Question: Chapter Exercise 6.2 1. Historical cost represents the actual payment of the items purchased by the company. 2. Depreciation is not an out of pocket

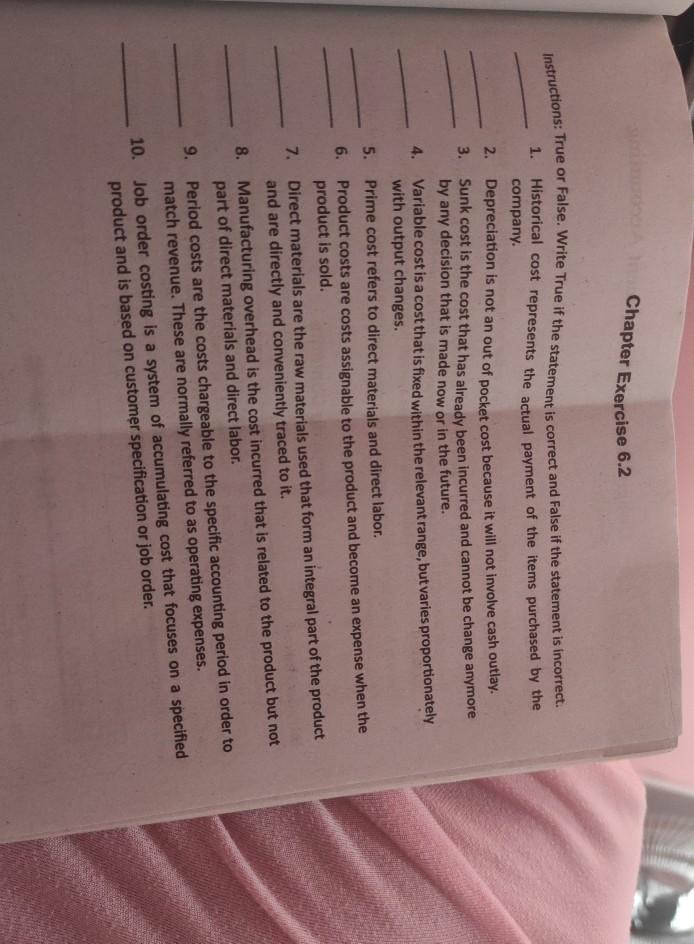

Chapter Exercise 6.2 1. Historical cost represents the actual payment of the items purchased by the company. 2. Depreciation is not an out of pocket cost because it will not involve cash outlay. 3. Sunk cost is the cost that has already been incurred and cannot be change anymore by any decision that is made now or in the future. 4. Variable cost is a cost that is fixed within the relevant range, but varies proportionately with output changes. 5. Prime cost refers to direct materials and direct labor. 6. Product costs are costs assignable to the product and become an expense when the product is sold. 7. Direct materials are the raw materials used that form an integral part of the product and are directly and conveniently traced to it. 8. Manufacturing overhead is the cost incurred that is related to the product but not part of direct materials and direct labor. 9. Period costs are the costs chargeable to the specific accounting period in order to match revenue. These are normally referred to as operating expenses. 10. Job order costing is a system of accumulating cost that focuses on a specified product and is based on customer specification or job order. Instructions: True or False. Write True if the statement is correct and False if the statement is incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts