Question: CHAPTER3 Austing Accouts for Financa Staterments e. Using the straight line depreciation method, calculate the ansuual depreciation for 21T d. In order to prepare the

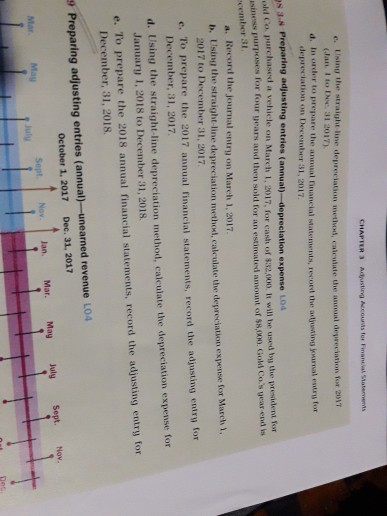

CHAPTER3 Austing Accouts for Financa Staterments e. Using the straight line depreciation method, calculate the ansuual depreciation for 21T d. In order to prepare the annual financial statements, record the adtjnusting journal entru for (lan. I to Dee. 31 2017) depreciation on December 31, 2017 s 3.s Preparing adjusting entries (annual)-depreclation expense LO4 old Co purchased a vehicle on March 1, 2017, for cash of s32,000. It will be used by the pr sines purposes for four gears and then sold for an estimated amount of $8,00 cember 31 esidet tor Gold Co's year end is a. Record the journal entry on March 1, 2017 the straight-line depreciation method, calculate the depreciation expense for March 1, 2017 to December 31, 2017 e. To prepare the 2017 annual financial statements, record the adjusting entry for December, 31, 2017 January 1, 2018 to December 31, 2018 December, 31, 2018. d. Using the straight-line depreciation method, calculate the depreciation expense for e. To prepare the 2018 annual financial statements, record the adjusting entry for 9 Preparing adjusting entries (annual)-unearned revenue LO4 Dec. 31, 2017 October 1, 2017 Mar May Sept. Nov.Jan. Mar. May Jly Sept. Nov july

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts