Question: CHECK FIGURE ( 2 ) , IRR = approx. 2 2 % Marlon Plastics purchased a new machine one year ago at a cost of

CHECK FIGURE

IRR approx.

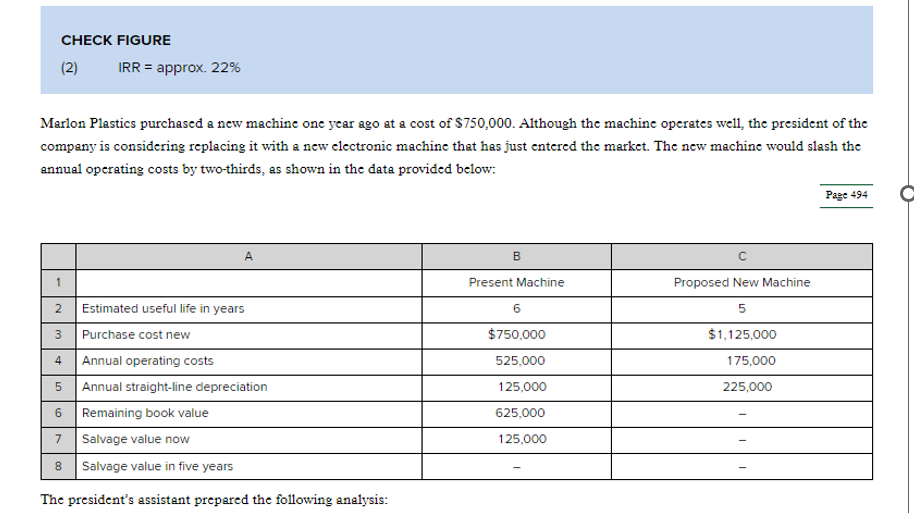

Marlon Plastics purchased a new machine one year ago at a cost of $ Although the machine operates well, the president of the company is considering replacing it with a new electronic machine that has just entered the market. The new machine would slash the annual operating costs by twothirds, as shown in the data provided below:

Page

tableABCPresent Machine,Proposed New MachineEstimated useful life in years,Purchase cost new,$$Annual operating costs,Annual straightline depreciation,Remaining book value,Salvage value now,Salvage value in five years,

The president's assistant prepared the following analysis:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock