Question: Check both screen shots for the whole problem. Problem 4. (10 Bonus Points) Many institutions have xed future liabilities to meet (such as pension payments)

Check both screen shots for the whole problem.

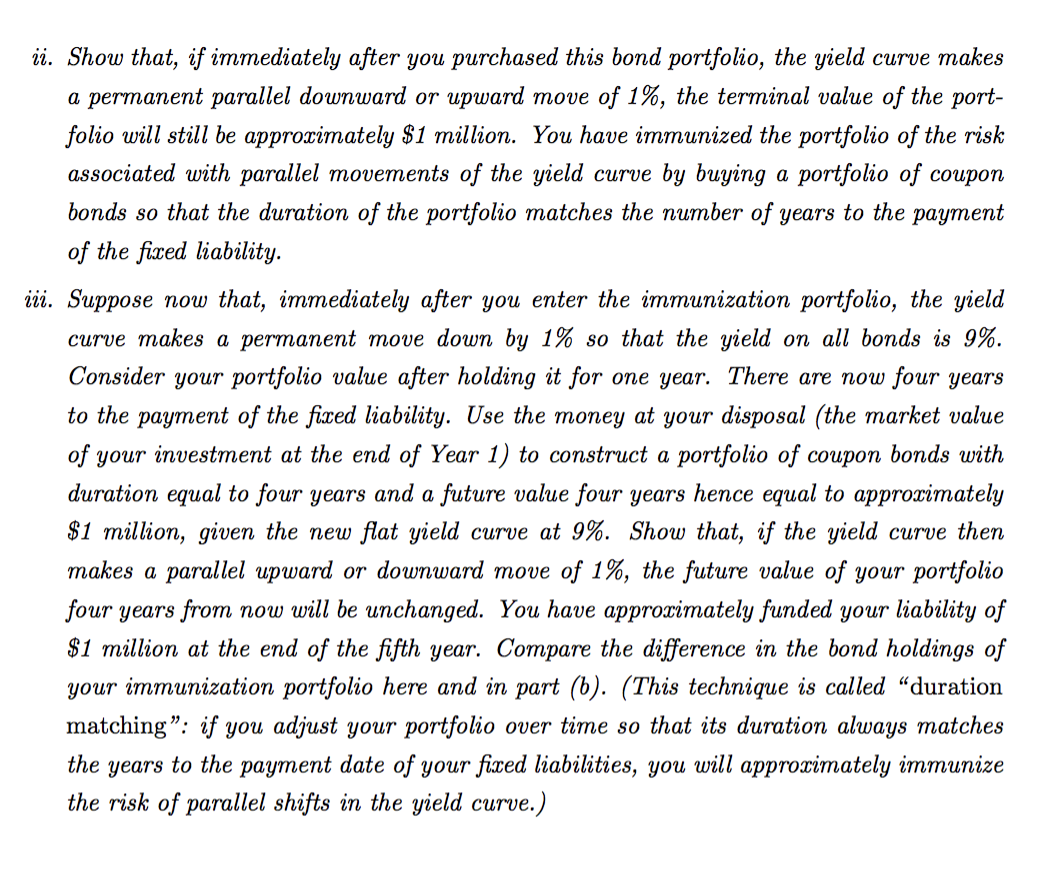

Problem 4. (10 Bonus Points) Many institutions have xed future liabilities to meet (such as pension payments) and they fund these future liabilities using default-free xed income securities. When zero-coupon bonds of all maturities are available, these institutions can simply buy zero- coupon bonds to fund their liabilities. For example, if there is a red liability equal to $1 million ve years from now, an institution can buy a zero-coupon bond maturing in ve years with a face value of $1 million. Unfortunately, there may not be the \"right\" zero-coupon bonds for a xed future liability and coupon bonds must be used. Then, an institution faces reinvestment risk on the coupons ( the risk that your coupon may not earn the same amount of interests when reinvested as you can earn now). For example, suppose that the yield curve is flat at 10% and we have the following coupon bonds ( paying annual coupons): |---| A 118.95 100 15 5 B 130.72 100 15 10 We have a $1 million liability five years from now. You may answer the questions below using Excel. (a) Suppose that the yield curve remains unchanged for the following ve years and you decide to use Bond A to fund the liability. That is, you want to buy Bond A and re-invest the coupons at the prevailing interest rates to produce a future value at the end of Year 5 of $1 million. How much should you invest in Bond A 5? (b) Now suppose that, right after you invested in Bond A, the yield curve makes a parallel move down by 1% to 9%. What will be the terminal value of your investment in the 5-year coupon bond if you purchased as many bonds as implied by Part (a)? What is the terminal value of your investment if the yield curve moves up by 1% to 11%? Are you over or underfunded in these scenarios? (c) Part (b) shows that the future value of your investment is sensitive to interest mte uc- tuations and you face the risk that your future liabilities may not be met. You can try to \"immunize\" this interest rate risk. But how? Do the following: i. Construct a portfolio of the two coupon bonds so that the future value of the portfolio is 1 million and the duration of this portfolio is equal to ve years, assuming that the yield curve will remain at at 10%. ii. Show that, if immediately after you purchased this bond portfolio, the yield curve makes a permanent parallel downward or upward move of 1%, the terminal value of the port- folio will still be approximately $1 million. You have immunized the portfolio of the risk associated with parallel movements of the yield curve by buying a portfolio of coupon bonds so that the duration of the portfolio matches the number of years to the payment of the xed liability. iii. Suppose now that, immediately after you enter the immunization portfolio, the yield curve makes a permanent move down by 1% so that the yield on all bonds is 9%. Consider your portfolio value after holding it for one year. There are new four years to the payment of the xed liability. Use the money at your disposal (the market value of your investment at the end of Year 1) to construct a portfolio of coupon bonds with duration equal to four years and a future value four years hence equal to approximately $1 million, given the new flat yield curve at 9%. Show that, if the yield curve then makes a parallel upward or downward move of 1%, the future value of your portfolio four years from now will be unchanged. You have approximately funded your liability of $1 million at the end of the fth year. Compare the difference in the bond holdings of your immunization portfolio here and in part (b). ( This technique is called \"duration matching\": if you adjust your portfolio over time so that its duration always matches the years to the payment date of your xed liabilities, you will approximately immunize the risk of parallel shifts in the yield curve.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts