Question: Charles Jackson has always been interested in determining the value of his small business. He started the operation five years ago with $1,500 of savings,

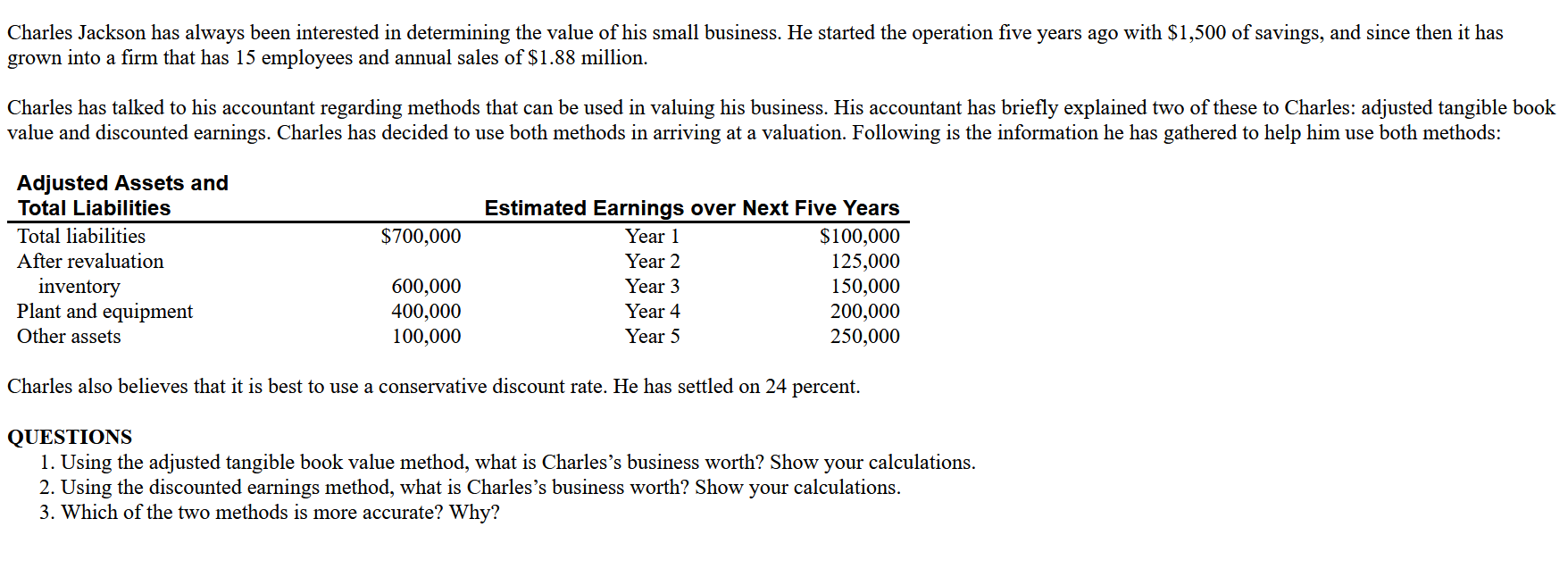

Charles Jackson has always been interested in determining the value of his small business. He started the operation five years ago with $1,500 of savings, and since then it has grown into a firm that has 15 employees and annual sales of $1.88 million. Charles has talked to his accountant regarding methods that can be used in valuing his business. His accountant has briefly explained two of these to Charles: adjusted tangible book value and discounted earnings. Charles has decided to use both methods in arriving at a valuation. Following is the information he has gathered to help him use both methods: Charles also believes that it is best to use a conservative discount rate. He has settled on 24 percent. QUESTIONS 1. Using the adjusted tangible book value method, what is Charles's business worth? Show your calculations. 2. Using the discounted earnings method, what is Charles's business worth? Show your calculations. 3. Which of the two methods is more accurate? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts