Question: check my A partnership is considering possible liquidation because one of the partners ( Bell ) is personally insolvent. Profits and losses are divided on

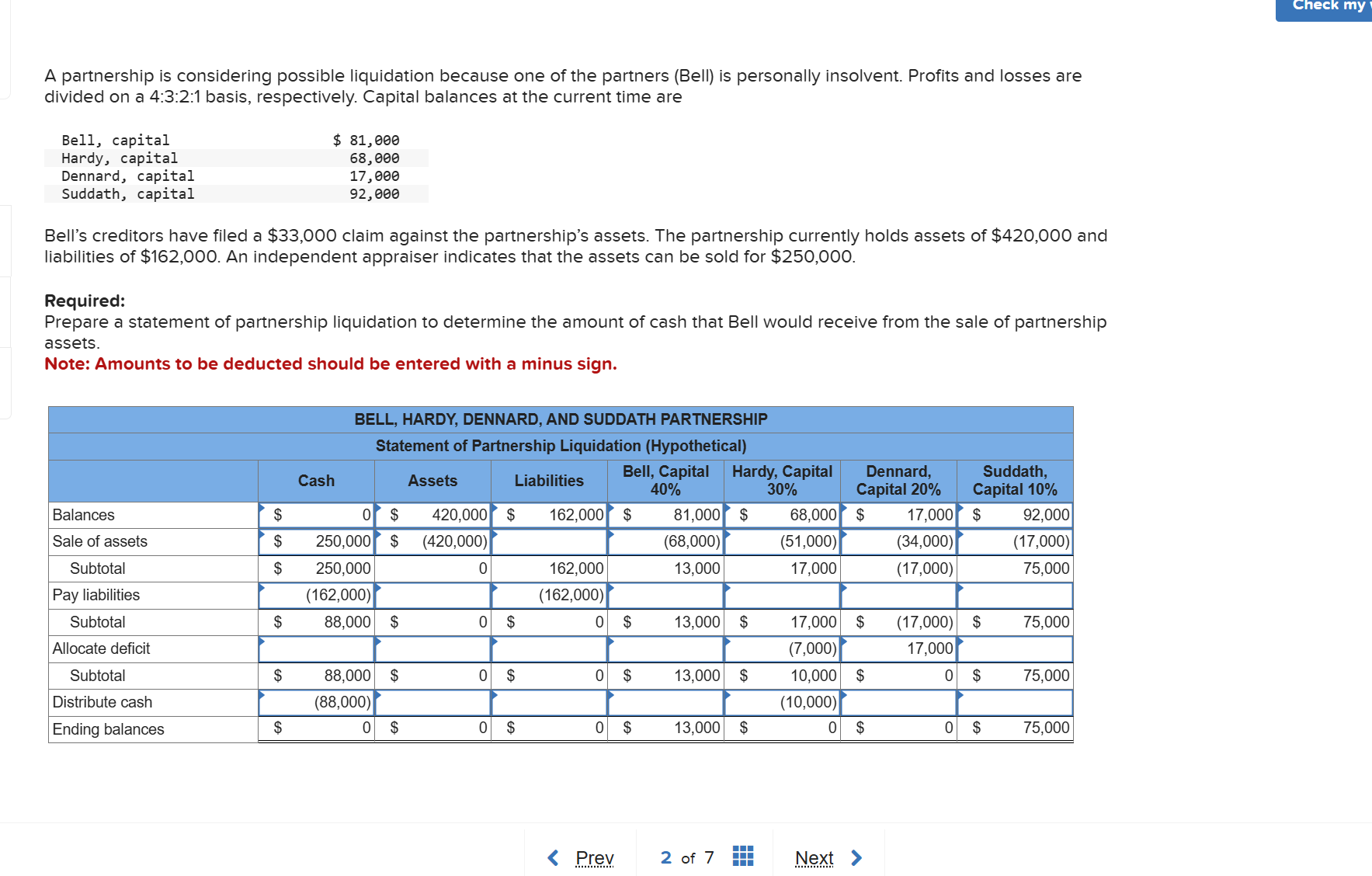

check my A partnership is considering possible liquidation because one of the partners Bell is personally insolvent. Profits and losses are divided on a ::: basis, respectively. Capital balances at the current time are begintabularlr Bell, capital & $ Hardy, capital & Dennard, capital & Suddath, capital & endtabular Bell's creditors have filed a $ claim against the partnership's assets. The partnership currently holds assets of $ and liabilities of $ An independent appraiser indicates that the assets can be sold for $ Required: Prepare a statement of partnership liquidation to determine the amount of cash that Bell would receive from the sale of partnership assets. Note: Amounts to be deducted should be entered with a minus sign. begintabularllllllllhline multicolumncBELL HARDY, DENNARD, AND SUDDATH PARTNERSHIPhline multicolumncStatement of Partnership Liquidation Hypotheticalhline & Cash & Assets & Liabilities & Bell, Capital & Hardy, Capital & Dennard, Capital & Suddath, Capital hline Balances & $ & $ & $ & $ & $ & $ & $ hline Sale of assets & $ & $ & & & & & hline Subtotal & $ & & & & & & hline Pay liabilities & & & & & & & hline Subtotal & $ & $ & $ & $ & $ & $ & $ hline Allocate deficit & & & & & & & hline Subtotal & $ & $ & $ & $ & $ & $ & $ hline Distribute cash & & & & & & & hline Ending balances & $ & $ & $ & $ & $ & $ & $ hline endtabular Prev of Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock