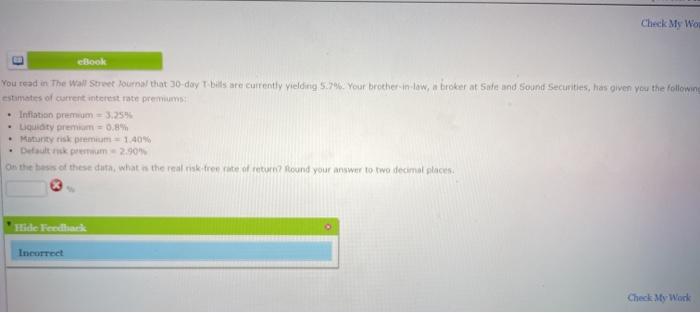

Question: Check My Wor E eBook You read in The Wall Street Journal that 30 day bills are currently vielding 5.79 Your brother in law, broker

Check My Wor E eBook You read in The Wall Street Journal that 30 day bills are currently vielding 5.79 Your brother in law, broker at Safe and Sound Securities, has given you the following estimates of current interest rate pe Inflation premium 3.25% Luty premium = 0.8% Matty risk remium 1.40% Default keem 2.901 the of these data, what is the risk free rate of return found your answer to two decimal places Hide Feedback Incorrect Check My Work Real Risk-Free Rate) eBook Flide Feedback orrect 9 You read in The Wall Street Journal that 30-day T-bills are currently yielding 5.7 Your brother-in-law, a broker at Safe and Sound Securities, has give you the own estimates of current interest rate premiums: Inflation premium 3.2596 Liquidity premium 0.8% Maturity risk premium = 1.40% Default risk premium = 2.9096 On the basis of these data, what is the real risk-free rate of return? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts