Question: Chapter: Leasing Question 1: A company leases a machine with a six-year life and a cost of $10,000 for 5 years with annual payments of

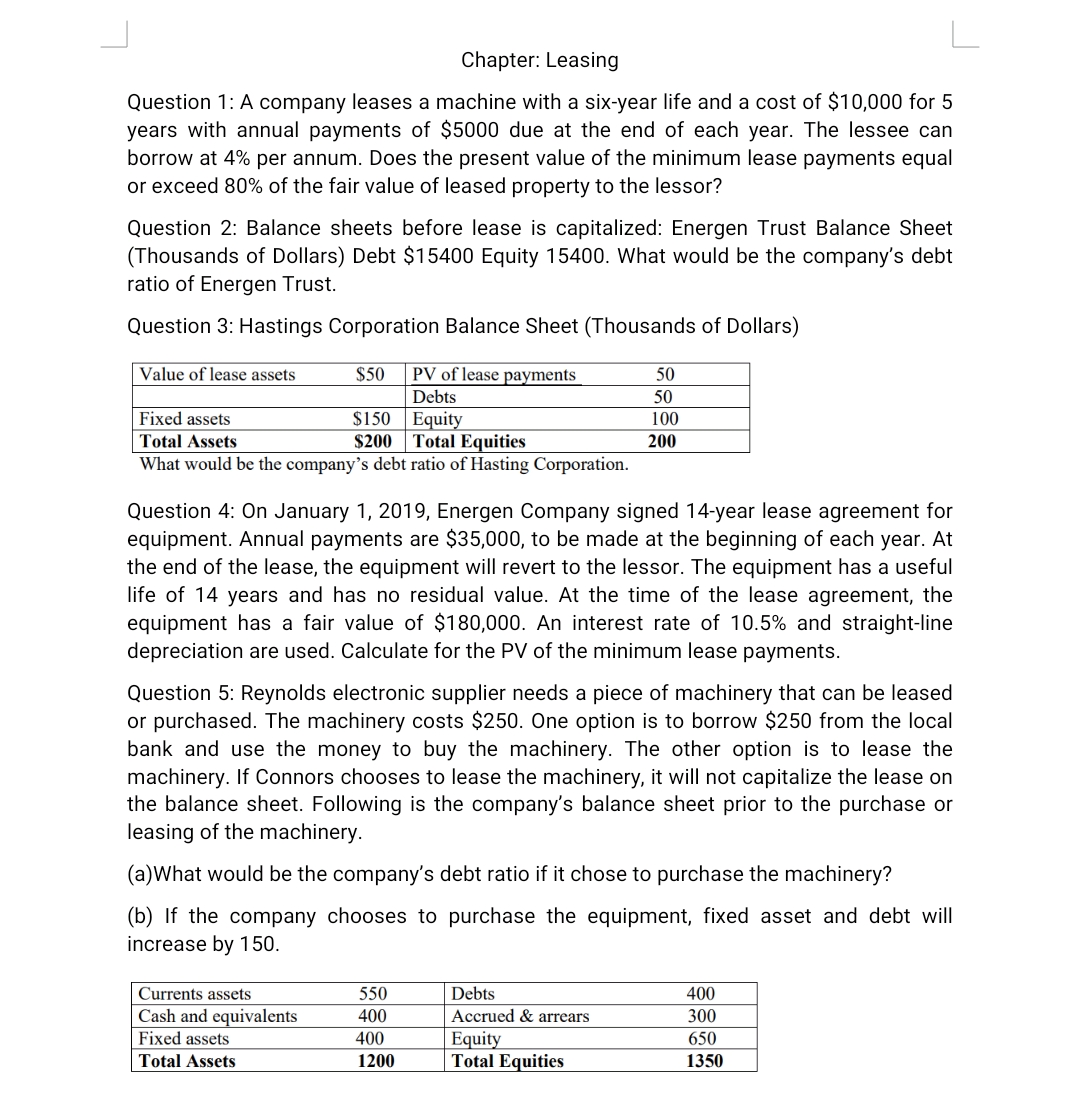

Chapter: Leasing Question 1: A company leases a machine with a six-year life and a cost of $10,000 for 5 years with annual payments of $5000 due at the end of each year. The lessee can borrow at 4% per annum. Does the present value of the minimum lease payments equal or exceed 80% of the fair value of leased property to the lessor? Question 2: Balance sheets before lease is capitalized: Energen Trust Balance Sheet (Thousands of Dollars) Debt $15400 Equity 15400 . What would be the company's debt ratio of Energen Trust. Question 3: Hastings Corporation Balance Sheet (Thousands of Dollars) What would be the company's debt ratio of Hasting Corporation. Question 4: On January 1, 2019, Energen Company signed 14-year lease agreement for equipment. Annual payments are $35,000, to be made at the beginning of each year. At the end of the lease, the equipment will revert to the lessor. The equipment has a useful life of 14 years and has no residual value. At the time of the lease agreement, the equipment has a fair value of $180,000. An interest rate of 10.5% and straight-line depreciation are used. Calculate for the PV of the minimum lease payments. Question 5: Reynolds electronic supplier needs a piece of machinery that can be leased or purchased. The machinery costs $250. One option is to borrow $250 from the local bank and use the money to buy the machinery. The other option is to lease the machinery. If Connors chooses to lease the machinery, it will not capitalize the lease on the balance sheet. Following is the company's balance sheet prior to the purchase or leasing of the machinery. (a)What would be the company's debt ratio if it chose to purchase the machinery? (b) If the company chooses to purchase the equipment, fixed asset and debt will increase by 150

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts