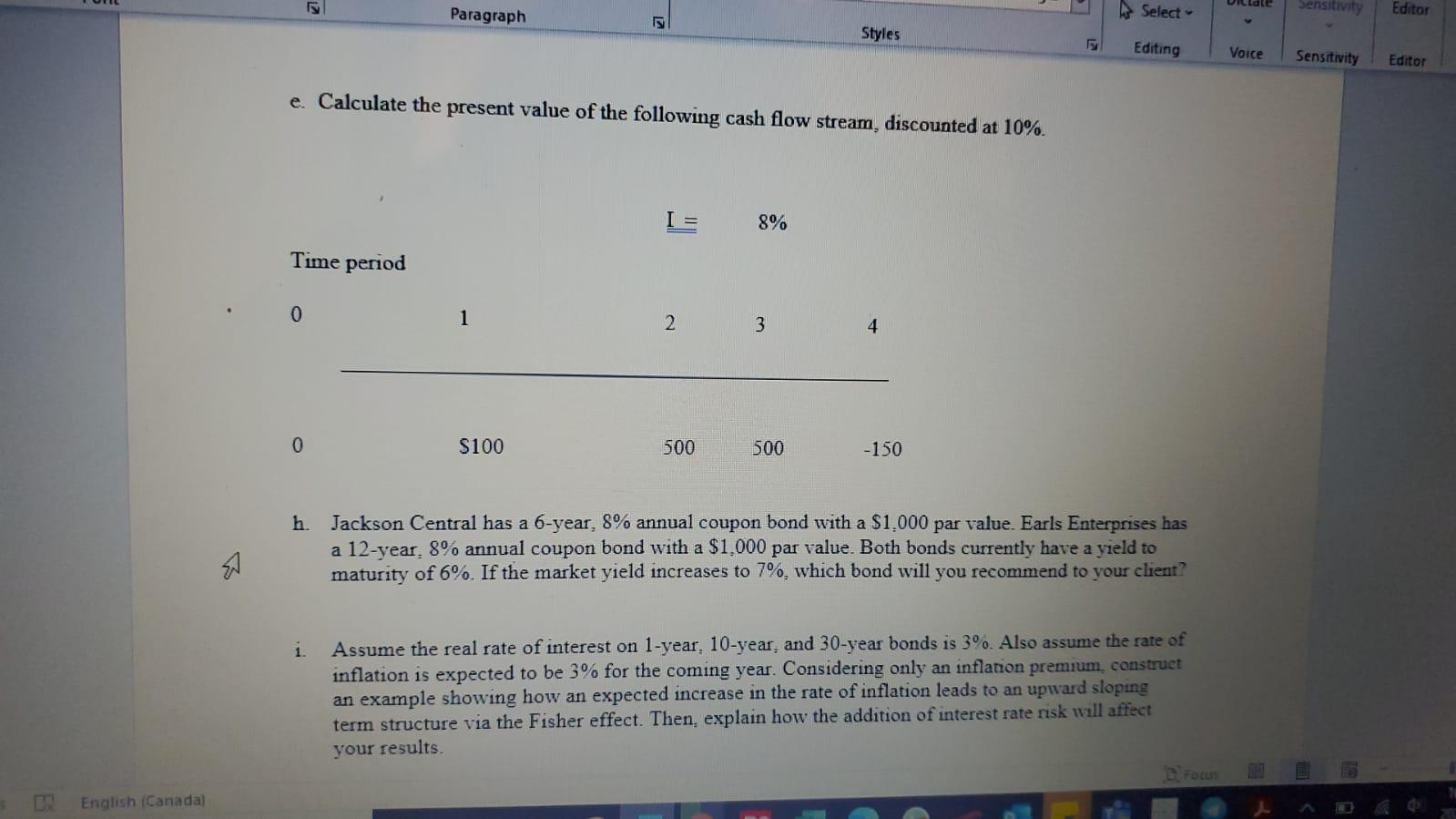

Question: Chate Paragraph W Select Sensitivity Editor Styles Editing Voice Sensitivity Editor e. Calculate the present value of the following cash flow stream, discounted at 10%.

Chate Paragraph W Select Sensitivity Editor Styles Editing Voice Sensitivity Editor e. Calculate the present value of the following cash flow stream, discounted at 10%. I = 8% Time period 0 1 2 3 4 0 S100 500 500 -150 h. Jackson Central has a 6-year, 8% annual coupon bond with a $1,000 par value. Earls Enterprises has a 12-year, 8% annual coupon bond with a $1,000 par value. Both bonds currently have a yield to maturity of 6%. If the market yield increases to 7%, which bond will you recommend to your client? i. Assume the real rate of interest on 1-year. 10-year, and 30-year bonds is 3%. Also assume the rate of inflation is expected to be 3% for the coming year. Considering only an inflation premium, construct an example showing how an expected increase in the rate of inflation leads to an upward sloping term structure via the Fisher effect. Then, explain how the addition of interest rate risk wall affect your results. English (Canada)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts