Charles a Shoe Company acquired all of Dorathy Company's outstanding stock on 1/1/22, for $210,000 in...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

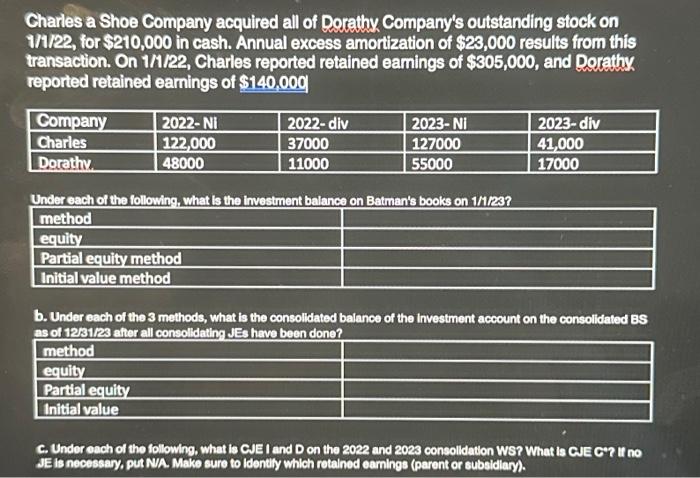

Charles a Shoe Company acquired all of Dorathy Company's outstanding stock on 1/1/22, for $210,000 in cash. Annual excess amortization of $23,000 results from this transaction. On 1/1/22, Charles reported retained earnings of $305,000, and Dorathy reported retained earnings of $140,000 Company Charles Dorathy 2022-Ni 122,000 48000 2022-div 37000 11000 2023-Ni 127000 55000 Under each of the following, what is the investment balance on Batman's books on 1/1/23? method equity Partial equity method Initial value method 2023-div 41,000 17000 b. Under each of the 3 methods, what is the consolidated balance of the investment account on the consolidated BS as of 12/31/23 after all consolidating JEs have been done? method equity Partial equity Initial value c. Under each of the following, what is CJE I and D on the 2022 and 2023 consolidation WS? What is CJE C? If no JE is necessary, put N/A. Make sure to identify which retained earnings (parent or subsidiary). Charles a Shoe Company acquired all of Dorathy Company's outstanding stock on 1/1/22, for $210,000 in cash. Annual excess amortization of $23,000 results from this transaction. On 1/1/22, Charles reported retained earnings of $305,000, and Dorathy reported retained earnings of $140,000 Company Charles Dorathy 2022-Ni 122,000 48000 2022-div 37000 11000 2023-Ni 127000 55000 Under each of the following, what is the investment balance on Batman's books on 1/1/23? method equity Partial equity method Initial value method 2023-div 41,000 17000 b. Under each of the 3 methods, what is the consolidated balance of the investment account on the consolidated BS as of 12/31/23 after all consolidating JEs have been done? method equity Partial equity Initial value c. Under each of the following, what is CJE I and D on the 2022 and 2023 consolidation WS? What is CJE C? If no JE is necessary, put N/A. Make sure to identify which retained earnings (parent or subsidiary).

Expert Answer:

Answer rating: 100% (QA)

a Investment Balance on Charless Books on 1123 Equity Method Initial Investment 210000 Net Income Sh... View the full answer

Related Book For

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Posted Date:

Students also viewed these accounting questions

-

How does implementing Total Quality Management (TQM) contribute to enhancing both product and service quality within an organization?

-

The disclosure rules for business combinations complicate financial analysis. Trend analysis becomes difficult because comparative financial statements are not retroactively adjusted to include data...

-

At the beginning of the current season, the ledger of Highland Tennis Shop showed Cash $2,500; Inventory $1,700; and Common Stock $4,200. The following transactions were completed during April. Apr....

-

(a) If g(x) = 1/x1, use your calculator or computer to make a table of approximate values of t g(x) dx for t = 5, 10, 100, 1000, and 10,000. Does it appear that is convergent or divergent? (b) Use...

-

Refer to the information in QS 20-10. Prepare the November 30 journal entry to record the transfer of costs from the Assembly department to the Painting department. Use the FIFO method. Data From QS...

-

Define the difference between process and function and provide an example.

-

Zimmer Corporation, a U.S. firm, purchased merchandise from Taisho Company of Japan on November 1, 2011, for 10,000,000 yen, payable on December 1, 2011. The spot rate for yen on November 1 was...

-

State the reasons why you believe unemployment among high school graduates vs unemployment amongst college graduates (bachelor's or higher) represents a challenge for the economy?

-

FeVer Beverages is a typical coffee shop that operates at Batangas. Recently, the general manager is facing a challenge about not meeting their target lead time of serving the hot coffee of 15...

-

Writ a java program that calculates the cost of individual items, including tax, and prints the grocery bill. Your program must do the following: 1. Ask the user to enter his/her full name. 2. Print...

-

Figure 4.36 shows irrotational flow past a circular cylinder. Assume that the approach velocity at A is constant (does not vary with time). a. Is the flow past the cylinder steady or unsteady? b. Is...

-

Cox Oil Company enters into an agreement to lease 80 acres from Ruby Jones. Jones receives a $15,000 bonus and a 1/8 royalty interest, and Cox Oil Company owns a 100% WI. In a separate agreement,...

-

Company Z owns a 100% WI in a proved property with net capitalized costs of $100,000. Company Z sold the property for $250,000 cash and a production payment of $150,000 plus interest of 10% to be...

-

Filbert Oil Company owns 100% of the working interest in an unproved lease that it acquired for $100,000. The property is individually significant, and individual impairment of $20,000 had been...

-

The standardized measure of future net cash flows from the production of proved oil and gas reserves must be disclosed by which companies? a. All companies with oil and gas producing activities b....

-

The partnership of Frick, Wilson, and Clarke has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the following account balances: Cash...

-

Presented below are income statements prepared on a LIFO and FIFO basis for Kenseth Company, which started operations on January 1, 2024. The company presently uses the LIFO method of pricing its...

-

A firm has experienced a decrease in its current ratio but an increase in its quick ratio during the last three years. What is the likely explanation for these results?

-

Refer to the websites and the Form 10-K reports of Home Depot (www.homedepot.com) and Lowes (www.lowes.com). Compare and contrast their business strategies.

-

Suppose an analyst reformulates financial statements to prepare the alternative decomposition of ROCE for a firm with no debt. The analyst determines that the company holds excess cash as large...

-

An open drainage canal with a rectangular cross section is $3 \mathrm{~m}$ wide and $1.5 \mathrm{~m}$ deep. If the canal slopes $950 \mathrm{~mm}$ in $1 \mathrm{~km}$ of length, what is the maximum...

-

You must design and specify equipment for transporting $100 %$ acetic acid (density $=1000 \mathrm{~kg} / \mathrm{m}^{3}$, $\mu=1 \mathrm{mPa}$ s), at a rate of $11.3 \mathrm{~m}^{3} / \mathrm{h}$,...

-

The Alaskan pipeline was designed to carry crude oil at a rate of 1.2 million $\mathrm{bbl} / \mathrm{day}(1 \mathrm{bbl}=$ $42 \mathrm{gal})$. If the oil is assumed to be Newtonian, with a viscosity...

Study smarter with the SolutionInn App