Question: Chatham Automotive ( should or should not ??) replace the forklifts now since the minimum total EAC for the electric forklifts is $_________(enter your response

Chatham Automotive ( should or should not ??) replace the forklifts now since the minimum total EAC for the electric forklifts is $_________(enter your response here),

which is (higher or lower ??) than $_________(enter your response here), the minimum total EAC for the propane forklifts

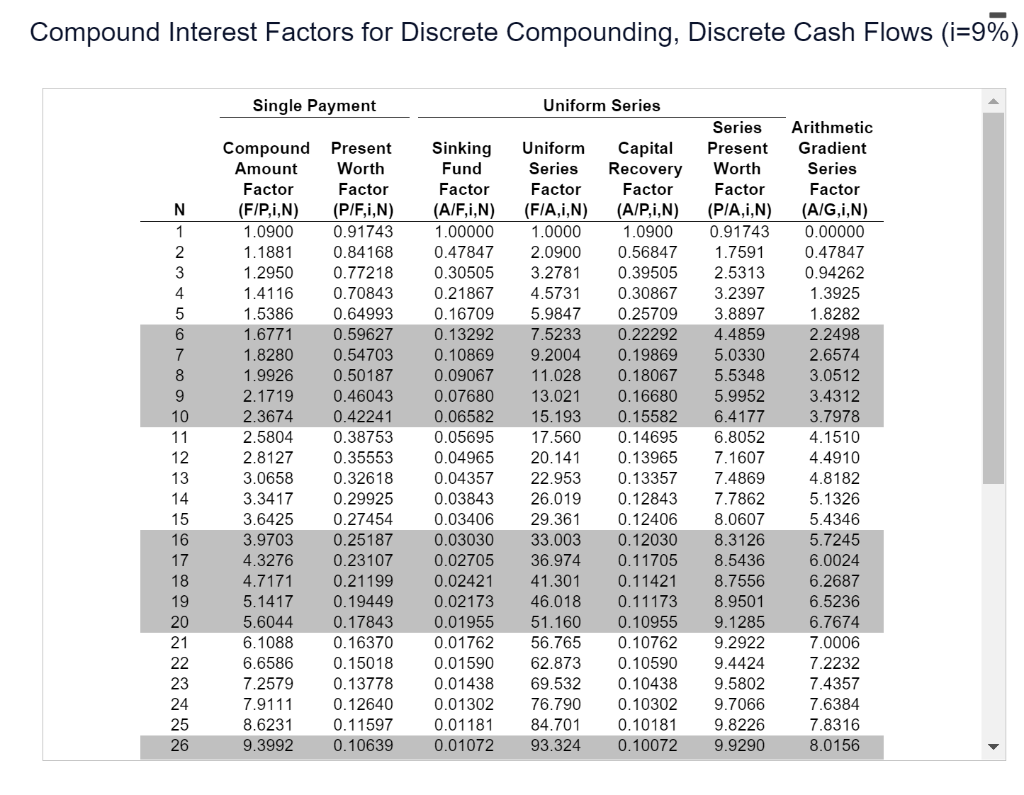

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $70,000 each, including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so operating costs are very high. As a result, their current salvage value is about $9,000. Chatham is considering replacing them with propane models. New propane forklifts cost $57,000 each. After one year, they have a salvage value of $40,000, and thereafter decline in value at a declining-balance depreciation rate of 20 percent, as does the electric model from this time on. The MARR is 9 percent. Operating costs for the electric model will be $20,000 this year, rising by 11 percent per year. Operating costs for the propane model will initially be $12,000 over the first year, rising by 11 percent per year. Should Chatham Automotive replace the forklifts now? Olial, theion + dinara uboni_001 - Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=9%) Single Payment Uniform Series N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Compound Amount Factor (F/P,1,N) 1.0900 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 2. 1719 2.3674 2.5804 2.8127 3.0658 3.3417 3.6425 3.9703 4.3276 4.7171 5.1417 5.6044 6.1088 6.6586 7.2579 7.9111 8.6231 9.3992 Present Worth Factor (P/F,i,1) 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 0.54703 0.50187 0.46043 0.42241 0.38753 0.35553 0.32618 0.29925 0.27454 0.25187 0.23107 0.21199 0.19449 0.17843 0.16370 0.15018 0.13778 0.12640 0.11597 0.10639 Sinking Fund Factor (A/F,1,N) 1.00000 0.47847 0.30505 0.21867 0.16709 0.13292 0.10869 0.09067 0.07680 0.06582 0.05695 0.04965 0.04357 0.03843 0.03406 0.03030 0.02705 0.02421 0.02173 0.01955 0.01762 0.01590 0.01438 0.01302 0.01181 0.01072 Uniform Series Factor (F/A,1,N) 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 9.2004 11.028 13.021 15.193 17.560 20.141 22.953 26.019 29.361 33.003 36.974 41.301 46.018 51.160 56.765 62.873 69.532 76.790 84.701 93.324 Capital Recovery Factor (A/P,i,N) 1.0900 0.56847 0.39505 0.30867 0.25709 0.22292 0.19869 0.18067 0.16680 0.15582 0.14695 0.13965 0.13357 0.12843 0.12406 0.12030 0.11705 0.11421 0.11173 0.10955 0.10762 0.10590 0.10438 0.10302 0.10181 0.10072 Series Present Worth Factor (PIA,1,N) 0.91743 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 5.5348 5.9952 6.4177 6.8052 7.1607 7.4869 7.7862 8.0607 8.3126 8.5436 8.7556 8.9501 9.1285 9.2922 9.4424 9.5802 9.7066 9.8226 9.9290 Arithmetic Gradient Series Factor (A/G,1,N) 0.00000 0.47847 0.94262 1.3925 1.8282 2.2498 2.6574 3.0512 3.4312 3.7978 4.1510 4.4910 4.8182 5.1326 5.4346 5.7245 6.0024 6.2687 6.5236 6.7674 7.0006 7.2232 7.4357 7.6384 7.8316 8.0156

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts