Question: Check My Work ( 1 remaining ) In the foreseeable future, the real risk - free rate of interest, r * * , is expected

Check My Work remaining

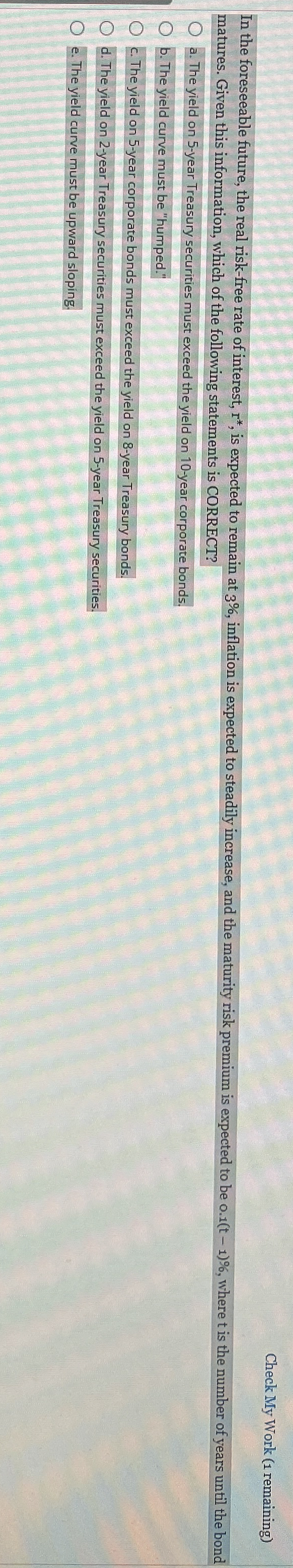

In the foreseeable future, the real riskfree rate of interest, is expected to remain at inflation is expected to steadily increase, and the maturity risk premium is expected to be where t is the number of years until the bond matures. Given this information, which of the following statements is CORRECT?

a The yield on year Treasury securities must exceed the yield on year corporate bonds.

b The yield curve must be "humped."

c The yield on year corporate bonds must exceed the yield on year Treasury bonds.

d The yield on year Treasury securities must exceed the yield on year Treasury securities

e The yield curve must be upward sloping.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock