Question: chapter5 290T Q#7 A debate is raging inside the top management team of Millcreek Company. The chief executive officer (CEO) is preparing to take the

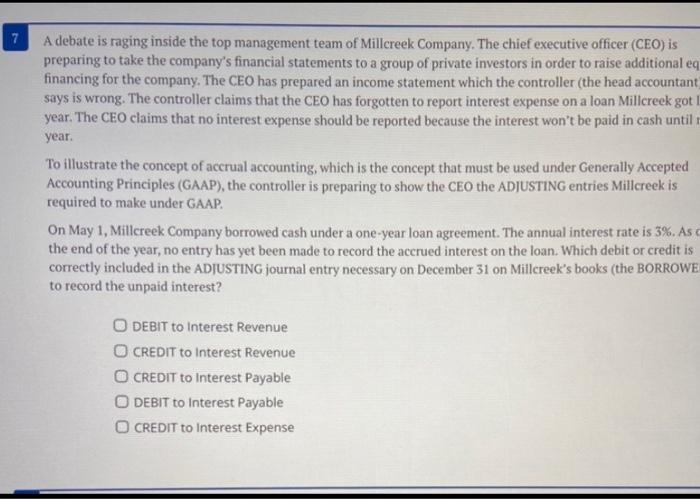

A debate is raging inside the top management team of Millcreek Company. The chief executive officer (CEO) is preparing to take the company's financial statements to a group of private investors in order to raise additional eq financing for the company. The CEO has prepared an income statement which the controller (the head accountant says is wrong. The controller claims that the CEO has forgotten to report interest expense on a loan Millcreek got I year. The CEO claims that no interest expense should be reported because the interest won't be paid in cash until year. To illustrate the concept of accrual accounting, which is the concept that must be used under Generally Accepted Accounting Principles (GAAP), the controller is preparing to show the CEO the ADIUSTING entries Millcreek is required to make under GAAP. On May 1, Millcreek Company borrowed cash under a one-year loan agreement. The annual interest rate is 3%. As the end of the year, no entry has yet been made to record the accrued interest on the loan. Which debit or credit is correctly included in the ADIUSTING journal entry necessary on December 31 on Millcreek's books (the BORROWE to record the unpaid interest? DEBIT to Interest Revenue CREDIT to interest Revenue CREDIT to interest Payable DEBIT to interest Payable CREDIT to Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts