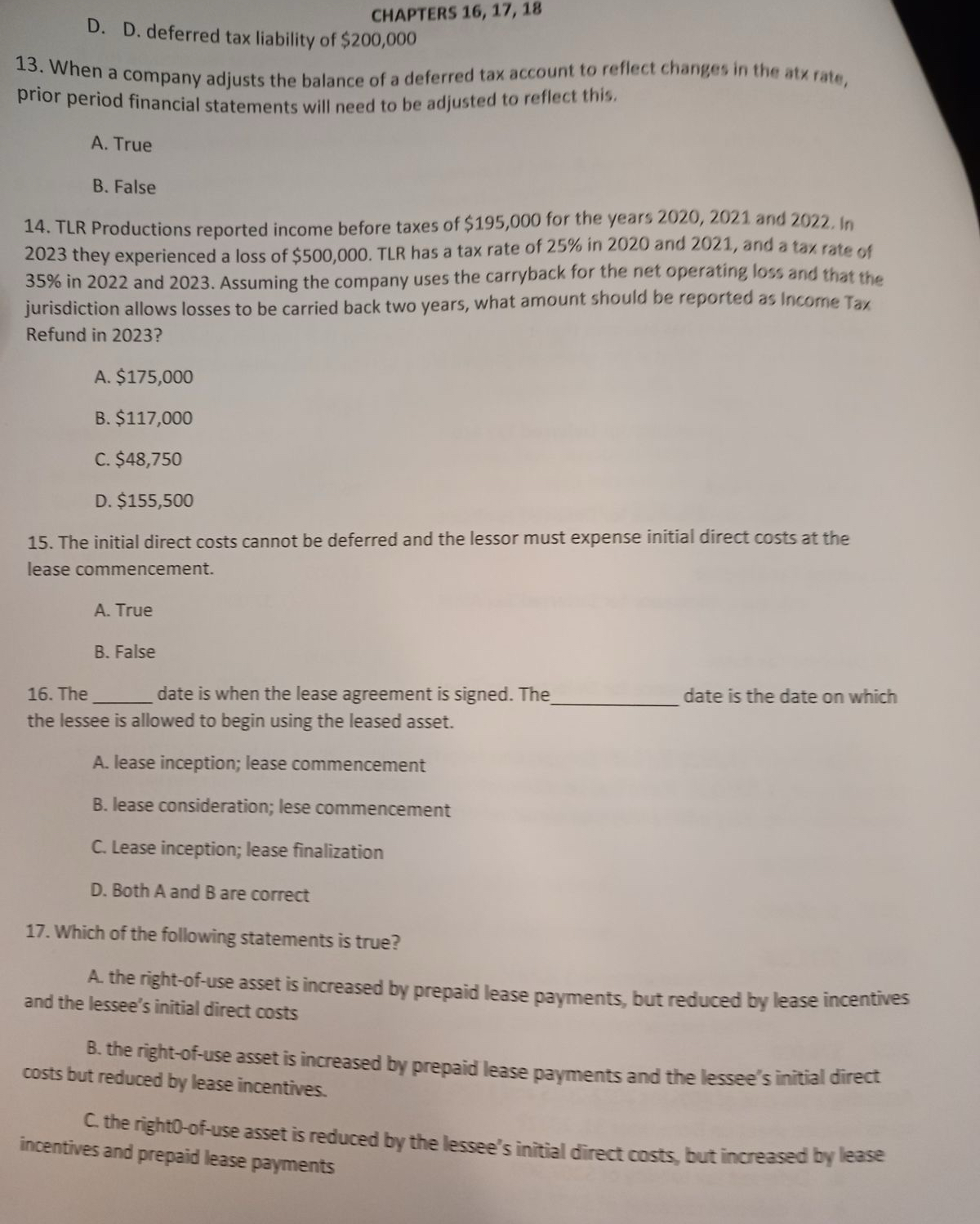

Question: CHAPTERS 1 6 , 1 7 , 1 8 D . D . deferred tax liability of $ 2 0 0 , 0 0 0

CHAPTERS

D D deferred tax liability of $

When a company adjusts the balance of a deferred tax account to reflect changes in the atx rate, prior period financial statements will need to be adjusted to reflect this.

A True

B False

TLR Productions reported income before taxes of $ for the years and In they experienced a loss of $ TLR has a tax rate of in and and a tax rate of in and Assuming the company uses the carryback for the net operating loss and that the jurisdiction allows losses to be carried back two years, what amount should be reported as Income Tax Refund in

A $

B $

C $

D $

The initial direct costs cannot be deferred and the lessor must expense initial direct costs at the lease commencement.

A True

B False

The date is when the lease agreement is signed. The the lessee is allowed to begin using the leased asset.

A lease inception; lease commencement

B lease consideration; lese commencement

C Lease inception; lease finalization

D Both A and are correct

Which of the following statements is true?

A the rightofuse asset is increased by prepaid lease payments, but reduced by lease incentives and the lessee's initial direct costs

B the rightofuse asset is increased by prepaid lease payments and the lessee's initial direct costs but reduced by lease incentives.

C the rightoofuse asset is reduced by the lessee's initial direct costs, but increased by lease incentives and prepaid lease payments

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock