Question: Chapter : Integrative Cases: Integrative Case 3.9 Moving Headquarters Overseas Book Title: Global Business 2023 Cengage Learning, Inc., Cengage Learning, Inc. Integrative Case 3.9 Moving

Chapter : Integrative Cases: Integrative Case 3.9 Moving Headquarters Overseas Book Title: Global Business 2023 Cengage Learning, Inc., Cengage Learning, Inc.

Integrative Case 3.9 Moving Headquarters Overseas Mike W. Peng (University of Texas at Dallas)

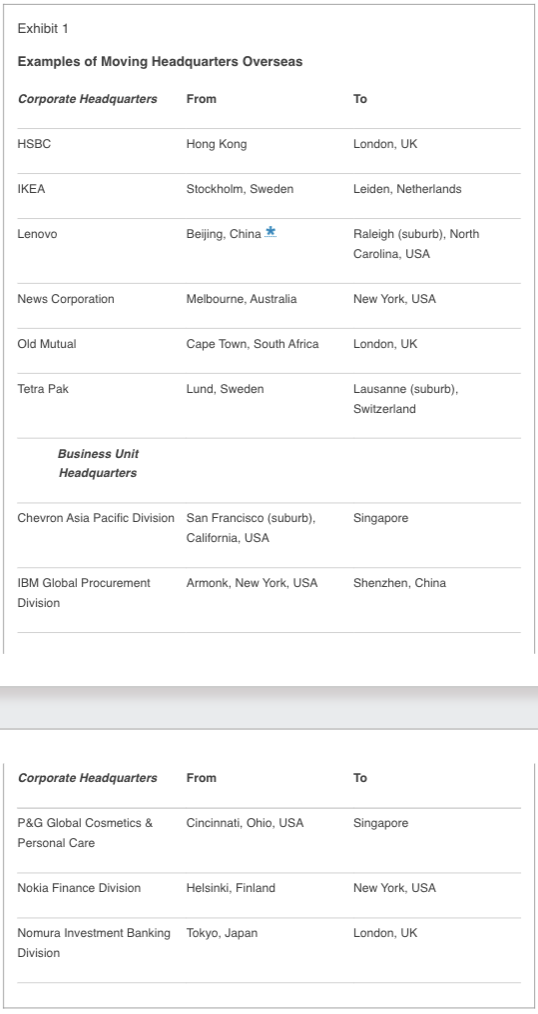

A number of multinationals have moved their corporate (global) headquarters or business unit headquarters overseas.

Given the cost, the hassle, and the inconvenience, why would they make these complex moves? A number of multinational enterprises (MNEs) have moved headquarters (HQ) overseas (see Exhibit 1). In general, there are two levels of HQ: corporate (global) and business unit. The question is, why?

If you have moved from one house to another in the same city, you can easily appreciate the logistical challenges (and nightmares!) associated with relocating HQ overseas. One simple answer to the why question is that the benefits must significantly outweigh the drawbacks. At the business unit level, the answer is straightforward: the center of gravity of the activities of a business unit may pull its HQ toward a host country. For example, Nokia moved its finance units HQ from Helsinki, Finland, to New York, which has the biggest capital market in the world. After Nomura acquired Lehman Brothers European business, it moved its investment banking division HQ to London to demonstrate its commitment to transform Nomura from a regional player to the global top tier in investment banking.

At the corporate level, there are at least five strategic rationales. First, a leading symbolic value is an unambiguous statement to various stakeholders that the firm is a global player. News Corporations new corporate HQ in New York is indicative of its global status, as opposed to being a relatively parochial firm from down under. Lenovos coming of age is undoubtedly underpinned by the establishment of its second HQ in the United States.

Second, there may be significant efficiency gains. If the new corporate HQ is in a major financial center, such as New York or London, the MNE can have more efficient and more frequent communication with institutional shareholders, financial analysts, and investment banks. The MNE also increases its visibility in a financial market, resulting in a broader shareholder base and greater market capitalization. Three leading (former) South African firms, Anglo American, Old Mutual, and SABMiller (more recently acquired by Anheuser- Busch InBev), have joined the FTSE 100the top 100 UK firms by capitalization.

Third, firms may benefit from their visible commitment to the laws of the new host country. They can also benefit from the higher-quality legal and regulatory regime under which they now operate. These benefits are especially crucial for firms from emerging economies where local rules are not world class. A lack of confidence about South Africas political stability drove Anglo American, Old Mutual, and SABMiller to London. By moving to London in 1992, HSBC likewise deviated from its Hong Kong roots at a time when the political future of Hong Kong was uncertain.

Fourth, moving corporate HQ to a new country clearly indicates a commitment to that country. In addition to political motivation, HSBCs move to London signaled its determination to become a more global player, instead of being a regional player centered on Asia. HSBC indeed carried out this more global strategy since the 1990s. However, in an Corporate Headquarters From To P&G Global Cosmetics & Personal Care Nokia Finance Division Nomura Investment Banking Division Cincinnati, Ohio, USA Helsinki, Finland Tokyo, Japan Singapore New York, USA London, UK interesting twist of events, HSBCs CEO relocated back to Hong Kong in 2010. Technically, HSBCs corporate HQ is still in London, and its chairman remains in London. But the symbolism of the CEOs return to Hong Kong is clear. As China becomes more economically powerful, HSBC is interested in demonstrating its commitment to that important part of the world, which was where HSBC started. (HSBC was set up in Hong Kong in 1865 as Hongkong and Shanghai Banking Corporation.)

Finally, by moving (or threatening to move) HQ, firms enhance their bargaining power vis-- vis that of their (original) home-country governments. Tetra Paks move of its HQ to Switzerland was driven primarily by the owners tax disputes with the Swedish government. Likewise, as three of Britains large banksBarclays, HSBC, and Standard Chartered, the three best-run ones that did not need bailouts during the Great Recession of 20082009 now face higher taxes and more government intervention, they, too, have threatened to move their HQ out of London. The message is clear: If the home-country government treats us harshly, we will pack our bags.

The last point, of course, is where the ethical and social responsibility controversies erupt. In 2014, Fiat announced its plan to merge itself and Chrysler into a new Amsterdam, the Netherlands-based holding company, Fiat Chrysler Automobiles NV. Its operational HQ where top executives workwould go to London. So Fiat in the end left Italyon paper at least. Although the absolute number of jobs lost is not great, these are high-quality (and high-paying) jobs that every government would prefer to see. For MNEs home countries, if a sufficient number of HQ move overseas, there is a serious ramification that other high- quality service providers, such as lawyers, bankers, and accountants, will follow them. In response, proposals are floating to offer tax incentives for these footloose MNEs to keep HQ at home. However, critics question why these wealthy MNEs (and executives) need to be subsidized (or bribed), while many other sectors and individuals are struggling.

Case Discussion Questions

1. What are the drawbacks and benefits associated with moving business unit HQ and corporate HQ to another country?

2. ON ETHICS: If you were a CEO or a business unit head, under what conditions would you consider moving HQ?

3. If you were a government official in the possible new country for the MNEs business unit or global HQ, you understand the MNE is also considering other countries as possible sites for its HQ. What can you do to encourage such moves of multinational HQ into your country?

4. If you were a government official in the MNEs home country, what can you do to discourage such moves of multinational HQ out of your country?

Exhibit 1 Examples of Moving Headquarters Overseas Corporate Headquarters From To \begin{tabular}{lll} \hline HSBC & Hong Kong London, UK \end{tabular} \begin{tabular}{lll} \hline IKEA & Stockholm, Sweden & Leiden, Netherlands \\ \hline Lenovo & Beijing, China * & Raleigh(suburb),NorthCarolina,USA \\ \hline News Corporation & Melbourne, Australia & New York, USA \\ \hline Old Mutual & Cape Town, South Africa & London, UK \\ \hline Tetra Pak & Lund, Sweden & Lausanne(suburb),Switzerland \\ & & \end{tabular} Business Unit Headquarters Chevron Asia Pacific Division San Francisco (suburb), Singapore California, USA IBM Global Procurement Armonk, New York, USA Shenzhen, China Division Corporate Headquarters P\&G Global Cosmetics \& Personal Care Nokia Finance Division Nomura Investment Banking Tokyo, Japan Division From To Singapore Cincinnati, Ohio, USA Helsinki, Finland New York, USA London, UK London, UK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts