Question: Chapters 10 & 11 Homework Handout Acct 110 Multiple Choice instructions: Choose the best word or phrase that completes each of the following statements type

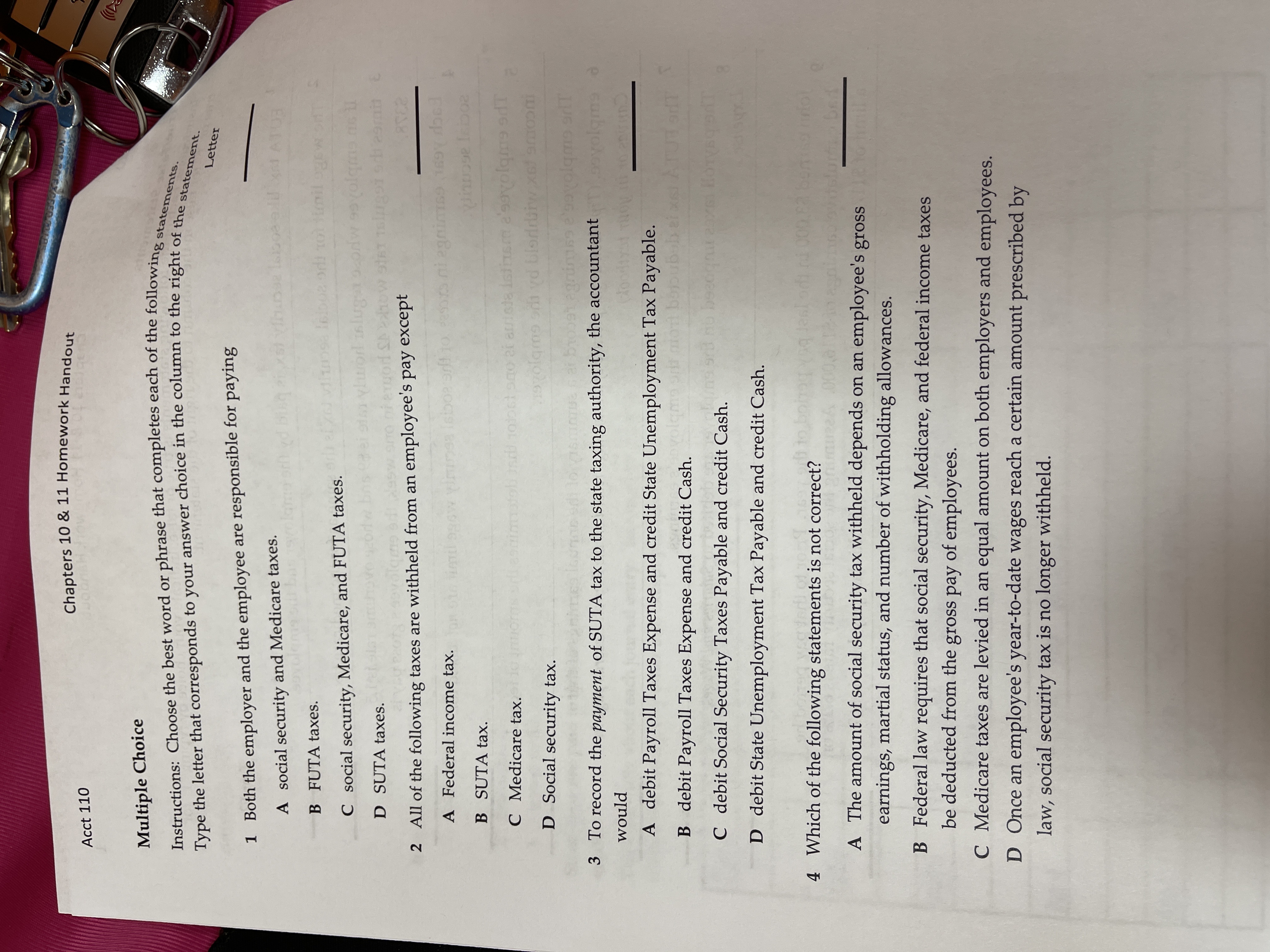

Chapters 10 & 11 Homework Handout Acct 110 Multiple Choice instructions: Choose the best word or phrase that completes each of the following statements type the letter that corresponds to your answer choice in the column to the right of the statement Letter 1 Both the employer and the employee are responsible for paying A social security and Medicare taxes. B FUTA taxes. be old rotimil ogewont C social security, Medicare, and FUTA taxes. tel sim yhuorl islugan ocordw sovolgris me U D SUTA taxes. 2 All of the following taxes are withheld from an employee's pay except A Federal income tax. to. desors ni egrimes 189y dos inose Isboe B SUTA tax. C Medicare tax. st sno at atriste istism e'ssvolume sdT spolams sni yd blorbiw xof anroom D Social security tax. so e'sovolume sriT 3 To record the payment of SUTA tax to the state taxing authority, the accountant T.sovolgms d would A debit Payroll Taxes Expense and credit State Unemployment Tax Payable. B debit Payroll Taxes Expense and credit Cash. afool ATUH andT C debit Social Security Taxes Payable and credit Cash. D debit State Unemployment Tax Payable and credit Cash. 4 Which of the following statements is not correct? A The amount of social security tax withheld depends on an employee's gross earnings, martial status, and number of withholding allowances. B Federal law requires that social security, Medicare, and federal income taxes be deducted from the gross pay of employees. C Medicare taxes are levied in an equal amount on both employers and employees. D Once an employee's year-to-date wages reach a certain amount prescribed by law, social security tax is no longer withheld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts