Question: Check my Problem 2-20 Both a call and a put currently are traded on stock XYZ, both have strike prices of $45 and expirations of

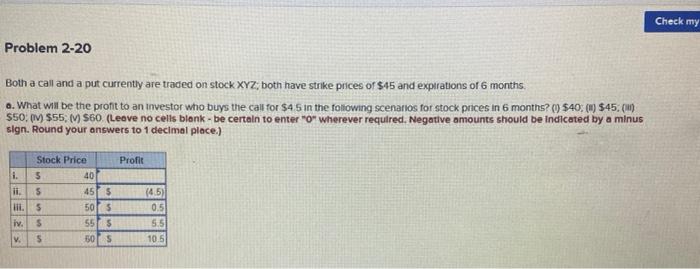

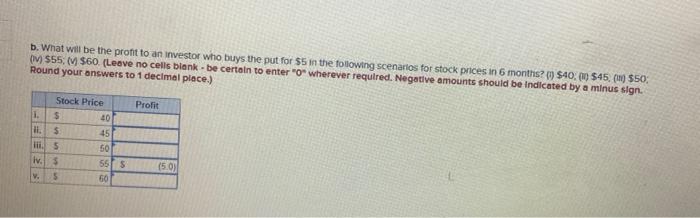

Check my Problem 2-20 Both a call and a put currently are traded on stock XYZ, both have strike prices of $45 and expirations of 6 months a. What will be the profit to an investor who buys the call for $4 5 in the following scenarios for stock prices in 6 months? () $40(H) $45. (1) $50, $55. M $60 (Leave no cells blenk- be certaln to enter "o" wherever requlred. Negative amounts should be indicated by a minus sign. Round your answers to 1 decimal place) Profit Stock Price i. 5 40 ii. 5 45 5 it. 5 50 5 iv. $ 555 5 50 s (45) 0.5 5.5 10.5 b. What will be the profit to an investor who buys the put for 55 in the following scenarios for stock prices in 6 months? $40,0 $45. (9 $50 (M$55M $60 (Leave no cells blank - be certain to enter "o wherever required. Negative amounts should be indicated by a minus sign. Round your answers to 1 decimal place.) Prolit Stock Price 1. $ 40 $ 45 5 50 vs 55 s v. 5 8888 3 (5.0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts