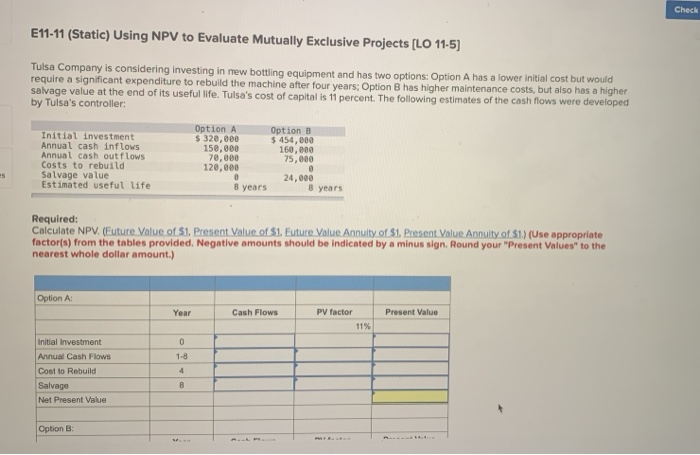

Question: Check E11-11 (Static) Using NPV to Evaluate Mutually Exclusive Projects [LO 11-5) Tulsa Company is considering investing in new bottling equipment and has two options:

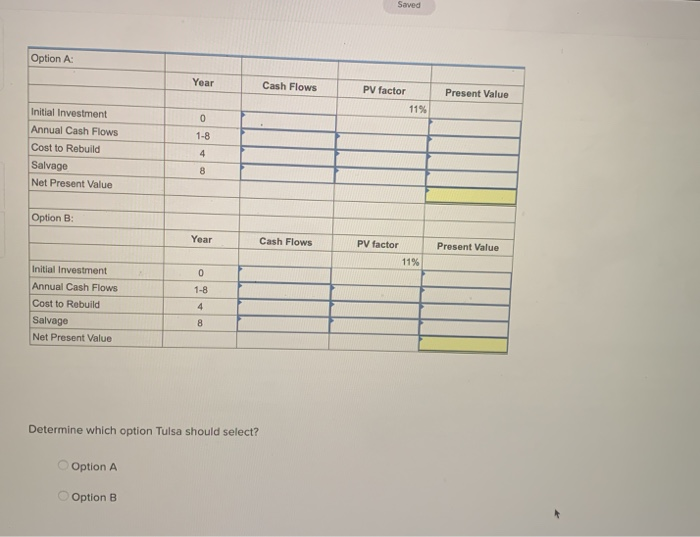

Check E11-11 (Static) Using NPV to Evaluate Mutually Exclusive Projects [LO 11-5) Tulsa Company is considering investing in new bottling equipment and has two options: Option A has a lower initial cost but would require a significant expenditure to rebuild the machine after four years: Option B has higher maintenance costs, but also has a higher salvage value at the end of its useful life. Tulsa's cost of capital is 11 percent. The following estimates of the cash flows were developed by Tulsa's controller: Initial investment Annual cash inflows Annual cash outflows Costs to rebuild Salvage value Estimated useful life Option A $ 320,000 150,000 70,000 120,000 Option B $ 454,000 160.00 75,000 8 years 24,000 8 years Required: Calculate NPV. (Future Value of $1. Present Value of $1. Euture Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount.) Option A: Cash Flows PV factor Present Value 1-8 Initial Investment Annual Cash Flows Cost to Rebuild Salvage Net Present Value Option : Option : Year Cash Flows PV factor Present Value 0 1-8 Initial Investment Annual Cash Flows Cost to Rebuild Salvage Net Present Value Option B: Year Cash Flows Py factor Present Value Initial Investment Annual Cash Flows Cost to Rebuild Salvage Net Present Value Determine which option Tulsa should select? Option A Option B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts