Question: Chart in second pic:) ACC and target weights After caretd analysis, Dexter Brothers has detemined that its optimsal capital structure is composed of the sources

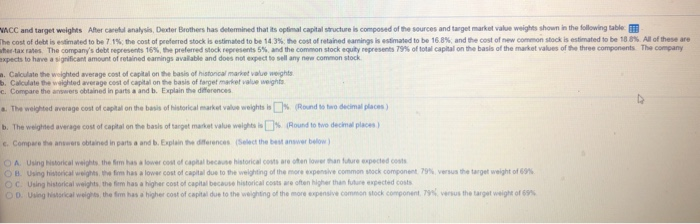

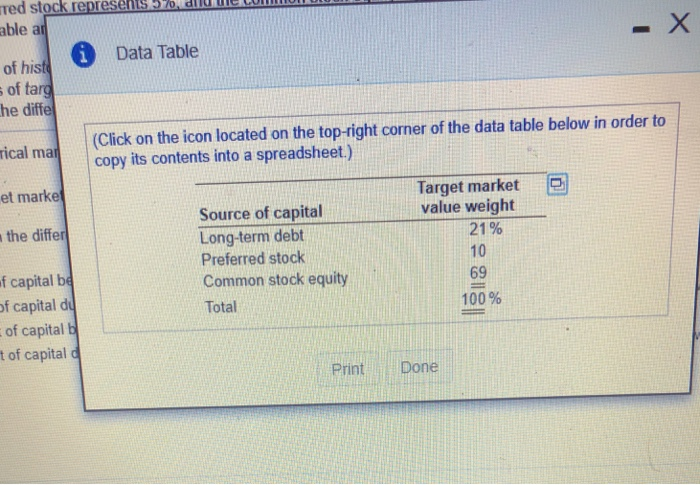

ACC and target weights After caretd analysis, Dexter Brothers has detemined that its optimsal capital structure is composed of the sources and target market vale weights shown h the following tabe he cost of debt is edinned to be 71% the cost of preferred stock is estimated to be 143% cost of retai ed earryl kesinated to be 168% and-cost of ewcon on stabest ated to be t88%A ofthese ter-tax ra es The company's debt represents 16% the preferred stock represents 5%, and the co n stock equty represents 79% of total cap al on the basis of the market values of he three components me-ny expects to have a significant amount of retained eamings avalable and does nol expect to sell any nevw common stock Calculate the weighted average cost of capital on the basis of historical market value weights b. Calculate the weighted average cost of capital on the basis of farget market value weghts c. Compare the answers obtained in parts a and b. Explain the differences .. The weighted average cost of capital on the basis of historical market vak e weghts is % (Rond to ho decimal places ) b. The weighted average cost of capital on the basis of target mutat value weight.% (Round to two decimal places) C. Compare the answers obtained in parts a and b.Explain the diferences (Select the best answer below A. Using historical weights the m has alower cost of capital because historical costs are oen lowrthan future expected costs B. Using historical weights the fom has a lower cost of capital due to the weighting of the more expensive common shock component % versus the target weight of C. Using historical weights the firm has a higher cost of capital because historical costs are often higher than tan espected costs OD. Using historical weights, the 5im has a bigher cost of capital due to the weighting of the more expensive common stock component, 79% versus the target weight of 69s red stock represents.57o,e Com able a fData Table sof ta he diffel (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) et marke Target market value weight Source of capital Long-term debt Preferred stock Common stock equity Total the differ f capital be of capital du of capital b t of capital d 21% 10 69 100% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts