons of the international sales? What addisonal risks will the company face?

What happens to the company's profis if the dollar strengthens? What if the dollar weakens?

Ignoring taxes, what are S&S Alr's projected gains or losses from this proposed arrangement at the ourrent exchange rate of What hagpens to profits if the exchange rate changes to $ At what exchange rate will the company break even?

How could the company hedge its exchange rate risk? What are the implications of this approach?

Taking all factors into account, should the compary pursue the international sales deal further? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock