Question: Check for Understanding 9 . 2 Major Folger is a Native American who grew up on a federal Indian reservation in Northern California. He went

Check for Understanding

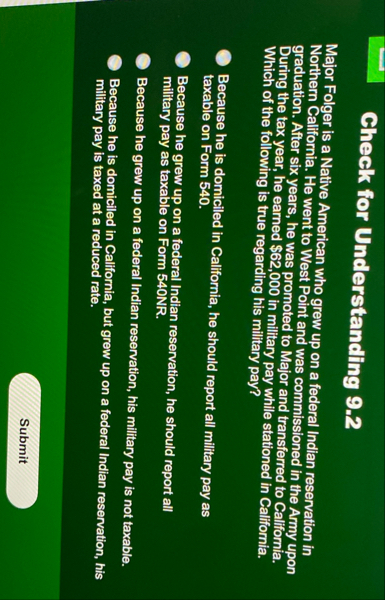

Major Folger is a Native American who grew up on a federal Indian reservation in Northern California. He went to West Point and was commissioned in the Army upon graduation. After six years, he was promoted to Major and transferred to California. During the tax year, he earned $ in military pay while stationed in California. Which of the following is true regarding his military pay?

Because he is domiciled in California, he should report all military pay as taxable on Form

Because he grew up on a federal Indian reservation, he should report all military pay as taxable on Form NR

Because he grew up on a federal Indian reservation, his military pay is not taxable.

Because he is domiciled in California, but grew up on a federal Indian reservation, his military pay is taxed at a reduced rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock