Question: Chapters 10 & 11 Multiple Choice Questions The Wild Halibut, Inc. bought a fish filet machine on January 1, 2017 for $100,000 . The machine

Chapters 10 & 11 Multiple Choice Questions\ The Wild Halibut, Inc. bought a fish filet machine on January 1, 2017 for

$100,000. The machine had\ an expected life of 20 years and was expected to have a salvage value of

$10,000. On July 1,2027, the\ company reviewed the potential of the machine and determined that its undiscounted future net cash flows\ totaled

$50,000and its fair value was

$35,000. What should The Wild Halibut record as an impairment loss\ on July 1, 2027 assuming the straightline method is used?\ A.

$0\ B.

$17,750\ C.

$7,750\ D.

$2,750

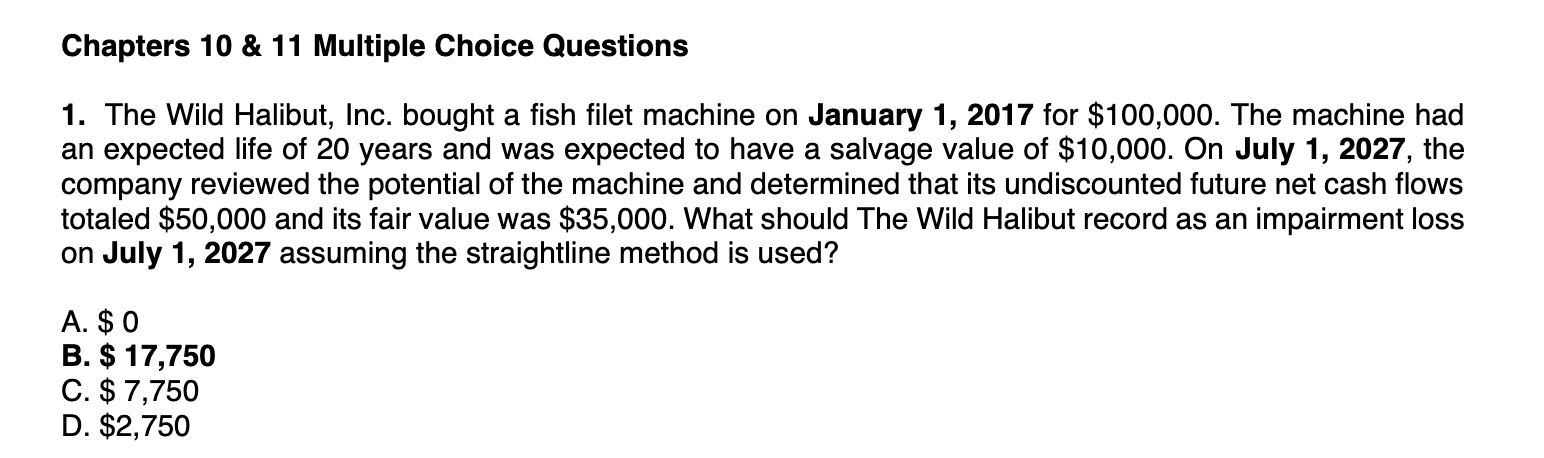

Chapters 10 \& 11 Multiple Choice Questions 1. The Wild Halibut, Inc. bought a fish filet machine on January 1, 2017 for $100,000. The machine had an expected life of 20 years and was expected to have a salvage value of $10,000. On July 1, 2027, the company reviewed the potential of the machine and determined that its undiscounted future net cash flows totaled $50,000 and its fair value was $35,000. What should The Wild Halibut record as an impairment loss on July 1, 2027 assuming the straightline method is used? A. $0 B. $17,750 C. $7,750 D. $2,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts