Question: chase Katy owns a second home. During the year, she used the home for 2 0 personaluse days and 5 0 rental days. Katy allocates

chase

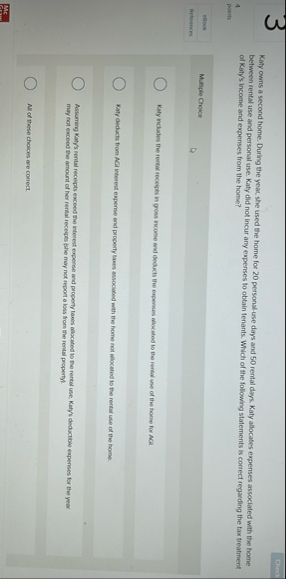

Katy owns a second home. During the year, she used the home for personaluse days and rental days. Katy allocates expenses associated with the home between rental use and personal use. Katy did not incur any expenses to obtain tenants. Which of the following statements is correct regarding the fax treatment of Katy's income and expenses from the home?

psysh

eBook

Multiple Choice

Beterms

Katy deducts from ACI interest expense and property lases associated with the home not allocated to the rental use of the home.

Assumirg Katy's rental recepts exceed the intexest experse and propeny taxes allocated to the rental use, Kalyh deductible expenses for the year may rot excesd Bee amount of her renail receips fine may not report a loss from the rental property.

All of these chaices are correct

Mc

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock