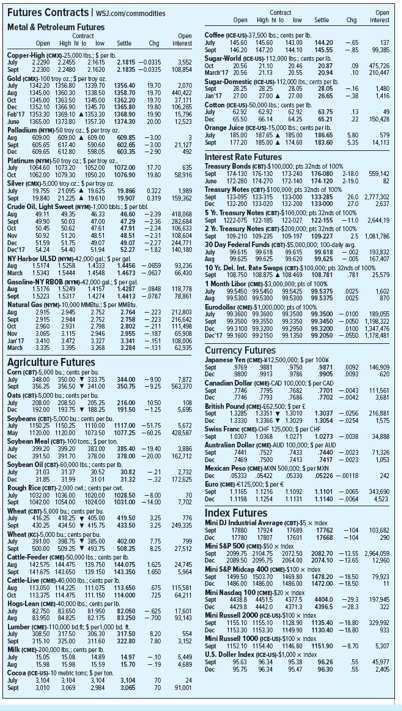

Question: che interest Open forest -65 -85 Futures Contracts I WS.com/commodities Metal & Petroleum Futures Contract Open High to low Settle Sorte che he Copper High

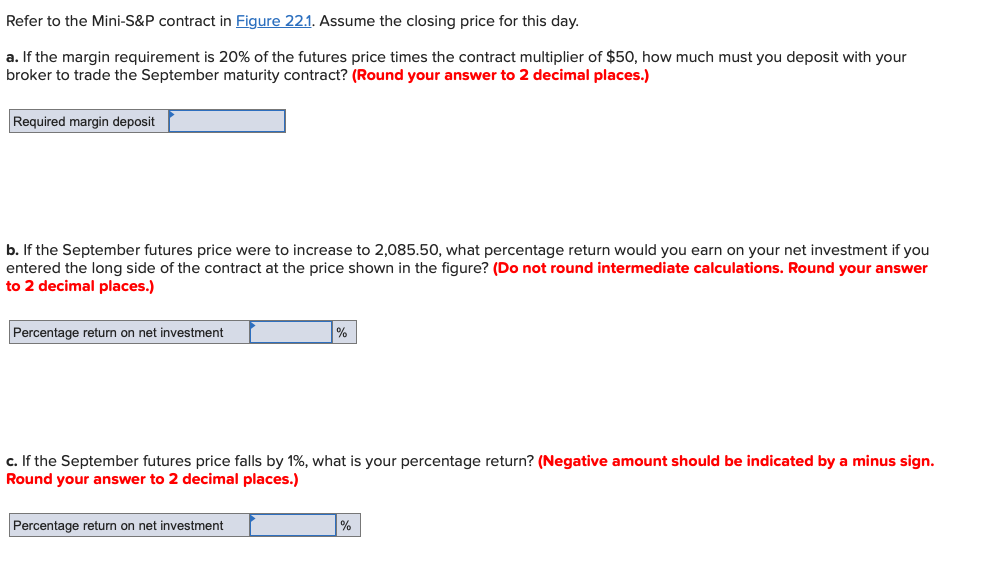

che interest Open forest -65 -85 Futures Contracts I WS.com/commodities Metal & Petroleum Futures Contract Open High to low Settle Sorte che he Copper High CMX 25,000 lbs: Sperib Luty 2290 2205 214152.1115-00335 Sept 22300 2200 2.16202.1835 -0.0335 Gold CMC-100 try or per woor. July 1342.20 1396 80 1339.701356.40 19.70 Mag 1345.00 1350 30 1338.50 1358.70 19.70 Oct 1345.00 1250 125.00 136220 19.0 1952.10 1266 90 1146.70 1965.60 108.954 16 210,447 Contract Open agh N lo low Coffee EU 7500 btcom per July 145.60 145.50 14200 144.20 Sept 156 20 147.20 1440 14555 Sugar-World C-USA 112.000 lbs., cents per Mardi 17 2056 21.11 2055 20.94 Sugar Domestik CE-US-112.000 lbs. cents per Sept 28.25 8.25 2805 28.05 Jan'17 2700 2700 2700 26.65 Cotton CF-US) 50,000 cents per July 6290 62.92 6292 62.75 Dec 6550 66.14 4.5 5.21 Orange Juice ECE-US-15.000 Escorts perib July 185.00 1879 A 1800 186.65 Sept 177.20 185.00 A 174.50 183.60 2010 440 432 37.171 106 265 -16 -38 1,490 1416 13 22 20.00 12.57 355.00 1373 80 1357.30 137430 Palladium NTM 50 tys: $ per tror. Aug 09.00 60900 A 609.00 Sept 605.65 617.40 590 60 600 66 Dec 609.65 612 80 598.05 603.35 49 150,428 529 14.113 -200 -700 -2.90 50 535 2177 PLN 50 20 July 1064,60 1073 20 1052.00 1072.00 17.70 6 35 Oct 1062.00 1070 1050 20 1076.50 19.80 58.916 Silver MX 5000 try : Sper troy E. July 19.755 21096 A 19.625 19.866 0.122 Sept 19.840 21225 A 19.610 19.9070319 159.36 Crude Oil, Light Sweet YE-1000 boks: $ per bal 50.92 51.20 8.51 -231108.504 5159 51.75 49 07 Dec 17 54,24 54.40 51.94 52.27 NY Harbor ULSD NYM42.000 gals per al March 1530 1544 14548 1.4673 66.400 Gasoline-NY RROBNYMO42.000 per on Aug 15176 15749141571.427 - 0848 110778 Sept 15223 1531714274 14413 -9787 78.361 Natural Gas NYM-10,000 MMS per Mit - 223 212.800 Interest Rate Futures Treasury Bonds icon) $100.000 pends of 100% Sope 174130 176-130 173.200 176 0802-18.0 569,142 June 172-10 174 210 172.100 174120 2.190 Treasury Notes con $100.000 ps 32nds of 100% Sep 113-095 11513900013-205 26.0 2.777.302 Dec 132-200 103-020 132-200 133.000 27.0 2,637 5 Y. Treasury Notes (CBT)-$100 000 ts 2nds of 100% Sept 1222-015 122.135 122.027 122.155 -110 2.644.19 2 Y. Treasury Notes ICT-$200 000, pts 32nd of 100% Sept 109 210 109-235 109-197 109 227 25 1,081.79 30 Day Federal Funds CBT)-5,000 000, 100-daily avg July 09615 09615 09615 611 -002 193.832 Aug 99.625 99625 620 99,625 -005 167 407 10 Y Del. Int. Rate Swaps CRT $100.000 pt inds of 100% Sept 108.750 108.875 A 108.459 103.781 781 25579 1 Month Libor (CE) $2.000.000 pes of 100% July 99.5450 99.5450 99.5425 99.5375 0025 1,602 Aug 99.5700 995300 995000 99.5375 0025 870 Eurodollar (CHE $1,000 000 of 100% July 100 .00 3500 99.3500-0100189055 Sock 99 3500 99 0 9 50 99.3450 -0050 1,198,322 Dec 99.3100 99.3200 99.2950 99.32000100 1347.476 Dec 17 99,1600 992150 99.1350 99.2050 - 1550 1,178,481 223 216.62 -187 65.908 Agriculture Futures Corn CBT) 5.000 b ons perb July 348.00 350.00 7 333.75 344.00 Sept 356.25 396.50 7 341.0035075 Oats CBT) 5,000 bucents per bu -9.00 -925 7872 2000 182.00 1985 1988 1990 9205 1989 Serbeans 5.000 bucents per bu. 1150 1150 5 111000 111700 -5175 May 112000 112000 107250 1077.25 -6025438587 Soybean Mealicer-100 tons perton uly 9.20 20 383.00 15.40 -19.40 2886 De 29150 39170 378.00 378.00 - 20.00 162.712 Soybean Oil CBT-50,000 lbs.:cents per la Mly 2101 2137 2012 2012 - 212 72 Dec 31.85 3199 3101 3132 - 32 Rough Rice (CAT)-2000 cwt cents per cut. July 1032.00 10300 102000 1998 50 -8.00 104200 1054.00 10400 1021.00 - 14.00 Wheat CAD 5000 bucents per 43025 3450 415.75 43350 335 Wheat CH 5,000 bu: cents per bu July 391.00 385 3500 40000 775 Sapt 500.00 509 25 493.75 508.25 8.25 Cattle-Feeder CME) 50,000 its contes per lb Aug 142575 144.475 139.750 144.075 1.625 24.745 Sept 141.675 141650 139.150 147.350 1650 4 Cattle Live CM) 40 000 lbs. cont perb Mag 113.050 114 225 111.075 113.650 Oct 113.375 114.475 111.150 114.000 Hogs-Lean CME)-40 000 lbs: cents perib. July 2.750 82.650 1.950 $2.050 - 25 82.950 84805 82.175 83.250 - 700 Lumber CME 110 000 t Spe1000 Sep 315.10 32500 2116032210 210 160 MIKICME-200.000 cents per July 15.05 1508 1489 1497 -10 5449 Aug 15.98 15.99 15.59 15.70 - 19 4 589 Cocoa PCE-US-10 min ton perton Currency Futures Japanese Yen ICME)-M12.500,000 per ook Sep 99699991 9750 9871 0092 146.909 De 800 9911 978 9906 0097 Canadian Dollar (CMO) CAD 100,000 $ per CAD Sept 7745 7795 7682 7701 - 0043 111,56 Dec 27870 6 7702 - 0042 British Pound CME-652,500,5 per Sock 132 131 13010 1.9097 - 0056 206,891 Dec 1.3330 13356 13029 1.3054 - 0254 Swiss Franc CME06 125.000 per CHF Sept 1.0307 1,0358 0271 1.0273 -0038 34.882 Australian Dollar (CMO) AUD 100,000 per ALD Sept 7441 .7527 7433 7440-002371,320 Dec 7469750074127417-0023 1053 Mexican Peso CME) MN 500,000 $ per MXN Dec 050 050205220 0522600118 Euro CME) 125.000 per Sept 1.1165 1.1216 11092 1.1101-0065 343,690 De 1.1198 1.1254 111311.1140 - 0054 Index Futures Mini DJ Industria Average CNT)$5x de Sept 1788017924 1768917762 -104 103.6 Dec 17780 17201 1260 17668 -104 290 Mini S&P 500CME-S80 x Index Sopt 2099.75 2104.75 2072.50 2082.70 - 13.55 2,954,059 Dec 2089 50 2096.75 2064.00 2074.10 - 13.65 12.960 Mini SAP Midap 400 CMES100 x index Sope 1499 50 1509.70 1459.80 1471.20 -1850 79923 Dec 1486.00 1486.00 13600 1472.00 - 18.50 Mini Nasdaq 100 CME-$20 x index Sept 4438 44515 4377.5 44040 -29.3 197,945 Dec 44298 44420 43713 4965 -28.7 322 Mini Russell 2000 OCE US $100 x Index Sept 1155.10 1155.10 1129.90 1135.40 -18.80 329,99% Dec 153.30 1152.30 1149.90 1120.40 -18.80 Mini Russell 1000 OCE-US-$100 x index Sop! 1152.10 1154.40 1145.80 115190 -8.70 US Doller Index US 51.000 x Index 956396.34 95.23 96.26 55 45977 95.0 96.30 55 2405 Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day. a. If the margin requirement is 20% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the September maturity contract? (Round your answer to 2 decimal places.) Required margin deposit b. If the September futures price were to increase to 2,085.50, what percentage return would you earn on your net investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Percentage return on net investment % c. If the September futures price falls by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return on net investment %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts