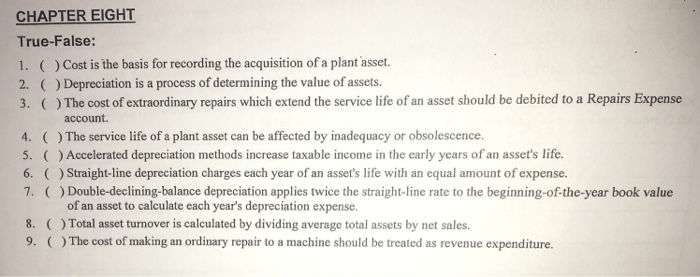

Question: CHAPTER EIGHT True-False: 1. () Cost is the basis for recording the acquisition of a plant asset. 2. () Depreciation is a process of determining

CHAPTER EIGHT True-False: 1. () Cost is the basis for recording the acquisition of a plant asset. 2. () Depreciation is a process of determining the value of assets. 3. The cost of extraordinary repairs which extend the service life of an asset should be debited to a Repairs Expense account. 4. The service life of a plant asset can be affected by inadequacy or obsolescence. 5. () Accelerated depreciation methods increase taxable income in the early years of an asset's life. 6. () Straight-line depreciation charges each year of an asset's life with an equal amount of expense. 7. (Double-declining-balance depreciation applies twice the straight-line rate to the beginning-of-the-year book value of an asset to calculate each year's depreciation expense. 8. )Total asset turnover is calculated by dividing average total assets by net sales 9. The cost of making an ordinary repair to a machine should be treated as revenue expenditure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts