Question: Chapter Eight I Return on lavested Capital and profitability Analysis EXERCISES 489 EXERCISE 8-1 Analyzing Financial Leverage for Alternative Financing Strategies FIT Corporation's return on

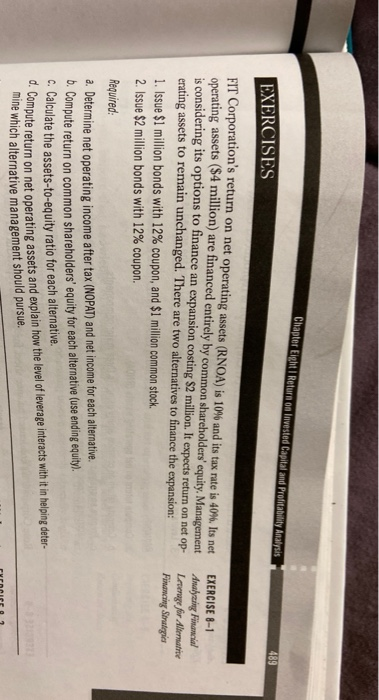

Chapter Eight I Return on lavested Capital and profitability Analysis EXERCISES 489 EXERCISE 8-1 Analyzing Financial Leverage for Alternative Financing Strategies FIT Corporation's return on net operating assets (RNOA) is 10% and its tax rate is 40%, Its net operating assets ($4 million) are financed entirely by common shareholders' equity. Management is considering its options to finance an expansion costing $2 million. It expects return on net op- erating assets to remain unchanged. There are two alternatives to finance the expansion: 1. Issue $1 million bonds with 12% coupon, and $1 million common stock. 2. Issue $2 million bonds with 12% coupon. Required: a. Determine net operating income after tax (NOPAT) and net income for each alternative. b. Compute return on common shareholders' equity for each alternative (use ending equity). C. Calculate the assets-to-equity ratio for each alternative. mine which alternative management should pursue. d. Compute return on net operating assets and explain how the level of leverage interacts with it in helping deter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts