Question: Chapter Nineteen: Financial Decision Making 11. When a financial advisor wants to determine how much of the value of their common shares is represented by

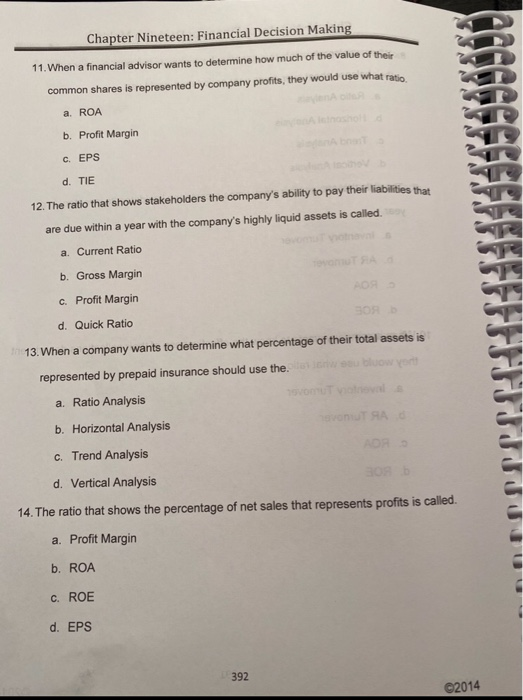

Chapter Nineteen: Financial Decision Making 11. When a financial advisor wants to determine how much of the value of their common shares is represented by company profits, they would use what ratio a. ROA b. Profit Margin C. EPS d. TIE 12. The ratio that shows stakeholders the company's ability to pay their liabilities that are due within a year with the company's highly liquid assets is called. a. Current Ratio b. Gross Margin c. Profit Margin d. Quick Ratio 13. When a company wants to determine what percentage of their total assets is represented by prepaid insurance should use these blow yor a. Ratio Analysis Vou voel b. Horizontal Analysis hevonut 9A C. Trend Analysis DR d. Vertical Analysis 14. The ratio that shows the percentage of net sales that represents profits is called a. Profit Margin b. ROA C. ROE d. EPS 392 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts