Question: Chapter Eleven Problems Saved Help Save & Exit Submit Check my work 2 A payroll summary for Mark Consulting Company, owned by Mark Fronke, for

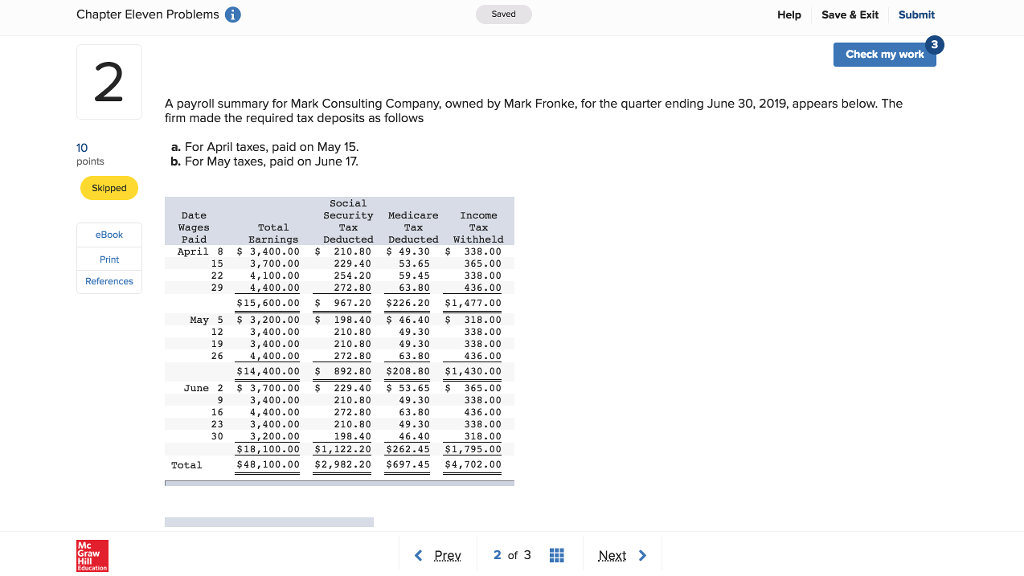

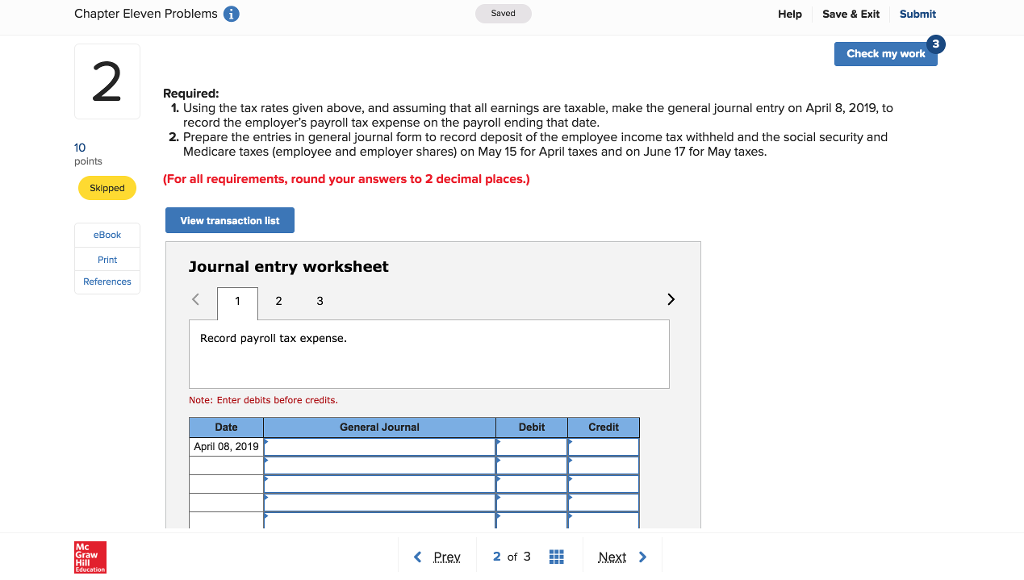

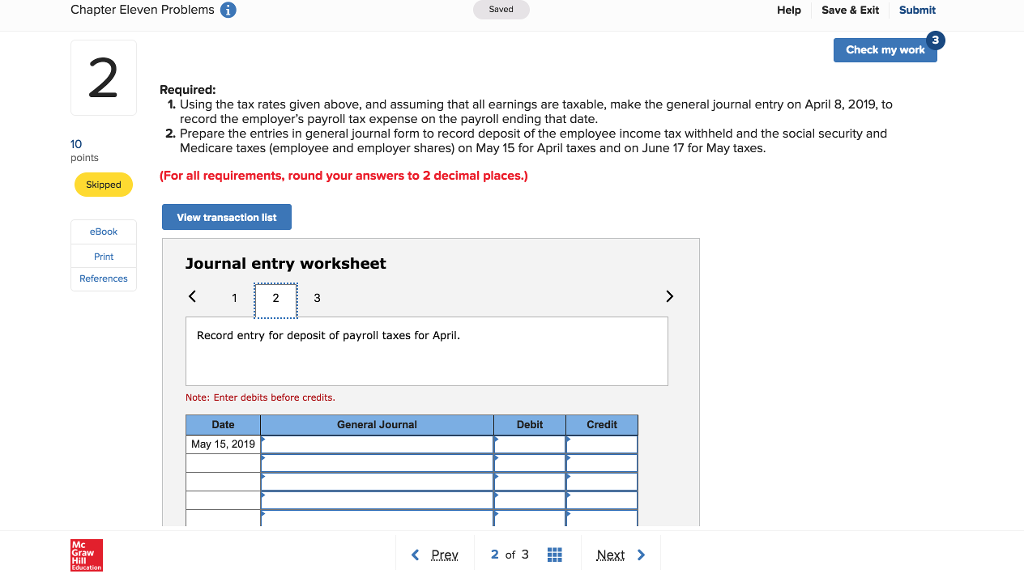

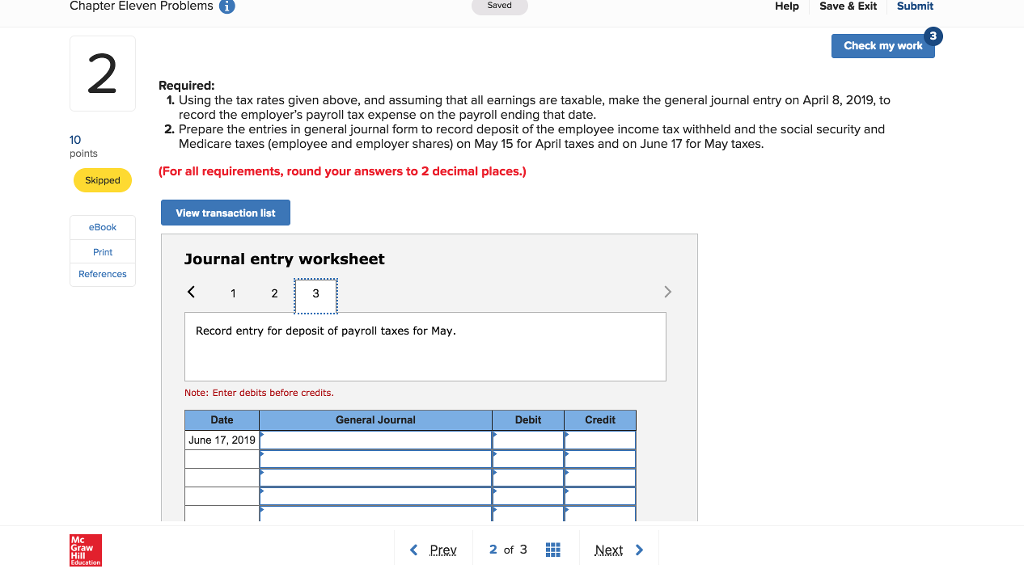

Chapter Eleven Problems Saved Help Save & Exit Submit Check my work 2 A payroll summary for Mark Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 2019, appears below. The firm made the required tax deposits as follows 10 points a. For April taxes, paid on May 15. b, For May taxes, paid on June 17. Skipped Social Security Medicare Income Date Wages Paid Total Earnings Tax Tax Tax Deducted Deducted Withheld eBook April 8 3,400.00 210.80 $ 49.30 338.00 365.00 338.00 436.00 Print 229.4 254.20 272.80 53.65 59.45 63.6 15 3,700.00 4,100.00 4,400.00 References 29 $15,600.00 $ 967.20 $226.20 $1,477.00 May 5 3,200.00 3,400.00 3,400.00 4,400.00 $14,400.00 12 19 26 198.40 46.40 49.30 49.30 63.80 210.80 210.80 272.80 318.00 338.00 338.00 436.00 892.80 $208.80 $1,430.00 June 2 3,700.00 229.40 53.65 365.00 338.00 436.00 338.00 318.00 $18,100.00 $1,122.20 $262.45 $1,795.00 $48,100.00 2,982.20 $697.45 $4,702.00 3,400.00 4,400.00 3,400.00 3,200.00 210.80 272.80 210.80 198.40 49.30 63.80 49.30 46-40 16 23 30 Total Mc Graw Hill Prey 2013 Next>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts